- Sweden

- /

- Metals and Mining

- /

- OM:BOL

Boliden (OM:BOL): One-Off Gain Drives Margin Decline, Raising Questions on Earnings Quality

Reviewed by Simply Wall St

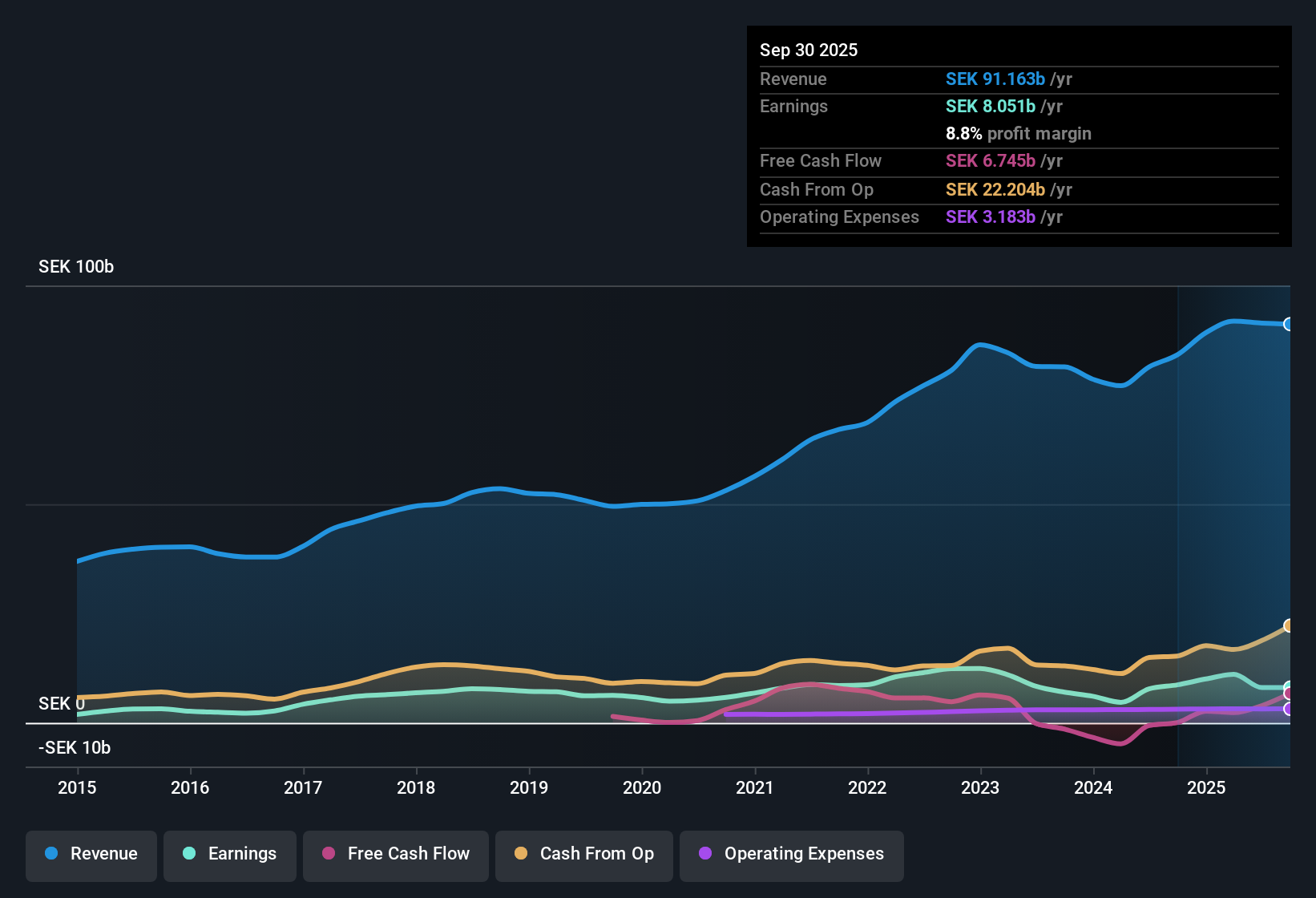

Boliden (OM:BOL) reported earnings that have grown at an average rate of 0.6% per year over the past five years, but the most recent year saw a decline. The latest net profit margin sits at 8.8%, down from last year’s 10.3%, even as a significant one-off gain of SEK3.3 billion impacted recent results. Looking forward, analysts expect annual earnings growth of 15.44% and revenue growth of 7.3%. Both figures are expected to outpace the Swedish market, though they do not reach the 20% threshold considered significant growth.

See our full analysis for Boliden.Next, we will see how these headline metrics compare to the prevailing narratives in the market, highlighting where interpretations align and where they get challenged.

See what the community is saying about Boliden

Margin Outlook Edges Higher Than Peers

- Boliden’s projected net profit margin is set to improve from 8.8% now to 9.9% in three years, nudging above last year's 10.3% but still trailing the 20% threshold that defines standout growth for analysts.

- Analysts' consensus view suggests operational gearing from digitalization and recycling expansions could sharpen margins,

- ongoing automation and cost controls are expected to boost operational efficiency, but higher depreciation costs from recent acquisitions may offset some of these gains. This could keep net profit margin growth moderate.

- successful ramp-ups at Odda and higher production volumes offer upside, though greater earnings resilience hinges on discipline as industry-wide cost inflation persists.

- Analyst forecasts expect earnings to reach SEK 10.8 billion by September 2028, with the most bullish scenarios predicting up to SEK 14.7 billion.

- To see if these targets reflect the real trajectory or miss key pitfalls, dive into the full consensus narrative for Boliden. 📊 Read the full Boliden Consensus Narrative.

Acquisitions and Expansion Drive Near-Term Upside

- Recently integrated assets, notably the Somincor and Zinkgruvan acquisitions, have immediately increased production volumes. This places Boliden to benefit from constrained global supply and growing demand for low-carbon metals.

- Analysts' consensus view notes that the ongoing Odda green zinc smelter expansion and higher stripping at Aitik could both accelerate revenue growth,

- Odda’s full run rate from 2026 could command premium pricing on green zinc as stricter ESG standards emerge in Europe, potentially lifting top-line growth and net margins further.

- However, greater debt load and larger depreciation, especially at Odda, may limit short-term profitability while enhancing long-term production scale.

Valuation Signals Discount to Sector and DCF

- Boliden’s Price-To-Earnings Ratio sits at 15.1x, lower than peers (19.1x) and below the European Metals and Mining industry average of 15.7x. The current share price of SEK427.70 also trades well below DCF fair value of SEK744.68.

- According to the analysts' consensus view, this valuation gap reflects investor caution about near-term earnings quality,

- recent results were lifted by a non-recurring SEK3.3 billion gain, so buyers may be skeptical about how representative underlying cash flows are for sustaining these multiples.

- Yet the forecast growth in both revenue and earnings, paired with long-term cost initiatives and capacity expansions, supports a view that the market could be undervaluing Boliden’s ability to capture sector tailwinds as investments pay off.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Boliden on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle others might miss? Shape your perspective into a narrative in just a few minutes and make your insights count. Do it your way

A great starting point for your Boliden research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite margin improvements and expansion efforts, Boliden faces pressured near-term profitability as a result of rising costs and greater debt from recent acquisitions.

If you want to prioritize financial strength and avoid similar balance sheet pressures, try our solid balance sheet and fundamentals stocks screener (1982 results) to discover companies built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives