- Sweden

- /

- Real Estate

- /

- OM:SAGA A

Swedish Growth Companies With Insider Ownership For October 2024

Reviewed by Simply Wall St

As global markets respond to China's robust stimulus measures, European indices like the STOXX Europe 600 have rebounded, signaling optimism amid slowing business activity and potential interest rate cuts. In Sweden, the Riksbank's recent interest rate reduction reflects a broader trend of central banks adjusting policies in response to evolving economic conditions. In this context, growth companies with high insider ownership may offer unique insights into strategic confidence and alignment within their sectors.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 19.1% | 22.2% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Underneath we present a selection of stocks filtered out by our screen.

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a hotel property company that owns, develops, and leases hotel properties worldwide, with a market cap of SEK40.67 billion.

Operations: The company's revenue segments are comprised of SEK3.27 billion from Own Operation and SEK3.82 billion from Rental Agreement.

Insider Ownership: 10.3%

Pandox has shown significant growth potential, with earnings forecasted to increase by 27% annually over the next three years, outpacing the Swedish market. Despite recent shareholder dilution through a SEK 2 billion equity offering, insider ownership remains high with no substantial insider selling in the past quarter. The company recently expanded by acquiring DoubleTree by Hilton Edinburgh City Centre for MGBP 49 and is negotiating a potential hotel portfolio acquisition in London valued at approximately MSEK 3,000.

- Click here to discover the nuances of Pandox with our detailed analytical future growth report.

- According our valuation report, there's an indication that Pandox's share price might be on the expensive side.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK102.57 billion.

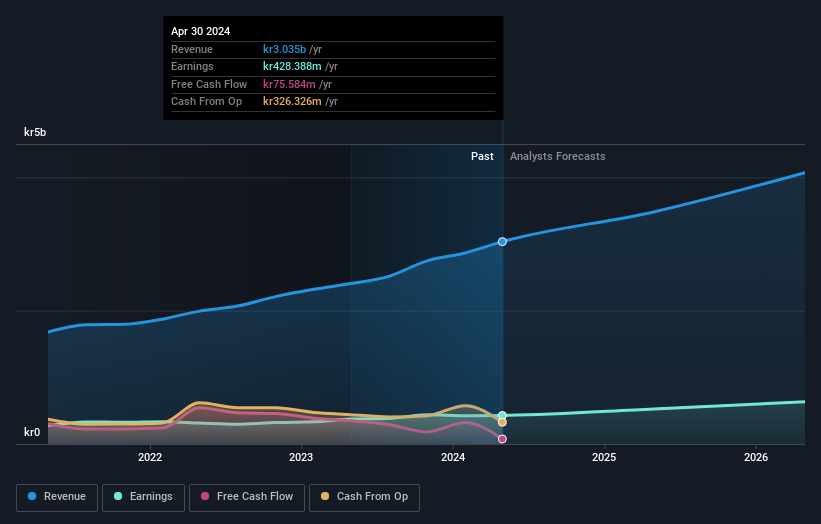

Operations: The company's revenue primarily comes from its real estate rental segment, totaling SEK4.63 billion.

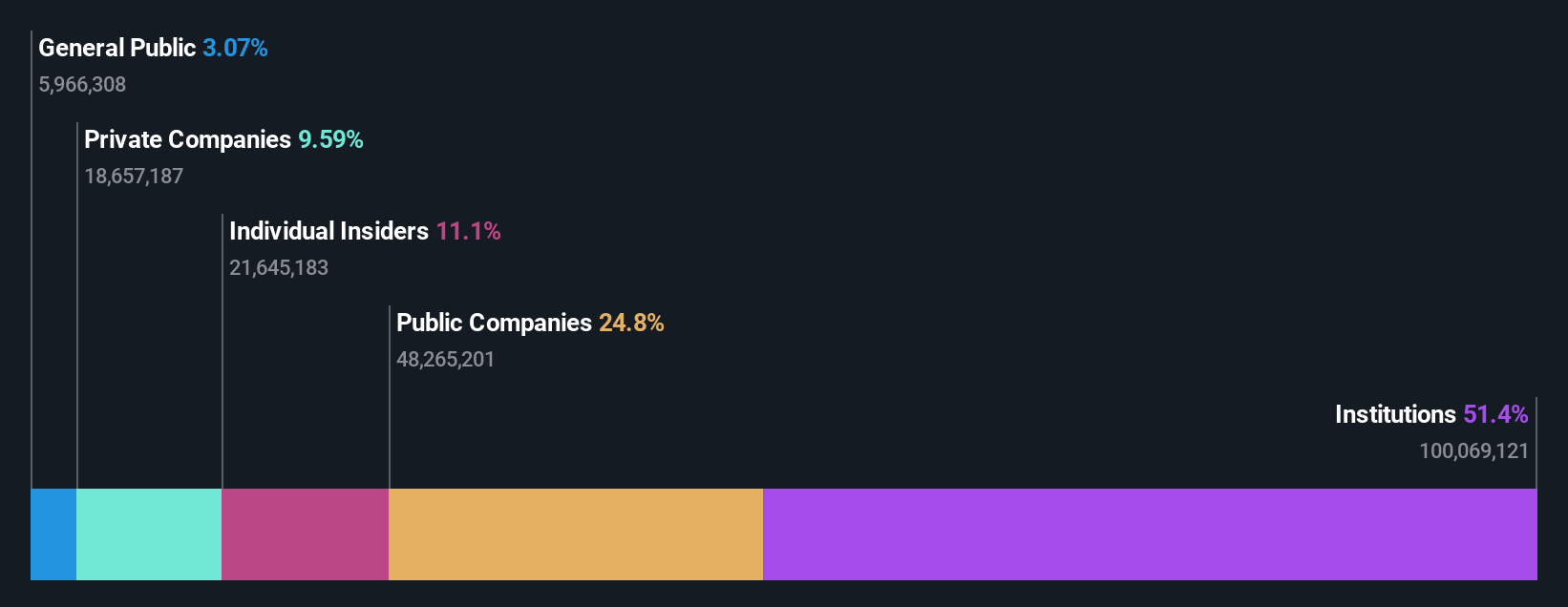

Insider Ownership: 28.6%

AB Sagax demonstrates strong growth potential with earnings expected to increase by 29.1% annually, surpassing the Swedish market's average. Recent financial results show impressive recovery, with net income for the first half of 2024 reaching SEK 2.06 billion compared to a loss last year. However, shareholder dilution occurred over the past year and debt coverage by operating cash flow is inadequate. The company's insider ownership remains substantial without significant recent insider trading activity.

- Take a closer look at AB Sagax's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of AB Sagax shares in the market.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers solutions in medical IT and cybersecurity across Sweden, the United Kingdom, the Netherlands, and other parts of Europe with a market cap of approximately SEK54.60 billion.

Operations: The company's revenue is primarily derived from its Imaging IT Solutions segment, which accounts for SEK2.67 billion, followed by Secure Communications at SEK388.55 million and Business Innovation at SEK90.77 million.

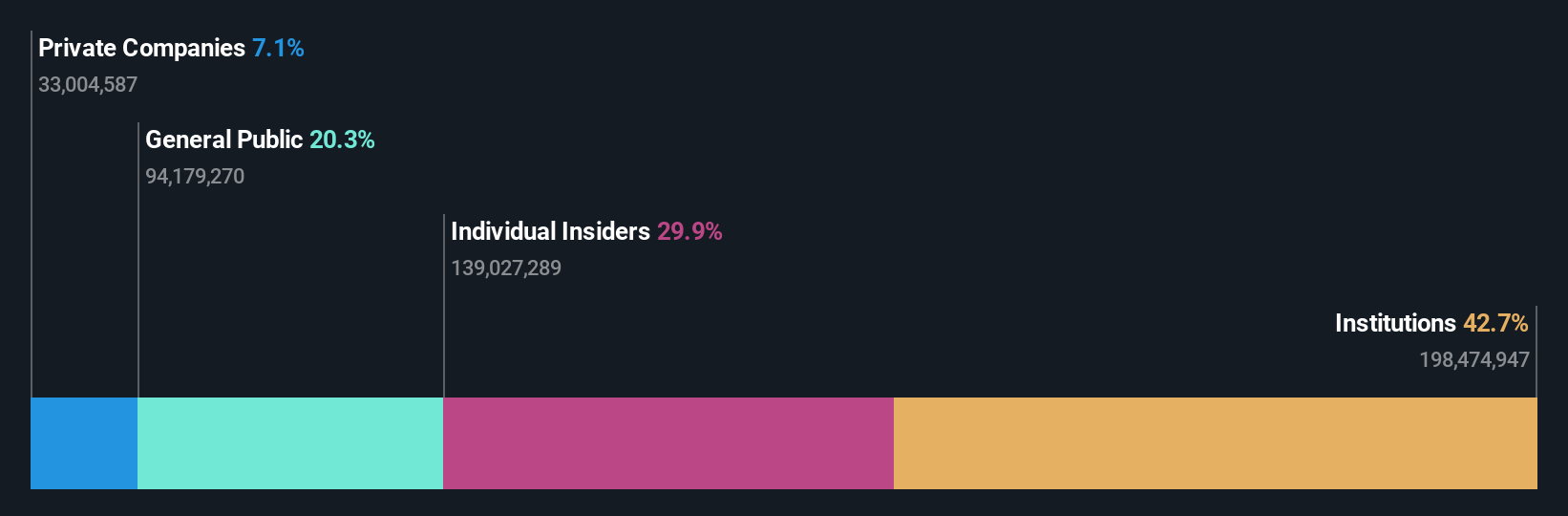

Insider Ownership: 30.3%

Sectra AB exhibits promising growth prospects, with earnings forecasted to grow at 21.2% annually, outpacing the Swedish market. Recent first-quarter results show revenue rising to SEK 739.48 million from SEK 603.03 million, and net income increasing to SEK 80.4 million from SEK 61.56 million year-on-year, indicating robust performance. Despite high-quality earnings and substantial insider ownership, revenue growth is projected below the ideal threshold of 20% annually but remains above the market average.

- Delve into the full analysis future growth report here for a deeper understanding of Sectra.

- Our comprehensive valuation report raises the possibility that Sectra is priced higher than what may be justified by its financials.

Where To Now?

- Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 77 more companies for you to explore.Click here to unveil our expertly curated list of 80 Fast Growing Swedish Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAGA A

AB Sagax

Operates as a property company in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries.

Proven track record average dividend payer.