- Sweden

- /

- Healthtech

- /

- OM:SECT B

High Growth Tech Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, key indices such as the S&P 500 and Nasdaq have experienced notable fluctuations, reflecting investor sentiment and broader economic indicators. In this dynamic environment, identifying high-growth tech stocks requires a keen understanding of market trends and potential regulatory impacts that could influence corporate earnings.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.59% | 31.50% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1303 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

DAEDUCK ELECTRONICS (KOSE:A353200)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daeduck Electronics Co., Ltd. is engaged in the provision of various printed circuit boards (PCB) both domestically in South Korea and internationally, with a market cap of ₩774.61 billion.

Operations: The primary revenue stream for Daeduck Electronics comes from the manufacture and sale of printed circuit boards (PCB), generating approximately ₩925.14 billion.

DAEDUCK Electronics, despite a challenging past year with earnings growth down by 79.3%, is poised for a significant rebound with projected earnings growth of 57.2% annually, outpacing the broader Korean market's 29%. This surge is underpinned by robust R&D investments that fuel innovation in its electronic segment, crucial for maintaining competitive edge in the fast-evolving tech landscape. Moreover, with revenue growth also set to exceed market averages at 12.4% annually compared to the market's 9.8%, DAEDUCK is strategically positioned to capitalize on expanding market opportunities. However, it faces hurdles like last year’s profit margin contraction from 9.8% to just 2.4%, underscoring efficiency challenges amid aggressive expansion efforts.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

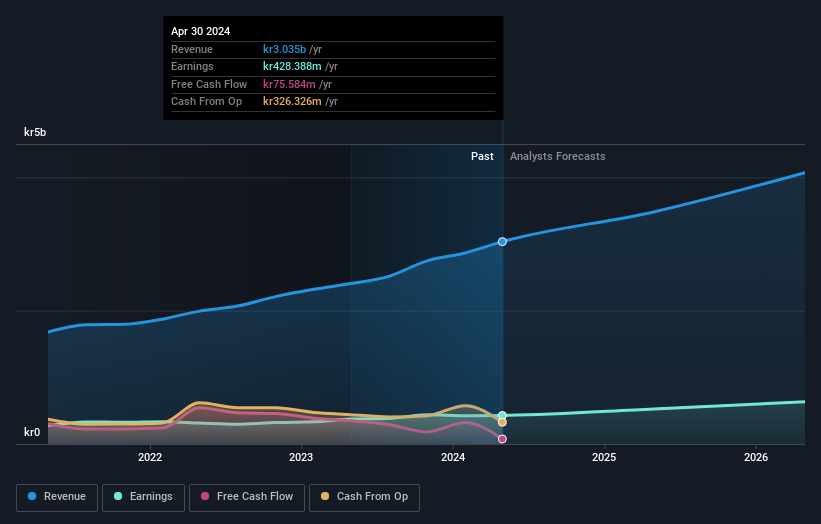

Overview: Sectra AB (publ) is a company that offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK54.87 billion.

Operations: The company's primary revenue stream is Imaging IT Solutions, generating SEK2.67 billion, followed by Secure Communications at SEK388.55 million. The focus on these sectors highlights its specialization in providing technological solutions for healthcare imaging and cybersecurity needs across several European markets.

Sectra, a leader in medical imaging IT and cybersecurity, is demonstrating robust growth with recent strategic contracts boosting its market presence. Notably, the company's engagement with UZ Leuven for a digital pathology solution and MaineGeneral Health for Sectra One Cloud underscores its commitment to advancing healthcare through technology. These partnerships not only expand Sectra’s footprint but also enhance its revenue streams, evidenced by a 14.2% annual revenue growth forecast—outpacing the Swedish market's 0.1%. Furthermore, Sectra’s R&D efforts are substantial, aligning with an expected earnings increase of 21.2% per year, indicative of its innovation-led strategy in a competitive landscape.

- Take a closer look at Sectra's potential here in our health report.

Understand Sectra's track record by examining our Past report.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Co., Ltd. offers marketing solutions and has a market cap of ¥69.81 billion.

Operations: The company specializes in marketing solutions, focusing on innovative strategies to enhance client engagement and brand presence. It generates revenue through providing tailored consulting services aimed at optimizing marketing operations for businesses.

Plus Alpha Consulting Co., Ltd. is navigating a promising trajectory with its recent corporate guidance indicating robust financial health; the firm anticipates net sales reaching JPY 17.73 billion and an operating profit of JPY 5.6 billion for FY2025. This outlook is bolstered by a notable increase in dividends, reflecting a rise from JPY 13 to JPY 18 per share, underscoring confidence in sustained profitability and shareholder value enhancement. The company's commitment to R&D is evident as it continues to allocate substantial resources towards innovation—crucial for maintaining competitive edge in the fast-evolving tech landscape where annual revenue growth of 13.5% outpaces the broader Japanese market's growth rate of 4.2%. Moreover, Plus Alpha’s earnings are expected to surge by an impressive 17.3% annually, demonstrating its potential within high-growth sectors driven by strategic expansions and effective capital management.

Next Steps

- Reveal the 1303 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Flawless balance sheet with high growth potential.