- Sweden

- /

- Real Estate

- /

- OM:SAGA A

Top Swedish Growth Stocks With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, Sweden's stock market has shown resilience, buoyed by strategic rate cuts from the European Central Bank and positive investor sentiment. In this environment, growth companies with high insider ownership can offer unique advantages, combining strong internal confidence with the potential for significant returns.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| Biovica International (OM:BIOVIC B) | 18.8% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

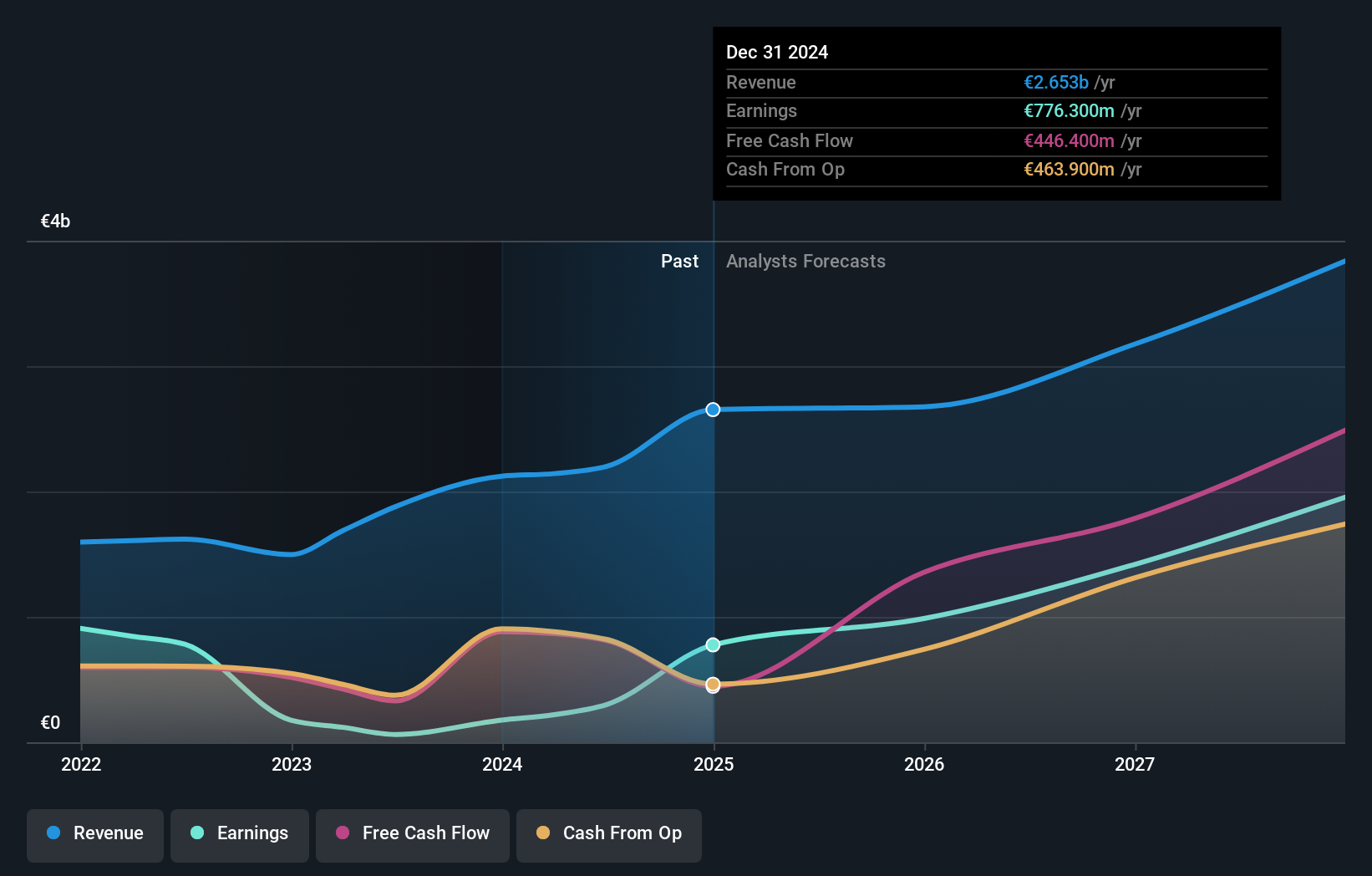

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of approximately SEK410.39 billion.

Operations: Revenue segments for EQT AB (publ) include €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

Insider Ownership: 30.9%

Earnings Growth Forecast: 35.9% p.a.

EQT AB (publ) showcases strong growth potential, with earnings forecasted to grow significantly at 35.9% per year, outpacing the Swedish market's 15.3%. Despite recent insider selling, the company's revenue is expected to increase by 15.6% annually, faster than the national average of 1%. Recent M&A activities include competing for Singapore Post Limited’s $1 billion Australian business and exploring a sale of Banking Circle valued over $2 billion, indicating strategic expansion efforts.

- Unlock comprehensive insights into our analysis of EQT stock in this growth report.

- Upon reviewing our latest valuation report, EQT's share price might be too optimistic.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

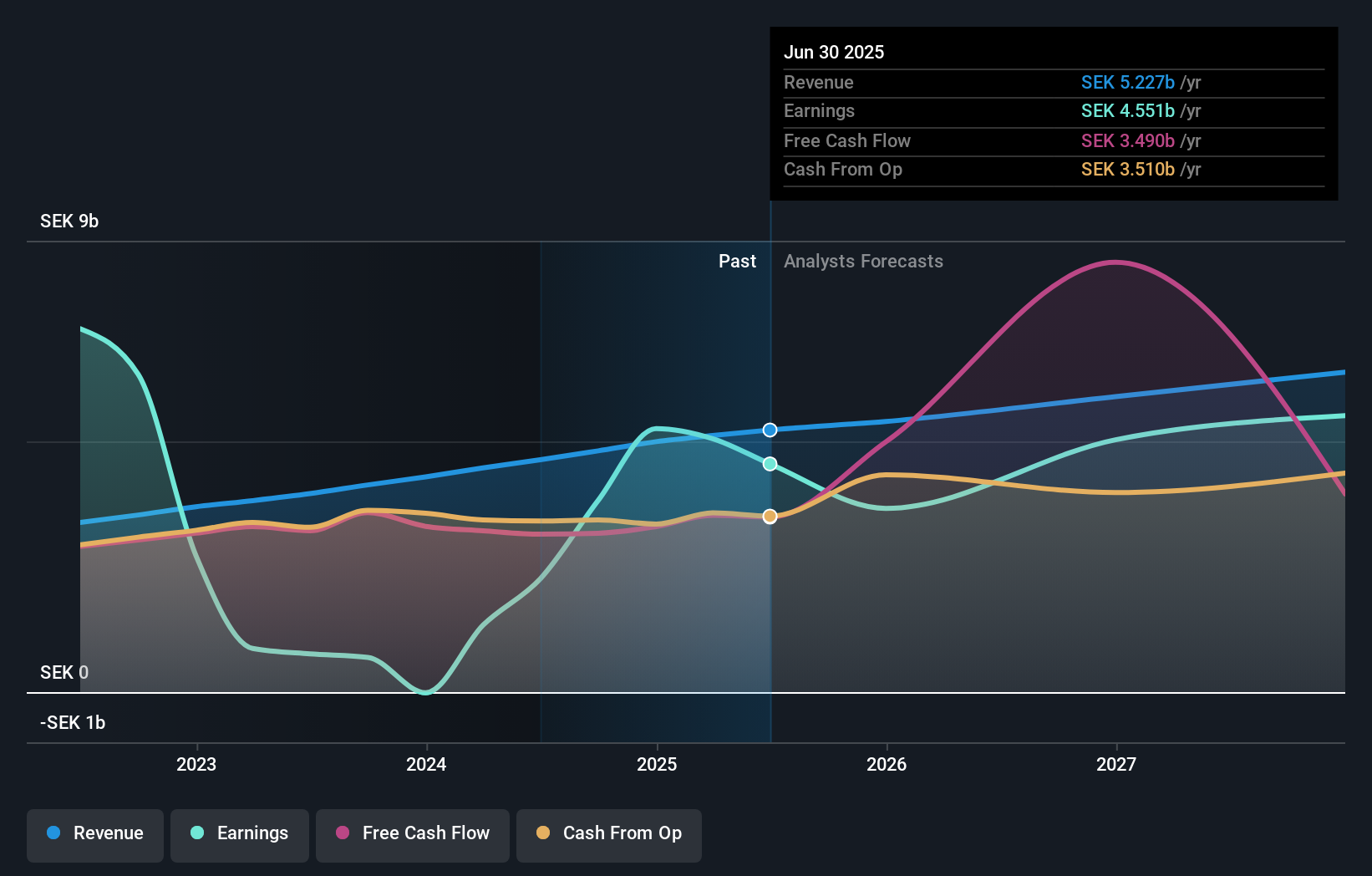

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK97.20 billion.

Operations: The company's revenue from Real Estate - Rental amounts to SEK4.63 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 28.7% p.a.

AB Sagax's earnings are projected to grow 28.72% annually over the next three years, surpassing the Swedish market's 15.3%. Despite recent shareholder dilution, the company reported impressive financial results for H1 2024, with net income of SEK 2.06 billion compared to a net loss of SEK 214 million a year ago. Insider ownership remains significant, aligning management interests with shareholders and supporting its growth trajectory in Sweden's real estate sector.

- Click to explore a detailed breakdown of our findings in AB Sagax's earnings growth report.

- The analysis detailed in our AB Sagax valuation report hints at an inflated share price compared to its estimated value.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

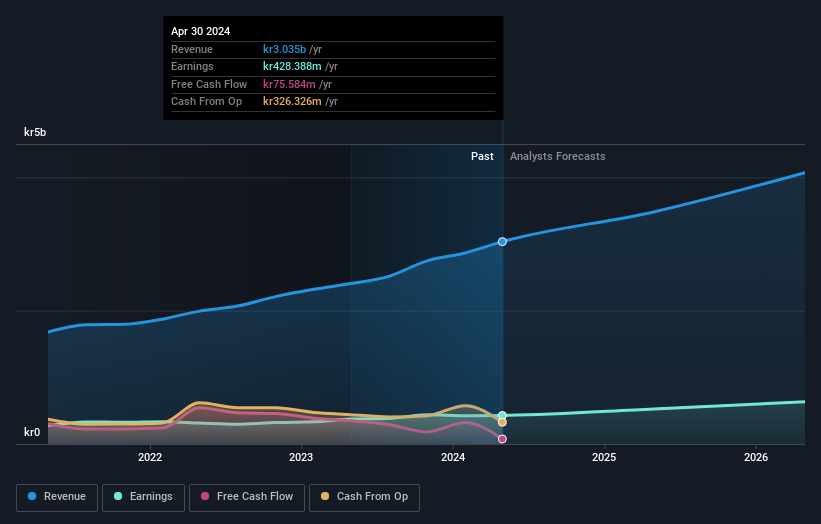

Overview: Sectra AB (publ) offers medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and the rest of Europe with a market cap of SEK51.94 billion.

Operations: Sectra's revenue segments include Imaging IT Solutions at SEK2.67 billion, Secure Communications at SEK388.55 million, and Business Innovation at SEK90.77 million.

Insider Ownership: 30.3%

Earnings Growth Forecast: 21.2% p.a.

Sectra's earnings are forecast to grow 21.21% annually, outpacing the Swedish market's 15.3%. Recent Q1 results showed a revenue increase to SEK 739.48 million from SEK 603.03 million year-over-year, with net income rising to SEK 80.4 million from SEK 61.56 million. The company's cloud service implementation in Belgian hospitals highlights its innovative approach and potential for operational efficiency gains, although insider trading data over the past three months is unavailable.

- Click here and access our complete growth analysis report to understand the dynamics of Sectra.

- Our comprehensive valuation report raises the possibility that Sectra is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Discover the full array of 91 Fast Growing Swedish Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAGA A

AB Sagax

Operates as a property company in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries.

Proven track record average dividend payer.