As global markets navigate a landscape marked by tariff uncertainties and mixed economic indicators, the tech sector remains a focal point for investors seeking growth opportunities. With U.S. job growth cooling and manufacturing showing signs of recovery, identifying high-growth tech stocks involves assessing companies that can adapt to shifting market dynamics and leverage technological advancements to drive innovation and expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.95% | 61.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 1214 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cafe24 Corp. operates an e-commerce platform globally and has a market cap of ₩1.39 trillion.

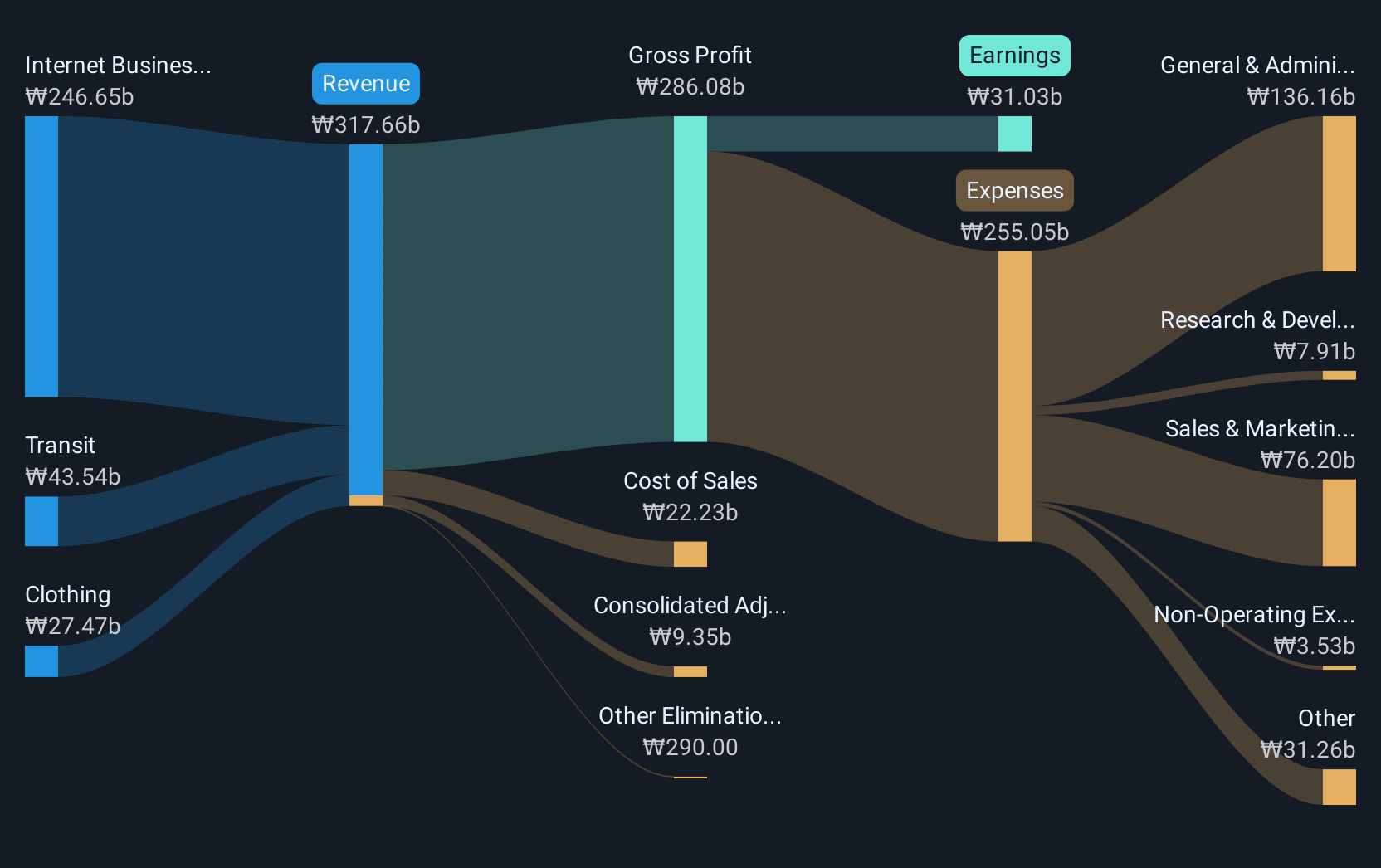

Operations: Cafe24 Corp. generates revenue primarily through its Internet Business Solution segment, which contributes ₩237.10 billion, followed by the Transit and Clothing segments at ₩44.06 billion and ₩22.16 billion respectively. The company experiences a consolidated adjustment of -₩9.66 billion in its financials.

With an impressive annual revenue growth of 11.3% and even more robust earnings growth forecasted at 35.5% per year, Cafe24 stands out in the tech sector, particularly when compared to the broader Korean market's growth rates of 8.7% and 25.9%, respectively. Despite a highly volatile share price in recent months, the company has transitioned into profitability this past year, showcasing its resilience and potential for sustained financial health. Notably, a significant one-off loss of ₩13.4 billion last September underscores some financial volatility but does not overshadow its strong growth trajectory and positive free cash flow status, positioning Cafe24 as a dynamic player in high-growth tech with promising future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Cafe24.

Evaluate Cafe24's historical performance by accessing our past performance report.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sectra AB (publ) is a company that offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK47.90 billion.

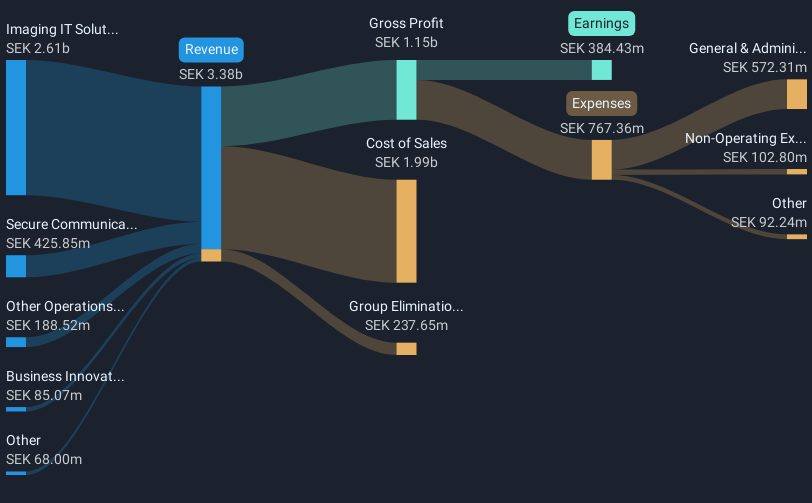

Operations: With a focus on medical IT and cybersecurity, Sectra generates significant revenue from its Imaging IT Solutions segment, which accounts for SEK2.61 billion. The Secure Communications division contributes SEK425.85 million to the overall revenue model.

Sectra's recent expansion into digital pathology with Region Västra Götaland and Helse Nord RHF underscores its strategic focus on enhancing diagnostic processes through integrated AI tools and a unified imaging strategy. This move, part of a broader trend towards digital solutions in healthcare, is set to improve treatment accuracy and speed, particularly in cancer care. Despite reporting a dip in net income to SEK 168.16 million from SEK 212.12 million year-over-year for the first half of fiscal 2024/2025, Sectra's commitment to innovation is evident in its R&D investments which remain robust, supporting long-term growth in the high-demand sector of medical diagnostics technology.

- Click to explore a detailed breakdown of our findings in Sectra's health report.

Understand Sectra's track record by examining our Past report.

China Resources Boya Bio-pharmaceutical GroupLtd (SZSE:300294)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Resources Boya Bio-pharmaceutical Group Co., Ltd operates in the blood product industry within China and has a market capitalization of CN¥14.51 billion.

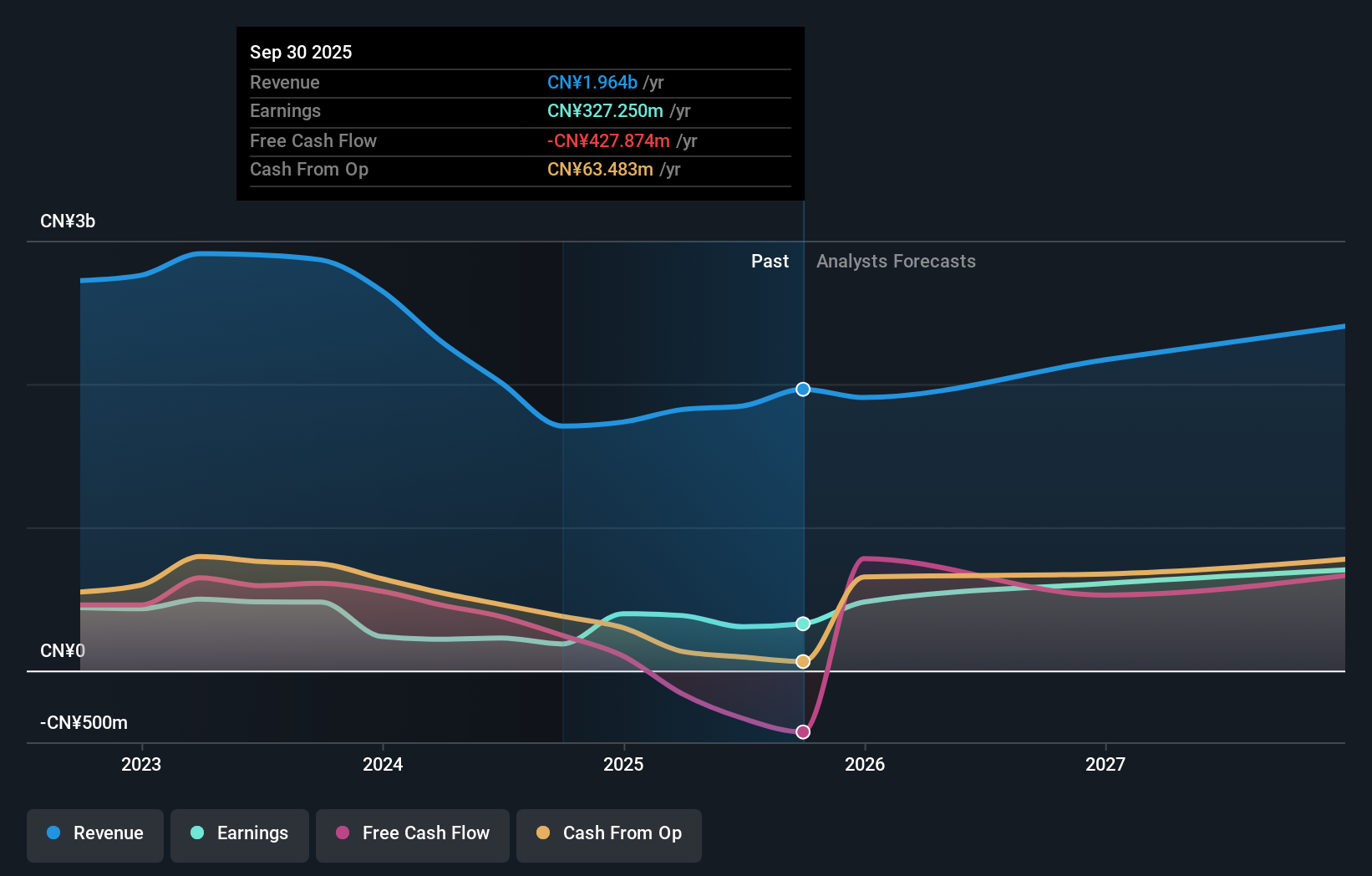

Operations: China Resources Boya Bio-pharmaceutical Group Co., Ltd focuses on the blood product sector in China. The company generates revenue through the production and sale of various blood-derived products.

China Resources Boya Bio-pharmaceutical GroupLtd's recent performance showcases a robust uptick in financial metrics, notably with an anticipated net profit range for 2024 showing substantial growth from RMB 237.46 million to between RMB 380.00 million and RMB 480.00 million. This leap is attributed to increased revenue from blood products and an enhanced plasma collection volume, which saw an impressive year-on-year increase of 11.71%. The company's strategic operations in its plasma stations have significantly contributed to these results, underpinning a promising outlook amidst a dynamic biopharmaceutical landscape where innovation and efficient resource management play critical roles in scaling operations sustainably.

- Delve into the full analysis health report here for a deeper understanding of China Resources Boya Bio-pharmaceutical GroupLtd.

Learn about China Resources Boya Bio-pharmaceutical GroupLtd's historical performance.

Taking Advantage

- Click this link to deep-dive into the 1214 companies within our High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300294

China Resources Boya Bio-pharmaceutical GroupLtd

Engages in the blood product businesses in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives