Netcompany Group And 2 Other High Growth European Tech Stocks To Watch

Reviewed by Simply Wall St

Amidst a backdrop of strong corporate earnings and hopes for geopolitical resolutions, the pan-European STOXX Europe 600 Index has seen a notable rise, reflecting investor optimism in the region's economic resilience. As interest rates are adjusted and industrial challenges persist, investors seeking high-growth opportunities may consider focusing on tech stocks that demonstrate robust potential and adaptability in this dynamic market environment.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| argenx | 21.03% | 24.97% | ★★★★★★ |

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Comet Holding | 11.97% | 36.74% | ★★★★★☆ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| KebNi | 20.56% | 65.02% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| Lipigon Pharmaceuticals | 104.89% | 93.94% | ★★★★★☆ |

| ContextVision | 3.17% | 34.60% | ★★★★★☆ |

| CD Projekt | 33.65% | 39.46% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

We'll examine a selection from our screener results.

Netcompany Group (CPSE:NETC)

Simply Wall St Growth Rating: ★★★★★☆

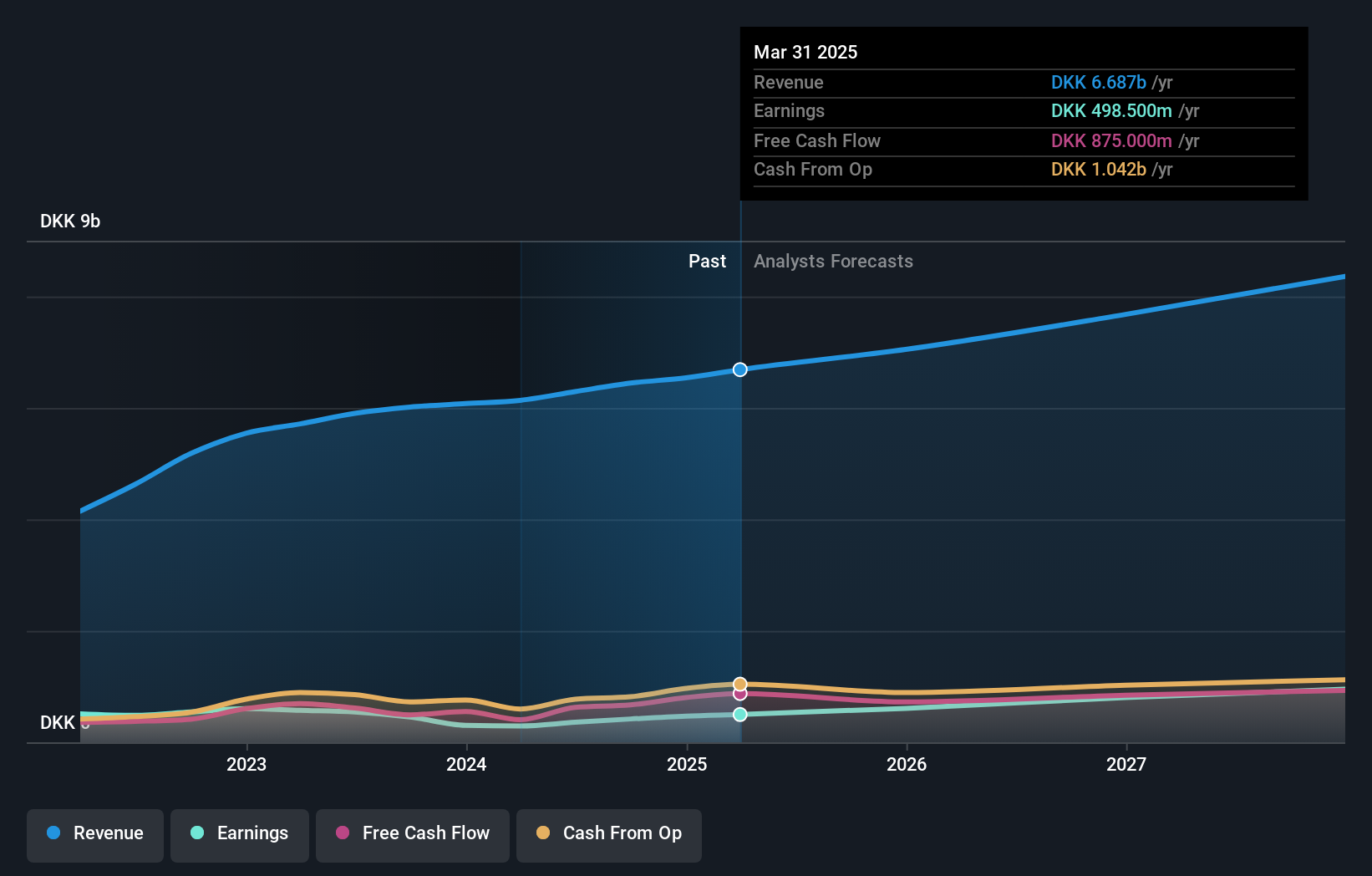

Overview: Netcompany Group A/S offers business critical IT solutions to both private and public sectors across Denmark, Norway, the United Kingdom, the Netherlands, Greece, Belgium, Luxembourg, and internationally with a market capitalization of DKK11.29 billion.

Operations: Netcompany Group A/S generates revenue primarily from providing IT solutions, with DKK4.64 billion coming from public sector clients and DKK2.04 billion from private sector clients.

Netcompany Group, a European IT provider, has recently launched Feniks AI, an innovative solution designed to modernize outdated IT systems efficiently. This breakthrough reduces the transformation process from years to months and is projected to slash IT costs by 30%. With a robust 70% earnings growth over the past year outpacing the industry's 0.5%, and forecasts indicating an annual earnings increase of 20.9%, Netcompany is not only reshaping its operational landscape but also demonstrating significant market outperformance. Moreover, with expected revenue growth at 8.3% per year—surpassing Denmark's market average of 6.7%—the company is well-positioned for sustained expansion in a challenging digital environment.

WithSecure Oyj (HLSE:WITH)

Simply Wall St Growth Rating: ★★★★☆☆

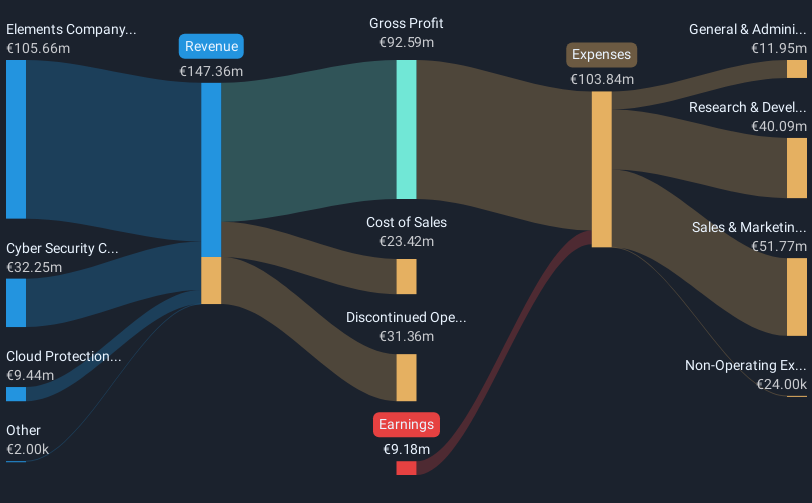

Overview: WithSecure Oyj is a global player in the corporate security sector with a market cap of €294.72 million.

Operations: The company generates revenue primarily through its Elements Company and Cloud Protection for Salesforce segments, with €105.12 million and €12.01 million respectively.

WithSecure Oyj, amid a recent acquisition by CVC Capital Partners for €300 million, shows potential reshaping in its operational strategy. Despite a net loss of €5.2 million in Q2 2025 and increased losses over the six months, WithSecure's revenue growth at 5.7% annually outpaces Finland's average of 3.7%. This growth coupled with an anticipated profitability within three years and a projected earnings surge by nearly 94% annually could signal a turnaround. The firm's presence at high-profile cybersecurity events like Black Hat USA underscores its commitment to innovation and sector leadership despite current financial challenges.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

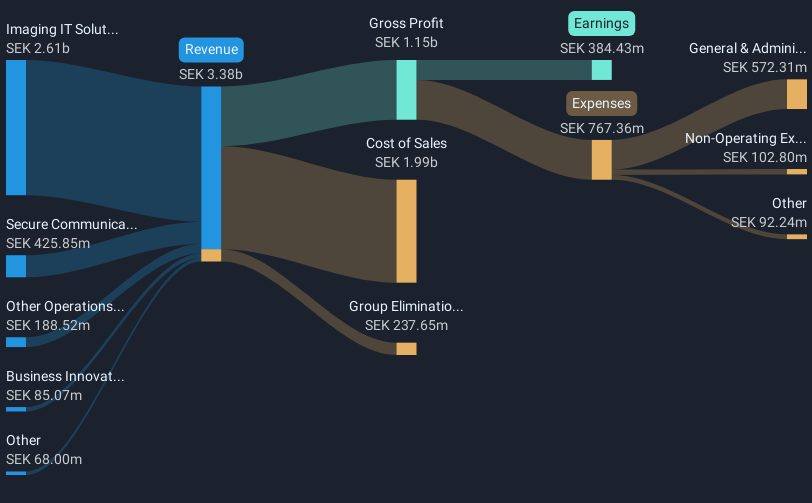

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK67.17 billion.

Operations: Sectra focuses on medical IT and cybersecurity, generating revenue primarily from Imaging IT Solutions (SEK2.80 billion) and Secure Communications (SEK406.96 million). The company's business model leverages technological solutions to serve healthcare providers and secure communication needs across several European regions.

Sectra's recent performance and strategic initiatives underscore its robust position in the tech-driven healthcare sector. With a 31.5% surge in earnings over the past year, Sectra is outpacing its industry significantly, reflecting high-quality earnings and effective market adaptation. Its commitment to integrating AI through solutions like Sectra Amplifier Service has enhanced operational efficiencies for clients such as Osler and various U.S health systems, demonstrating a forward-thinking approach in medical imaging IT. Moreover, with an expected annual revenue growth of 15.3% and profit growth of 18.2%, Sectra is set to continue its upward trajectory, leveraging technology to solidify its footprint in healthcare diagnostics and cybersecurity amidst growing global demand for innovative medical solutions.

- Get an in-depth perspective on Sectra's performance by reading our health report here.

Evaluate Sectra's historical performance by accessing our past performance report.

Seize The Opportunity

- Delve into our full catalog of 56 European High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WithSecure Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:WITH

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives