- Sweden

- /

- Metals and Mining

- /

- NGM:BLUE

Recent 12% pullback isn't enough to hurt long-term Bluelake Mineral (NGM:BLUE) shareholders, they're still up 14% over 5 years

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Bluelake Mineral AB (publ) (NGM:BLUE), since the last five years saw the share price fall 83%. Even worse, it's down 22% in about a month, which isn't fun at all. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Bluelake Mineral

With zero revenue generated over twelve months, we don't think that Bluelake Mineral has proved its business plan yet. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Bluelake Mineral finds some valuable resources, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Bluelake Mineral has already given some investors a taste of the bitter losses that high risk investing can cause.

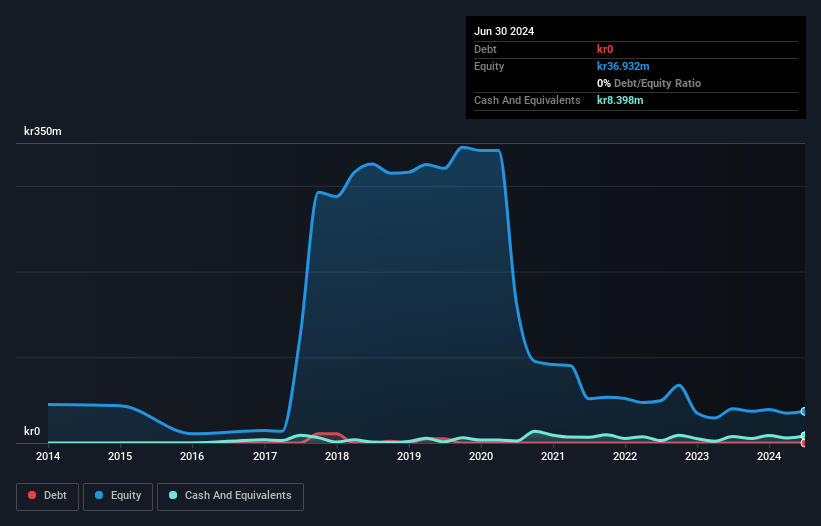

Bluelake Mineral had liabilities exceeding cash by kr11m when it last reported in June 2024, according to our data. That makes it extremely high risk, in our view. But since the share price has dived 29% per year, over 5 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Bluelake Mineral's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Bluelake Mineral's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Bluelake Mineral hasn't been paying dividends, but its TSR of 14% exceeds its share price return of -83%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Bluelake Mineral had a tough year, with a total loss of 15%, against a market gain of about 32%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 5 warning signs for Bluelake Mineral (4 are concerning) that you should be aware of.

We will like Bluelake Mineral better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bluelake Mineral might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:BLUE

Bluelake Mineral

Engages in the exploration and mine development in the Nordic region.

Slight with mediocre balance sheet.

Market Insights

Community Narratives