- Poland

- /

- Consumer Durables

- /

- WSE:DCR

Three Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices showing varied results and economic indicators like inflation and labor data influencing central bank decisions, investors are increasingly focused on stability and income generation. In such an environment, dividend stocks can offer a reliable source of returns by providing consistent payouts, making them a compelling option for those looking to balance growth potential with steady income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Shaanxi International TrustLtd (SZSE:000563) | 3.16% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

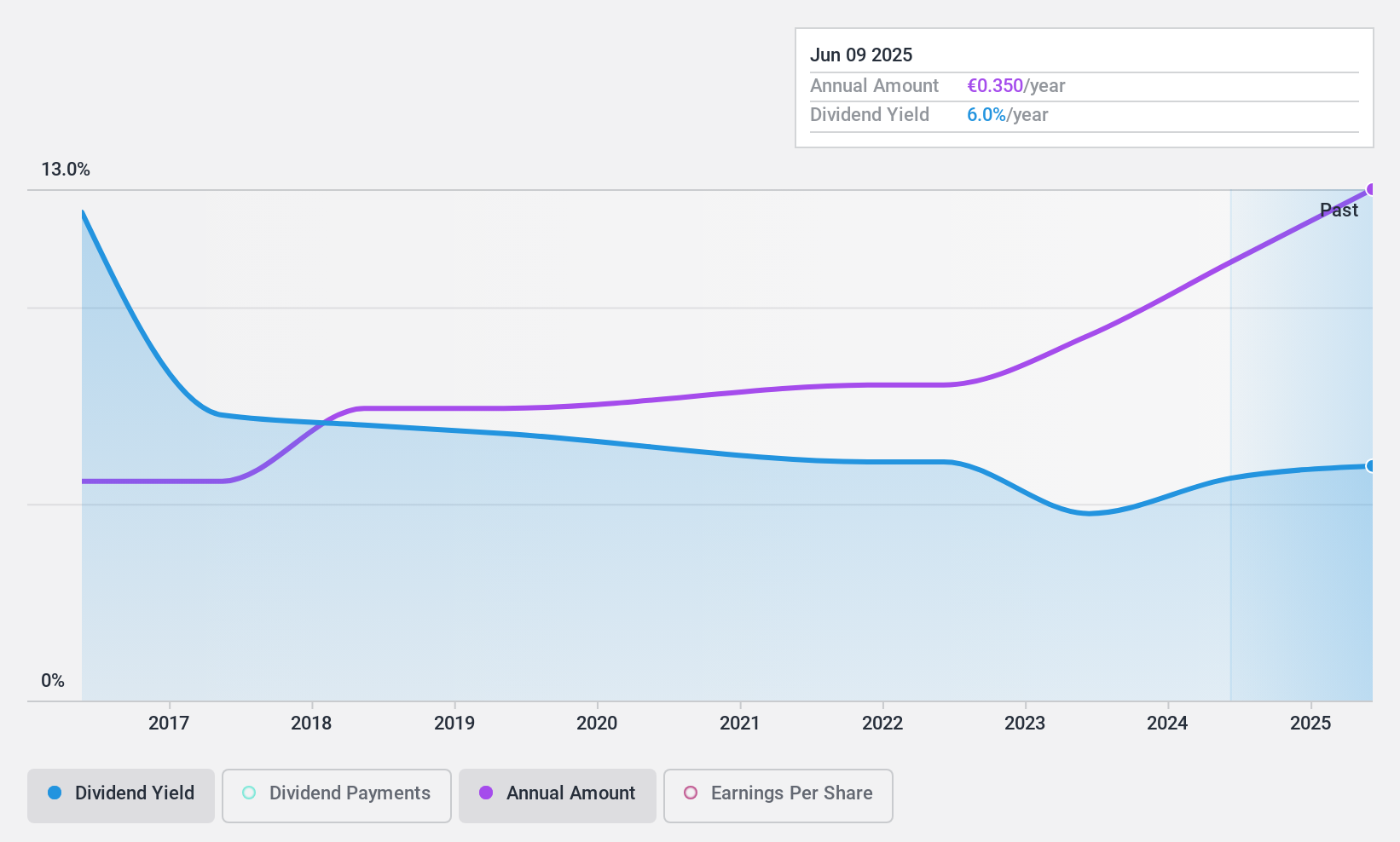

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market cap of €178.50 million.

Operations: Toyota Caetano Portugal, S.A. generates revenue primarily through the commercialization of motor vehicles (€764.41 million domestically and €28.15 million externally), along with providing services (€24.70 million) and industrial equipment machines (€12.25 million).

Dividend Yield: 5.5%

Toyota Caetano Portugal's dividend payments have shown volatility over the past decade, with some years experiencing significant drops. Despite this, recent earnings growth of 40.2% and a payout ratio of 47.2% suggest dividends are currently well-covered by earnings. The company's price-to-earnings ratio of 8.6x indicates it may be undervalued compared to the broader Portuguese market. However, its dividend yield of 5.5% is below the top tier in Portugal, and share price volatility remains a concern for investors seeking stability.

- Unlock comprehensive insights into our analysis of Toyota Caetano Portugal stock in this dividend report.

- Our expertly prepared valuation report Toyota Caetano Portugal implies its share price may be too high.

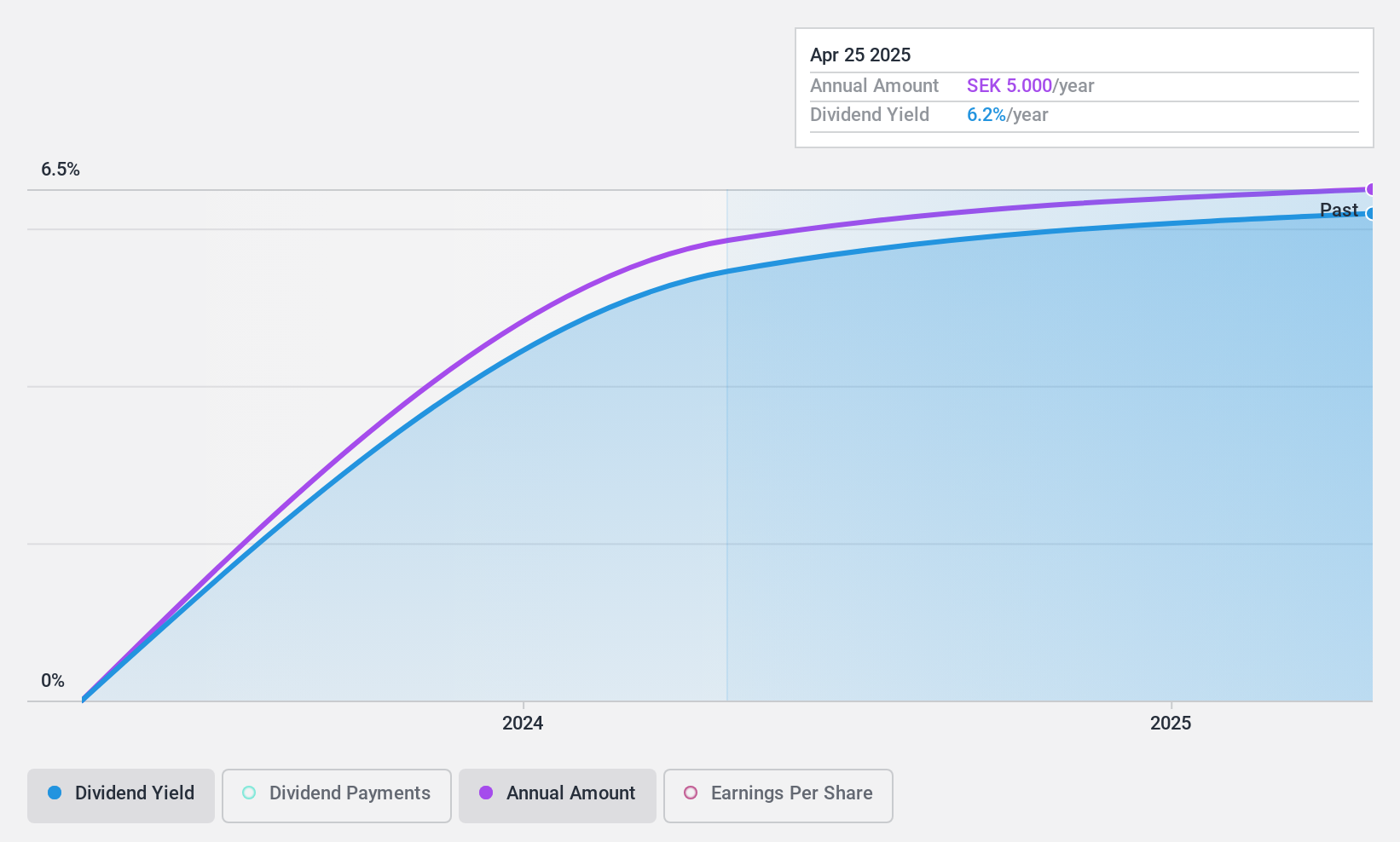

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (publ) offers non-life insurance services to both private and business clients across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and internationally with a market capitalization of approximately SEK1.47 billion.

Operations: Solid Försäkringsaktiebolag generates revenue from its key segments, which include Product (SEK311.85 million), Assistance (SEK371.42 million), and Personal Safety (SEK441.04 million).

Dividend Yield: 5.4%

Solid Försäkringsaktiebolag's dividend payments, though only two years in duration, have been stable and are well-covered by earnings with a payout ratio of 46.4% and cash flows at 60.3%. The company's recent earnings growth supports its dividend sustainability, reporting SEK 48.8 million net income for Q3 2024, up from SEK 40.38 million the previous year. Trading significantly below estimated fair value enhances its appeal as a potential value investment in Sweden's market.

- Get an in-depth perspective on Solid Försäkringsaktiebolag's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Solid Försäkringsaktiebolag's share price might be too pessimistic.

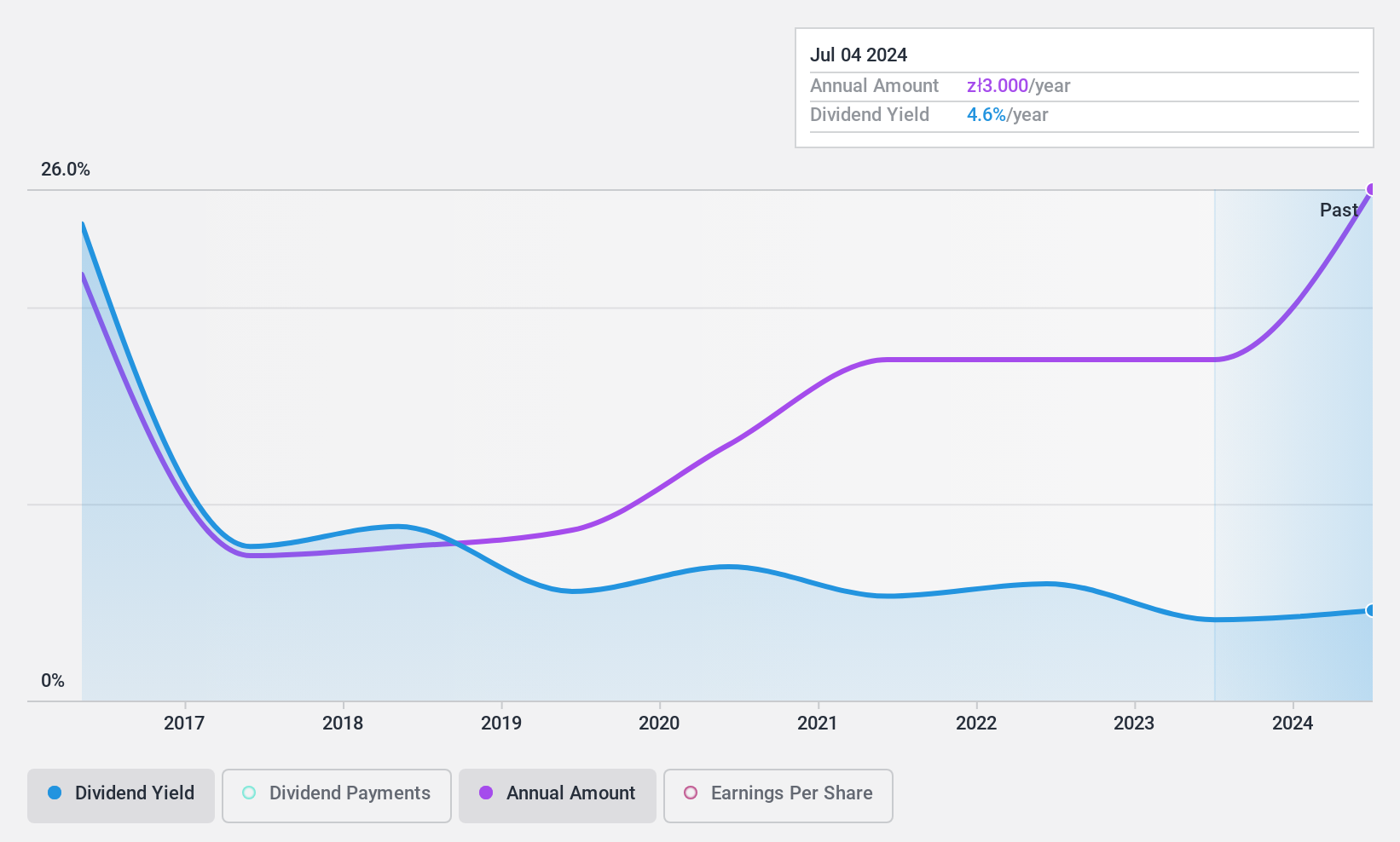

Decora (WSE:DCR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Decora S.A. is involved in the production, distribution, sale, and export of flooring products and accessories in Poland with a market cap of PLN645.48 million.

Operations: Decora S.A.'s revenue segments include PLN128.58 million from Wall products and PLN439.84 million from Flooring products.

Dividend Yield: 4.7%

Decora's dividends are well-supported by earnings and cash flows, with payout ratios of 38.1% and 42%, respectively. However, despite a decade of increasing payments, the dividend has been volatile. Recent Q3 earnings showed net income rising to PLN 21.8 million from PLN 16.93 million year-over-year, indicating strong financial performance. Although trading at a discount to estimated fair value, its dividend yield is lower than top-tier Polish payers, highlighting potential value but also risk factors for investors seeking stable dividends.

- Take a closer look at Decora's potential here in our dividend report.

- According our valuation report, there's an indication that Decora's share price might be on the cheaper side.

Next Steps

- Click here to access our complete index of 1970 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DCR

Decora

Engages in the production, distribution, sale, and export of flooring products and accessories in Poland.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives