We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in Boliden AB (STO:BOL).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.'

Check out our latest analysis for Boliden

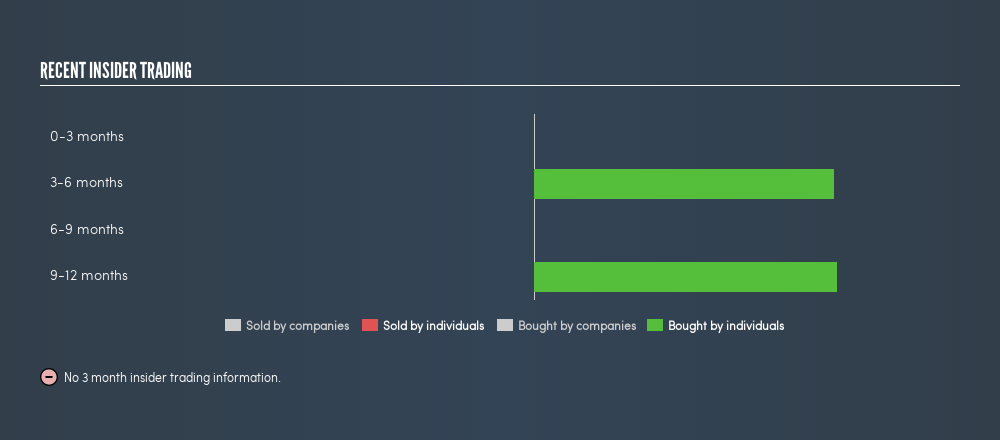

The Last 12 Months Of Insider Transactions At Boliden

Over the last year, we can see that the biggest insider purchase was by Lennart Evrell for kr598k worth of shares, at about kr323 per share. That means that an insider was happy to buy shares at above the current price. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. That purchase may suggest an expectation of positive returns over the long term.

Happily, we note that in the last year insiders bought 6.03k shares for a total of kr1.5m. Overall, Boliden insiders were net buyers last year. They paid about kr256 on average. I'd consider this a positive as it suggests insiders see value at around the current price, which is kr244. You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. Our data suggests Boliden insiders own 0.03% of the company, worth about kr19m. We prefer to see high levels of insider ownership.

So What Do The Boliden Insider Transactions Indicate?

The fact that there have been no Boliden insider transactions recently certainly doesn't bother us. However, our analysis of transactions over the last year is heartening. Insiders own shares in Boliden and we see no evidence to suggest they are worried about the future. Therefore, you should should definitely take a look at this FREEreport showing analyst forecasts for Boliden.

Of course Boliden may not be the best stock to buy. So you may wish to see this freecollection of high quality companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives