Billerud (STO:BILL) Is Paying Out Less In Dividends Than Last Year

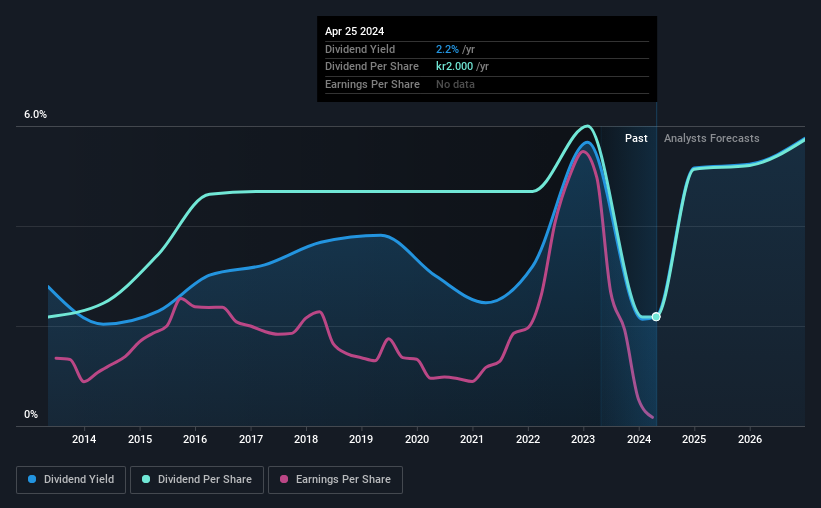

Billerud AB (publ) (STO:BILL) has announced that on 28th of May, it will be paying a dividend ofSEK2.00, which a reduction from last year's comparable dividend. Based on this payment, the dividend yield will be 2.2%, which is lower than the average for the industry.

Check out our latest analysis for Billerud

Billerud's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, the company was paying out 315% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 68%. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 21% which is fairly sustainable.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The last annual payment of SEK2.00 was flat on the annual payment from10 years ago. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been sinking by 33% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Billerud's Dividend Doesn't Look Sustainable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Billerud that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Billerud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BILL

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026