- Sweden

- /

- Metals and Mining

- /

- OM:BOL

Boliden (OM:BOL) Is Up 10.2% After Deutsche Bank Highlights Precious Metals Growth – Has the Outlook Shifted?

Reviewed by Sasha Jovanovic

- Deutsche Bank recently upgraded Boliden AB’s rating, citing renewed growth prospects and increased exposure to precious metals like gold and silver, following the company’s exit from a challenging operational period between 2023 and 2025.

- An important insight is that Deutsche Bank specifically called out expected improvements from expansion projects and precious metal revenues as significant drivers for Boliden’s outlook into 2026 and 2027.

- We’ll examine how Deutsche Bank’s renewed outlook, especially regarding precious metals, could shape Boliden’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Boliden Investment Narrative Recap

To be a shareholder in Boliden today, you need to believe in the company’s ability to increase volume and capitalize on higher precious metal exposure, particularly as it emerges from a challenging operational period. Deutsche Bank’s recent upgrade and positive outlook highlight volume growth and precious metal revenues as key short-term catalysts, but ongoing risks like commodity price volatility and margin pressure from smelting charges remain unchanged and continue to warrant close monitoring.

Among recent announcements, Boliden’s upcoming 2026 guidance release on December 5 is most relevant to Deutsche Bank’s optimism for a turnaround. This event should provide more detail on planned volume increases, the ramp-up of expansion projects, and clarify the timing of any improvements tied to gold, silver, and operational execution, the core catalysts spotlighted in the upgrade.

By contrast, investors should be aware that persistent margin compression in its smelting operations could present challenges if industry conditions do not shift...

Read the full narrative on Boliden (it's free!)

Boliden's narrative projects SEK108.9 billion revenue and SEK10.8 billion earnings by 2028. This requires 6.0% yearly revenue growth and a SEK2.8 billion earnings increase from SEK8.0 billion today.

Uncover how Boliden's forecasts yield a SEK412.07 fair value, a 9% downside to its current price.

Exploring Other Perspectives

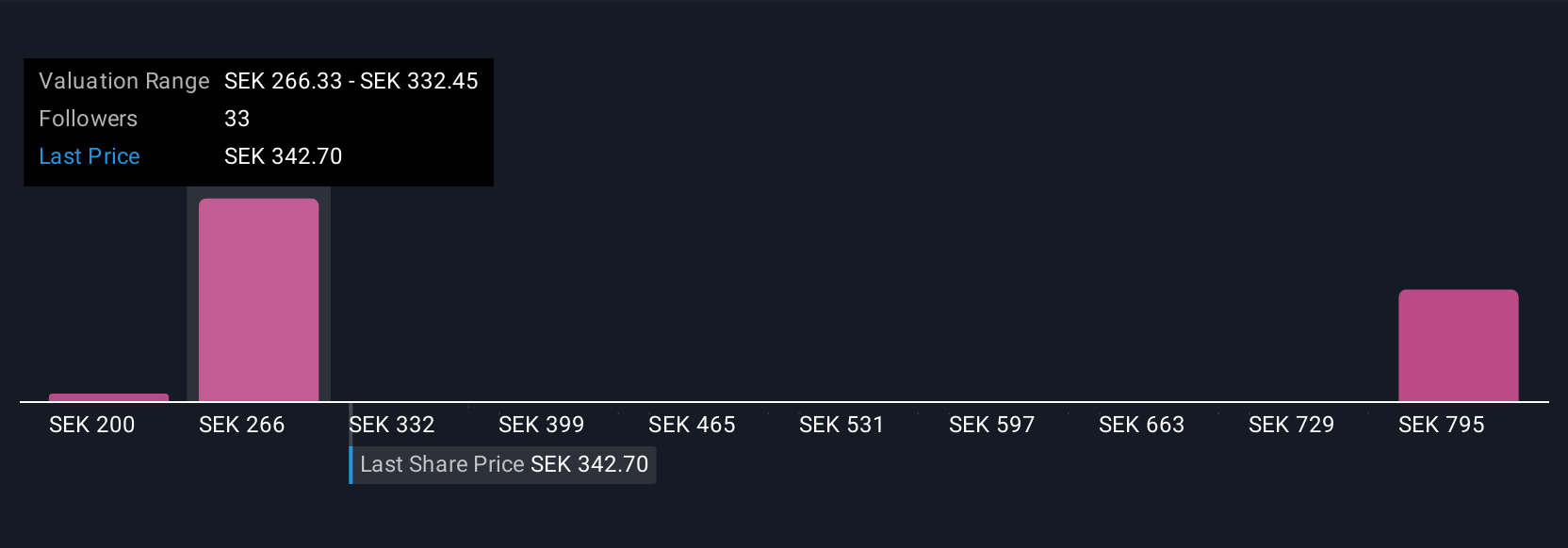

Seven fair value estimates from the Simply Wall St Community range widely from SEK200.20 to SEK1,026.28 per share. While opinions differ, many are watching how higher depreciation and project execution risks may affect Boliden’s growing earnings potential, explore these perspectives for a fuller picture.

Explore 7 other fair value estimates on Boliden - why the stock might be worth less than half the current price!

Build Your Own Boliden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boliden research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boliden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boliden's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026