- Sweden

- /

- Metals and Mining

- /

- NGM:SOSI

Sotkamo Silver AB's (NGM:SOSI) Shares Climb 27% But Its Business Is Yet to Catch Up

Despite an already strong run, Sotkamo Silver AB (NGM:SOSI) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 66%.

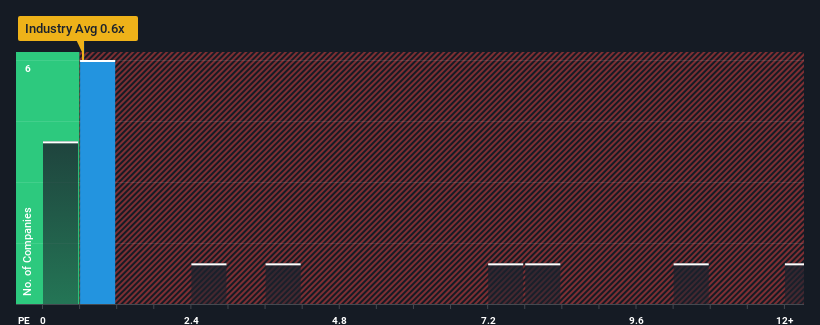

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sotkamo Silver's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Sweden is also close to 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Sotkamo Silver

How Sotkamo Silver Has Been Performing

Recent times have been pleasing for Sotkamo Silver as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sotkamo Silver.How Is Sotkamo Silver's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Sotkamo Silver's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 7.8%. The solid recent performance means it was also able to grow revenue by 9.2% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.6% each year as estimated by the only analyst watching the company. Meanwhile, the broader industry is forecast to expand by 1.2% each year, which paints a poor picture.

With this information, we find it concerning that Sotkamo Silver is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Sotkamo Silver's P/S Mean For Investors?

Sotkamo Silver appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Sotkamo Silver currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Sotkamo Silver (2 are a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Sotkamo Silver's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:SOSI

Sotkamo Silver

A mining and ore prospecting company, develops and utilises mineral deposits in the Kainuu region in Finland.

Reasonable growth potential and fair value.

Market Insights

Community Narratives