High Growth Tech Stocks And 2 Other Top Picks With Potential

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are closely watching economic indicators and policy shifts that could impact growth prospects. In this environment, identifying high-growth tech stocks requires careful consideration of factors like resilient business models and innovative potential that align with evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.40% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.92% | 61.97% | ★★★★★★ |

Click here to see the full list of 1224 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sectra AB (publ) is a company that offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK47.95 billion.

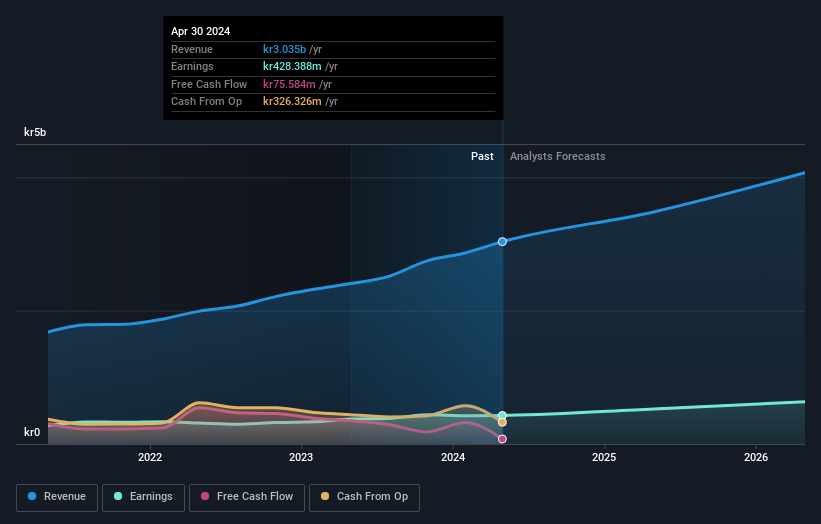

Operations: Revenue primarily comes from Imaging IT Solutions, generating SEK2.61 billion, followed by Secure Communications at SEK425.85 million. The company's focus on medical IT and cybersecurity solutions is evident in its revenue distribution across these segments.

Sectra stands out in the digital healthcare tech landscape, notably with its recent expansion into digital pathology through a new contract with Helse Nord RHF. This move is set to enhance patient care by streamlining pathologists' workflows, indicative of Sectra's strategic push towards integrated medical solutions. Despite a slight dip in quarterly earnings as reported on December 12, 2024, with net income falling to SEK 87.76 million from SEK 150.56 million year-over-year, the company's commitment to innovation remains robust. The adoption of Sectra's enterprise imaging solutions by prominent healthcare providers like AZ Sint-Lucas Gent and MaineGeneral Health underscores its pivotal role in advancing medical diagnostics efficiency and security on a global scale.

- Unlock comprehensive insights into our analysis of Sectra stock in this health report.

Explore historical data to track Sectra's performance over time in our Past section.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of various printed circuit boards in China with a market capitalization of CN¥31.97 billion.

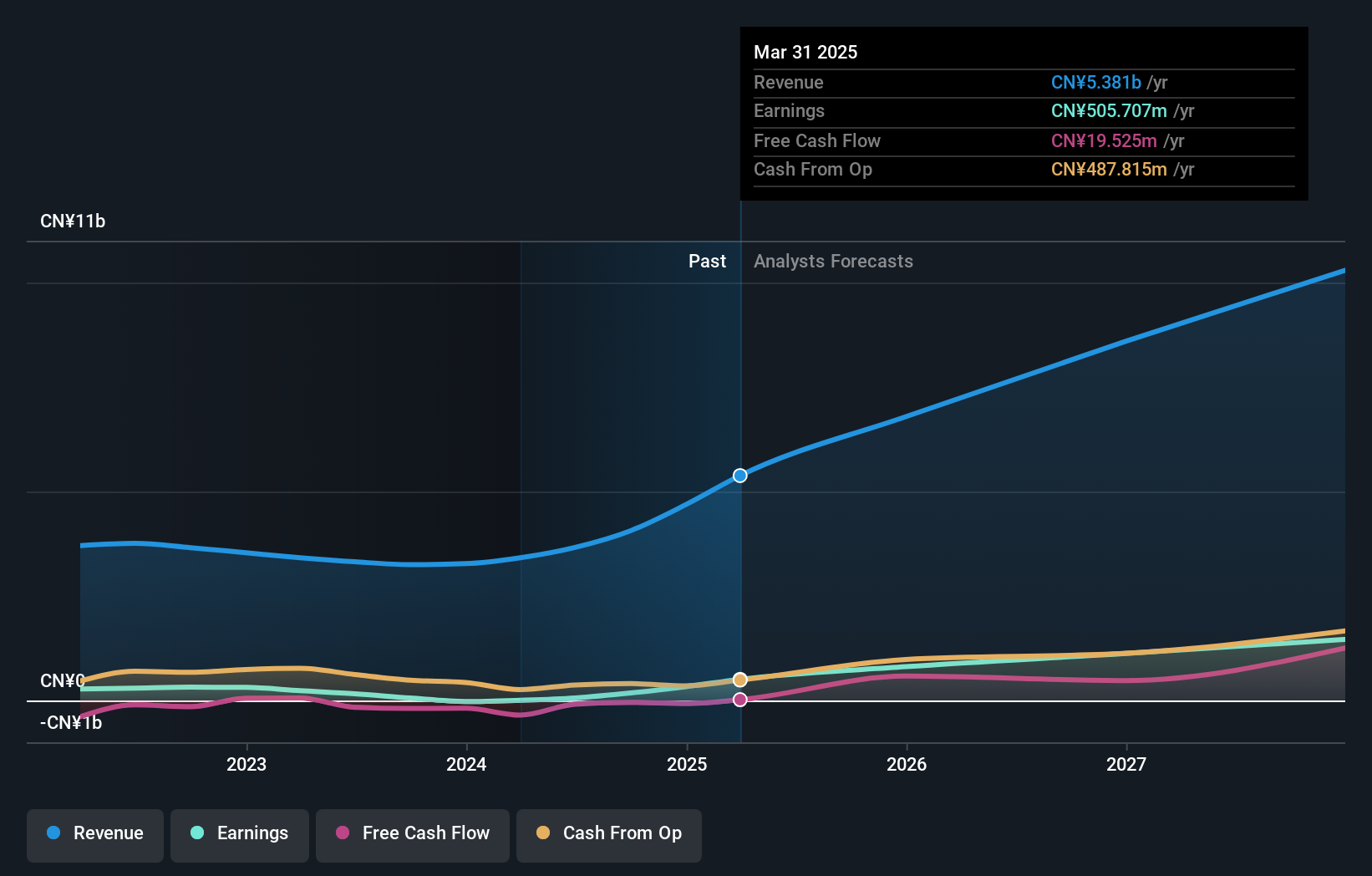

Operations: Shengyi Electronics Co., Ltd. specializes in producing and selling a range of printed circuit boards, leveraging its expertise in research and development to cater to the Chinese market.

Shengyi Electronics has demonstrated remarkable financial agility, with its earnings skyrocketing by 201.9% over the past year, significantly outpacing the electronic industry's growth of 2.7%. This surge is underpinned by a robust increase in revenue, up 19.1% annually, which eclipses the broader Chinese market's growth rate of 13.4%. The company’s strategic focus on R&D is evident from its substantial investment in this area, totaling CNY 82.3 million in the last fiscal year alone, reflecting a commitment to innovation and future readiness in a competitive sector. Shengyi's recent transition from a net loss to a net income of CNY 186.52 million underscores its potential for sustained growth and resilience amidst dynamic market conditions.

Nomura Research Institute (TSE:4307)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nomura Research Institute, Ltd. operates as a provider of consulting, financial IT solutions, industrial IT solutions, and IT platform services both in Japan and internationally with a market capitalization of ¥2.56 trillion.

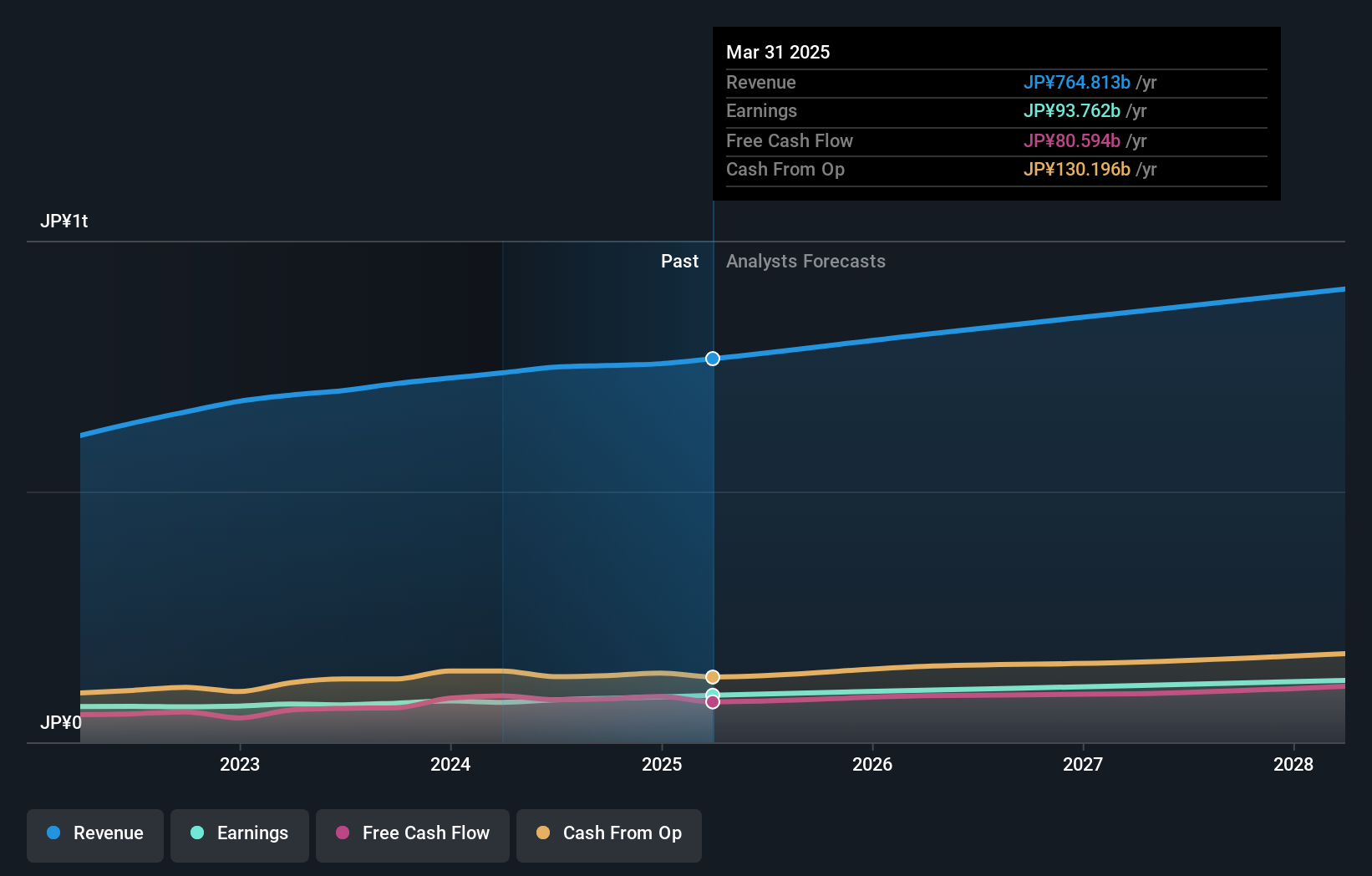

Operations: The company's revenue primarily comes from financial IT solutions and industrial IT solutions, generating ¥364.18 billion and ¥280.09 billion respectively. IT infrastructure services contribute ¥192.32 billion, while consulting adds ¥58.91 billion to the revenue stream.

Nomura Research Institute has adeptly navigated the tech sector with a strategic emphasis on R&D, investing JPY 50 billion last year, which represents a significant portion of its revenue. This commitment fuels innovations that keep it competitive in a rapidly evolving industry. With an annual revenue growth of 5.1% and earnings growth at 8.2%, the company outpaces the Japanese market averages, reflecting robust operational efficiency and market adaptation. Recent corporate actions include increasing dividends and repurchasing shares worth JPY 29.99 billion, signaling strong financial health and shareholder confidence as it projects revenues to reach JPY 780 billion by March 2025.

Key Takeaways

- Delve into our full catalog of 1224 High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Research Institute might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4307

Nomura Research Institute

Provides consulting, financial information technology (IT) solution, industrial IT solution, and IT platform services in Japan and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives