- Sweden

- /

- Metals and Mining

- /

- NGM:BAT

We're Hopeful That Eurobattery Minerals (NGM:BAT) Will Use Its Cash Wisely

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Eurobattery Minerals (NGM:BAT) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Eurobattery Minerals

When Might Eurobattery Minerals Run Out Of Money?

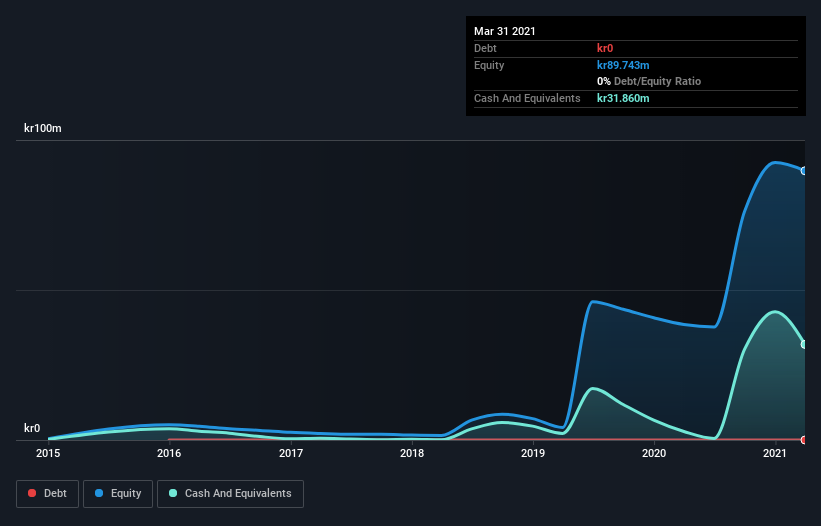

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In March 2021, Eurobattery Minerals had kr32m in cash, and was debt-free. Importantly, its cash burn was kr17m over the trailing twelve months. Therefore, from March 2021 it had roughly 22 months of cash runway. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. You can see how its cash balance has changed over time in the image below.

How Is Eurobattery Minerals' Cash Burn Changing Over Time?

Because Eurobattery Minerals isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. As it happens, the company's cash burn reduced by 10% over the last year, which suggests that management are maintaining a fairly steady rate of business development, albeit with a slight decrease in spending. Eurobattery Minerals makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

Can Eurobattery Minerals Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Eurobattery Minerals to raise more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Eurobattery Minerals has a market capitalisation of kr269m and burnt through kr17m last year, which is 6.4% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Eurobattery Minerals' Cash Burn A Worry?

The good news is that in our view Eurobattery Minerals' cash burn situation gives shareholders real reason for optimism. Not only was its cash runway quite good, but its cash burn relative to its market cap was a real positive. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, Eurobattery Minerals has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Eurobattery Minerals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eurobattery Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:BAT

Medium-low risk with imperfect balance sheet.

Market Insights

Community Narratives