- Poland

- /

- Entertainment

- /

- WSE:CIG

January 2025's Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As we approach the new year, global markets are experiencing a mix of optimism and caution. While major U.S. stock indexes have shown moderate gains, there are concerns about declining consumer confidence and mixed economic indicators. Amid these conditions, penny stocks—traditionally seen as investments in smaller or newer companies—continue to offer intriguing opportunities for growth at lower price points. Despite being considered a niche market, these stocks can provide significant potential when backed by strong fundamentals and financial health.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £149.54M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,826 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Nexam Chemical Holding (OM:NEXAM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nexam Chemical Holding AB (publ) develops solutions to enhance the properties and performance of various polymers in Sweden, Europe, and internationally, with a market cap of SEK343.08 million.

Operations: The company's revenue is divided into two segments: Performance Chemicals, generating SEK92.25 million, and Performance Masterbatch, contributing SEK109.15 million.

Market Cap: SEK343.08M

Nexam Chemical Holding AB has made significant strides in sustainable polymer solutions, evidenced by recent patent approvals and industrial-scale orders. The European Patent Office's decision to grant a patent for recycled polypropylene enhances its intellectual property portfolio, covering nearly half of global plastic production. Furthermore, the company secured its first large-scale order for rPET additives from a major player in circular food packaging and received substantial repeat orders in high-temperature materials. Despite these advancements, Nexam remains unprofitable with increasing losses over five years but maintains a satisfactory debt level and sufficient cash runway.

- Click here to discover the nuances of Nexam Chemical Holding with our detailed analytical financial health report.

- Assess Nexam Chemical Holding's future earnings estimates with our detailed growth reports.

P.S.P. Specialties (SET:PSP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: P.S.P. Specialties Public Company Limited, with a market cap of THB5.94 billion, manufactures and sells lubricants and greases both in Thailand and internationally through its subsidiaries.

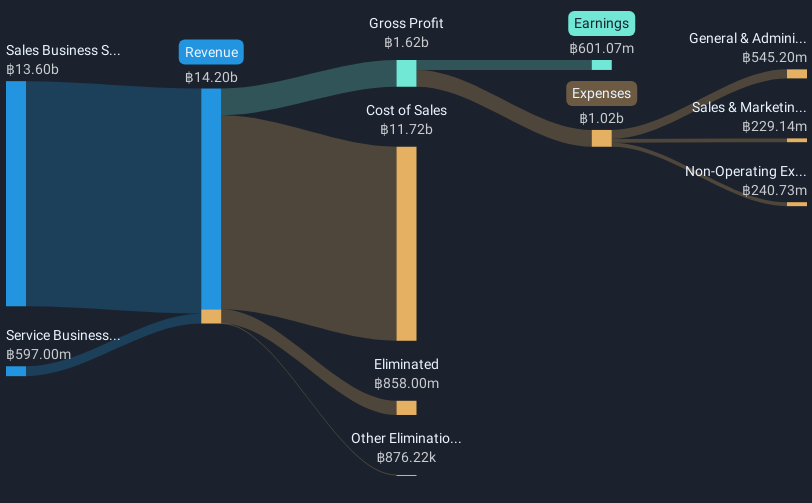

Operations: The company generates revenue from two main segments: the Sales Business Section, contributing THB13.60 billion, and the Service Business Segment, contributing THB597 million.

Market Cap: THB5.94B

P.S.P. Specialties has demonstrated robust financial performance, with earnings growth of 55.4% over the past year, surpassing the Chemicals industry average. The company's short-term assets comfortably cover both short and long-term liabilities, indicating sound financial health. Despite a low return on equity at 17.2%, its net debt to equity ratio of 24.5% is satisfactory, and interest payments are well covered by EBIT at 5.2 times coverage. Recent earnings reports show an increase in revenue for the third quarter to THB3.36 billion from THB3.15 billion a year ago, although net income slightly declined from THB139 million to THB113 million.

- Jump into the full analysis health report here for a deeper understanding of P.S.P. Specialties.

- Learn about P.S.P. Specialties' historical performance here.

CI Games (WSE:CIG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CI Games SE is a video game company involved in production, publishing, and distribution across Europe, the Americas, Asia, and Africa with a market cap of PLN242.40 million.

Operations: The company's revenue is primarily generated from the CI Games Group, contributing PLN250.73 million, and United Label JSC, adding PLN4.51 million.

Market Cap: PLN242.4M

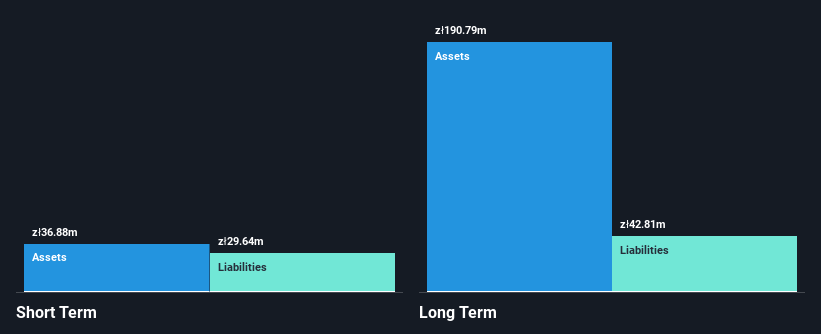

CI Games SE, with a market cap of PLN242.40 million, has shown financial resilience despite recent challenges. The company's debt is well covered by operating cash flow, and it holds more cash than total debt, reflecting strong liquidity management. However, the board's average tenure is only two years, suggesting limited experience at the helm. CI Games became profitable this year and reported high-quality earnings; however, its recent quarterly sales dropped to PLN10.58 million from PLN36.88 million a year ago resulting in a net loss of PLN2.11 million for the quarter despite improved nine-month performance compared to last year.

- Navigate through the intricacies of CI Games with our comprehensive balance sheet health report here.

- Understand CI Games' earnings outlook by examining our growth report.

Taking Advantage

- Unlock our comprehensive list of 5,826 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CIG

CI Games

Produces, publishes, and distributes video games in Europe, North and South America, Asia, and Africa.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives