- Sweden

- /

- Household Products

- /

- OM:ESGR B

Investors Appear Satisfied With ES Energy Save Holding AB (publ)'s (STO:ESGR B) Prospects

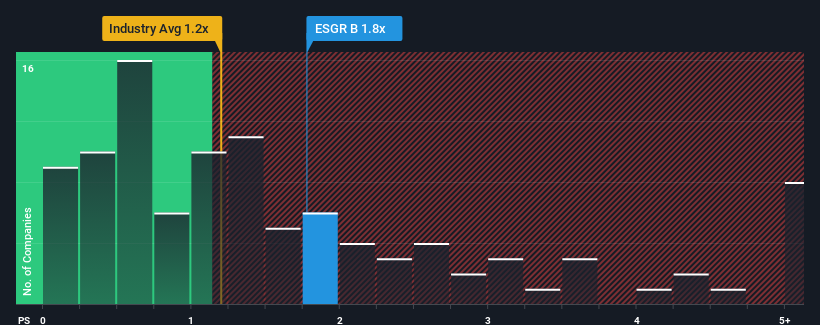

When close to half the companies in the Household Products industry in Sweden have price-to-sales ratios (or "P/S") below 0.5x, you may consider ES Energy Save Holding AB (publ) (STO:ESGR B) as a stock to potentially avoid with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for ES Energy Save Holding

What Does ES Energy Save Holding's P/S Mean For Shareholders?

For instance, ES Energy Save Holding's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for ES Energy Save Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For ES Energy Save Holding?

In order to justify its P/S ratio, ES Energy Save Holding would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Still, the latest three year period has seen an excellent 290% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 1.7% shows it's a great look while it lasts.

With this information, we can see why ES Energy Save Holding is trading at a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What We Can Learn From ES Energy Save Holding's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of ES Energy Save Holding revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

Before you take the next step, you should know about the 2 warning signs for ES Energy Save Holding that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ES Energy Save Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ESGR B

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives