- Sweden

- /

- Medical Equipment

- /

- OM:VIMIAN

February 2025's Top Growth Stocks Backed By Insiders

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are nearing record highs, with growth stocks outperforming their value counterparts. In this environment, companies with high insider ownership often signal confidence from those who know the business best, making them a compelling focus for investors seeking potential growth opportunities amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB operates in the global animal health industry and has a market capitalization of approximately SEK24.04 billion.

Operations: The company generates revenue from several segments, including Medtech (€123.90 million), Diagnostics (€20.90 million), Specialty Pharma (€172 million), and Veterinary Services (€58.20 million).

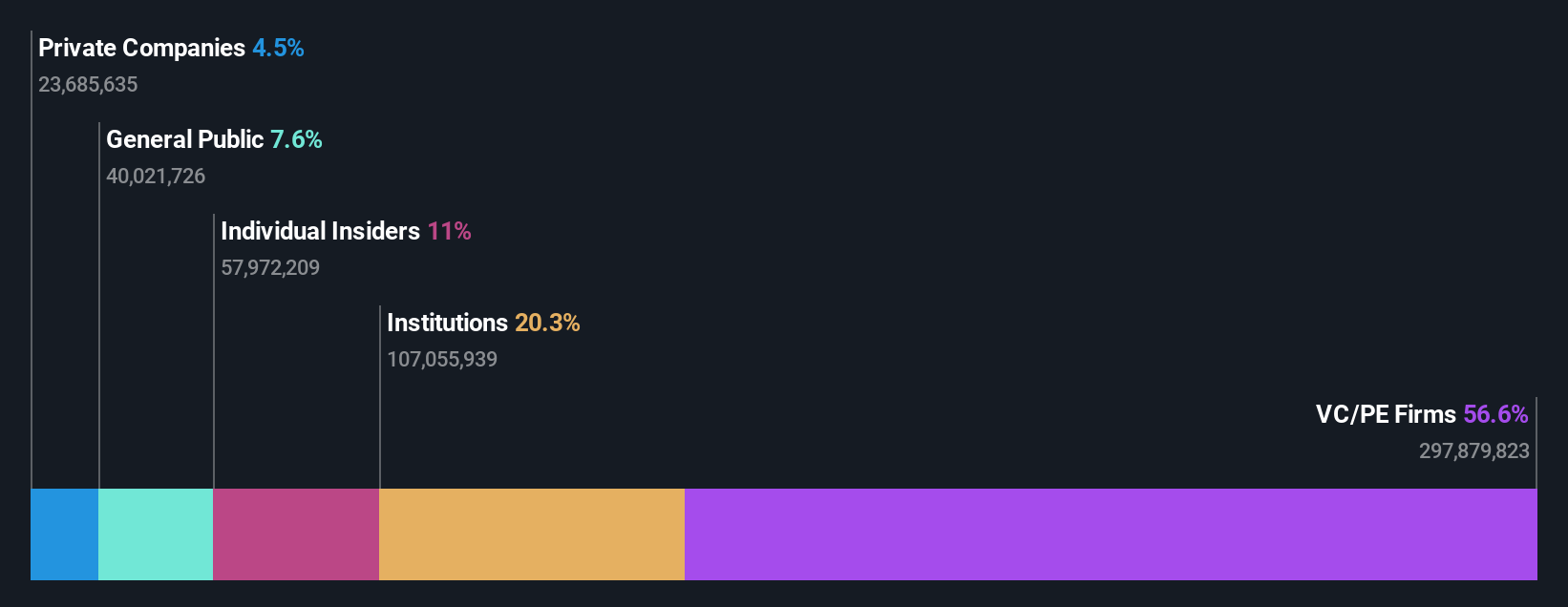

Insider Ownership: 11.1%

Revenue Growth Forecast: 12.2% p.a.

Vimian Group's recent earnings report showed a strong performance with sales reaching €104.9 million, up from €82.5 million the previous year, and net income at €12.2 million compared to a prior net loss. Although there has been significant insider selling recently, Vimian's earnings are forecast to grow significantly at 44.3% annually, surpassing the Swedish market's growth rate of 10.7%. The stock trades below its estimated fair value by 23.3%.

- Click to explore a detailed breakdown of our findings in Vimian Group's earnings growth report.

- In light of our recent valuation report, it seems possible that Vimian Group is trading beyond its estimated value.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥22.28 billion.

Operations: The company's revenue segments include network security products, trusted security management platforms, and specialized security services and solutions.

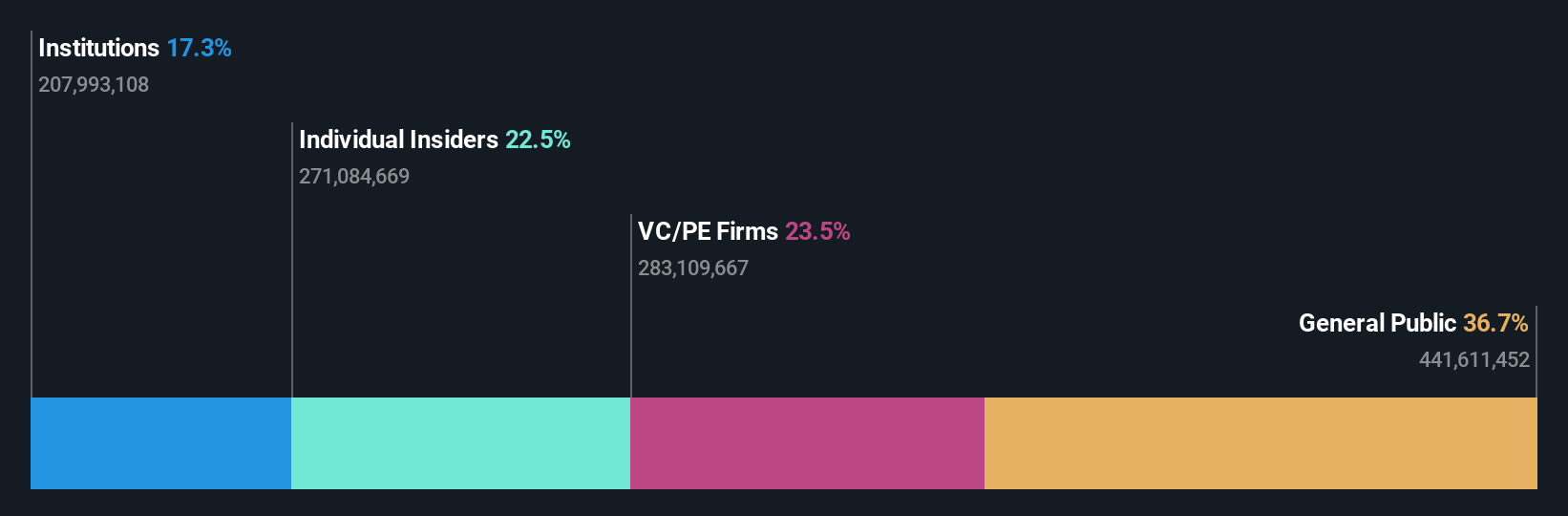

Insider Ownership: 22.4%

Revenue Growth Forecast: 14.1% p.a.

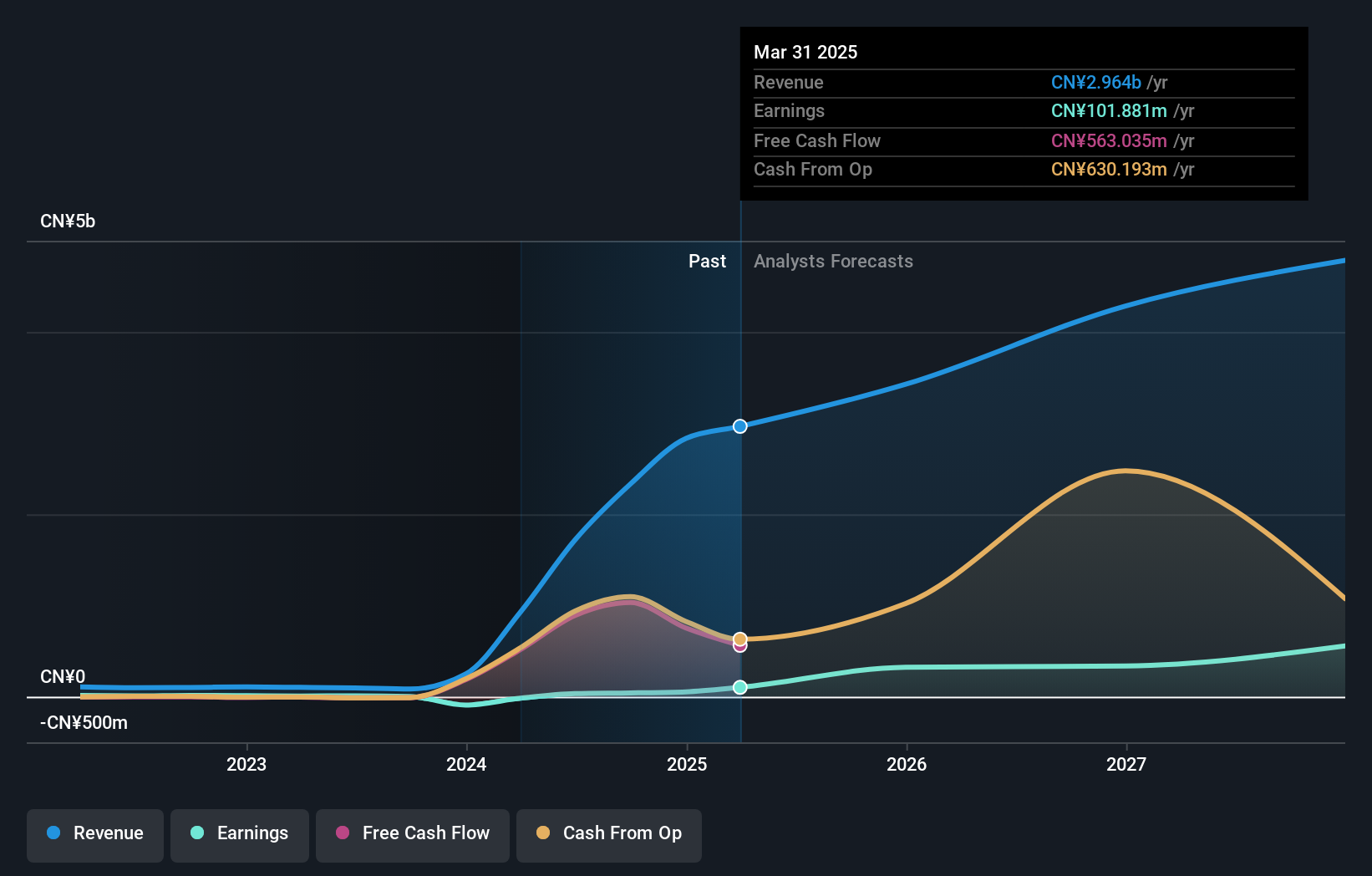

Venustech Group's revenue is forecast to grow at 14.1% annually, outpacing the Chinese market's growth rate of 13.3%. Earnings are expected to increase significantly by 33.6% per year, surpassing market expectations of 25.1%. Despite a recent decline in profit margins from 23.3% to 6.7%, the stock trades slightly below its estimated fair value and lacks recent insider trading activity. An upcoming shareholders meeting will address financial service agreements and continuing transactions for 2025.

- Navigate through the intricacies of Venustech Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Venustech Group's shares may be trading at a premium.

Huatu Cendes (SZSE:300492)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to a diverse range of clients in China, with a market cap of CN¥11.07 billion.

Operations: Huatu Cendes generates revenue through providing architectural design, consulting, and engineering services to state-owned enterprises, multinational corporations, private companies, and government agencies in China.

Insider Ownership: 22.4%

Revenue Growth Forecast: 22.5% p.a.

Huatu Cendes shows promising growth prospects with earnings forecasted to rise 73.66% annually, significantly outpacing the Chinese market's 25.1% growth rate. Revenue is expected to grow at 22.5% per year, surpassing the market average of 13.3%. The company recently affirmed a cash dividend of CNY 2 per 10 shares for Q3 2024 profits, reflecting solid financial health despite no recent insider trading activity reported over three months.

- Unlock comprehensive insights into our analysis of Huatu Cendes stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Huatu Cendes shares in the market.

Seize The Opportunity

- Reveal the 1462 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIMIAN

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives