- Sweden

- /

- Paper and Forestry Products

- /

- OM:HOLM B

There Is A Reason Holmen AB (publ)'s (STO:HOLM B) Price Is Undemanding

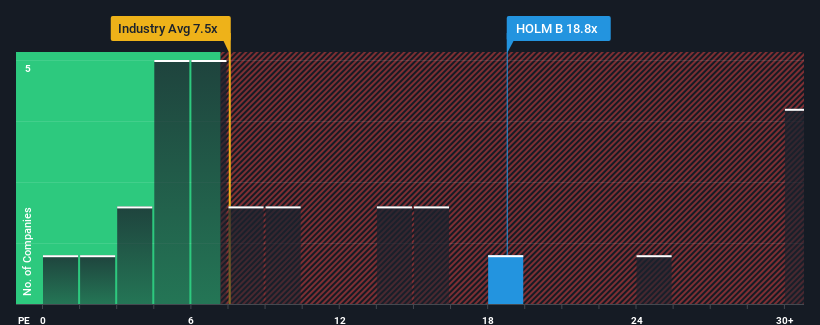

Holmen AB (publ)'s (STO:HOLM B) price-to-earnings (or "P/E") ratio of 18.8x might make it look like a buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 22x and even P/E's above 41x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Holmen could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Holmen

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Holmen's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 90% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 1.0% each year during the coming three years according to the six analysts following the company. Meanwhile, the broader market is forecast to expand by 19% each year, which paints a poor picture.

In light of this, it's understandable that Holmen's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Holmen's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Holmen maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Holmen, and understanding these should be part of your investment process.

If you're unsure about the strength of Holmen's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Holmen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HOLM B

Holmen

Engages in forest, paperboard, paper, wood products, and renewable energy businesses in Sweden and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives