- Sweden

- /

- Healthtech

- /

- OM:SECT B

3 Swedish Growth Stocks With High Insider Ownership And 41% Earnings Growth

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts fuel optimism for further monetary easing, Sweden's stock market is experiencing a favorable environment that may support growth-oriented investments. In this context, stocks with high insider ownership can be particularly appealing due to their potential alignment of interests and commitment to long-term performance, making them noteworthy in today's economic landscape.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.7% | 21.8% |

| Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.2% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| InCoax Networks (OM:INCOAX) | 20.1% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

| Catena Media (OM:CTM) | 10% | 123.9% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's explore several standout options from the results in the screener.

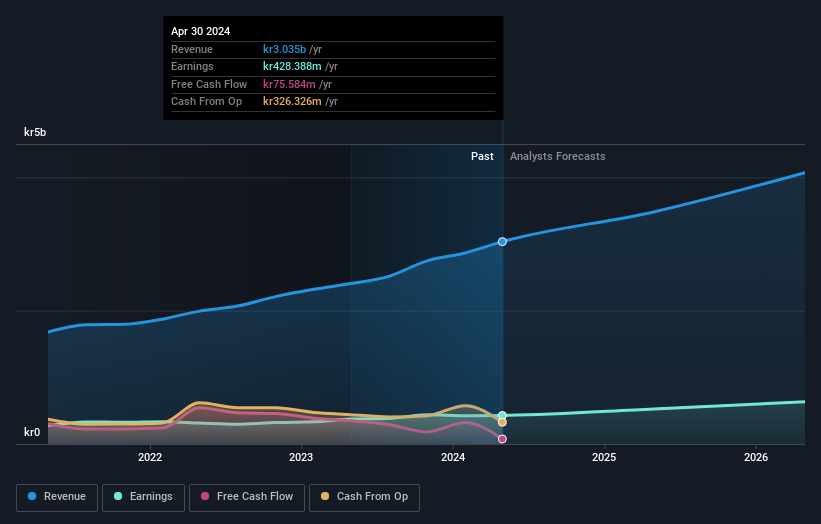

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK36.29 billion.

Operations: The company's revenue segments are comprised of SEK734 million from Core Products, SEK378 million from Businesses, SEK352 million from Accounting Firms, SEK249 million from Financial Services, and SEK160 million from Marketplaces.

Insider Ownership: 19.1%

Earnings Growth Forecast: 23.7% p.a.

Fortnox has seen substantial insider buying recently, with no significant selling, indicating strong internal confidence. Its earnings grew by 48.1% last year and are expected to grow significantly over the next three years, outpacing the Swedish market's growth rate. Analysts anticipate a 30.3% rise in stock price, and it currently trades at nearly 30% below its estimated fair value. Revenue is forecast to grow at 19.9% annually, faster than the market average.

- Navigate through the intricacies of Fortnox with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Fortnox is priced lower than what may be justified by its financials.

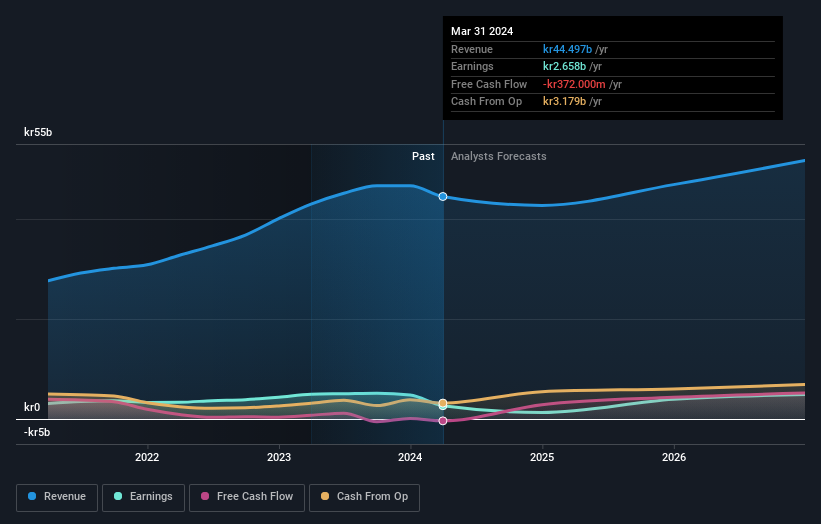

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control across the Nordic countries, Europe, North America, and internationally; it has a market cap of approximately SEK102.82 billion.

Operations: The company's revenue segments are comprised of Stoves (SEK5.33 billion), Element (SEK13.48 billion), and Climate Solutions (SEK35.22 billion).

Insider Ownership: 20.2%

Earnings Growth Forecast: 41.1% p.a.

NIBE Industrier's insider ownership aligns with its growth potential, although recent earnings reports show challenges. The company experienced a decline in sales and net income for both the second quarter and the first half of 2024. Despite this, analysts forecast significant annual earnings growth of 41.1%, surpassing the Swedish market average. Revenue is expected to grow at 6.7% annually, faster than the market but below high-growth benchmarks, while profit margins have decreased compared to last year.

- Dive into the specifics of NIBE Industrier here with our thorough growth forecast report.

- Our expertly prepared valuation report NIBE Industrier implies its share price may be too high.

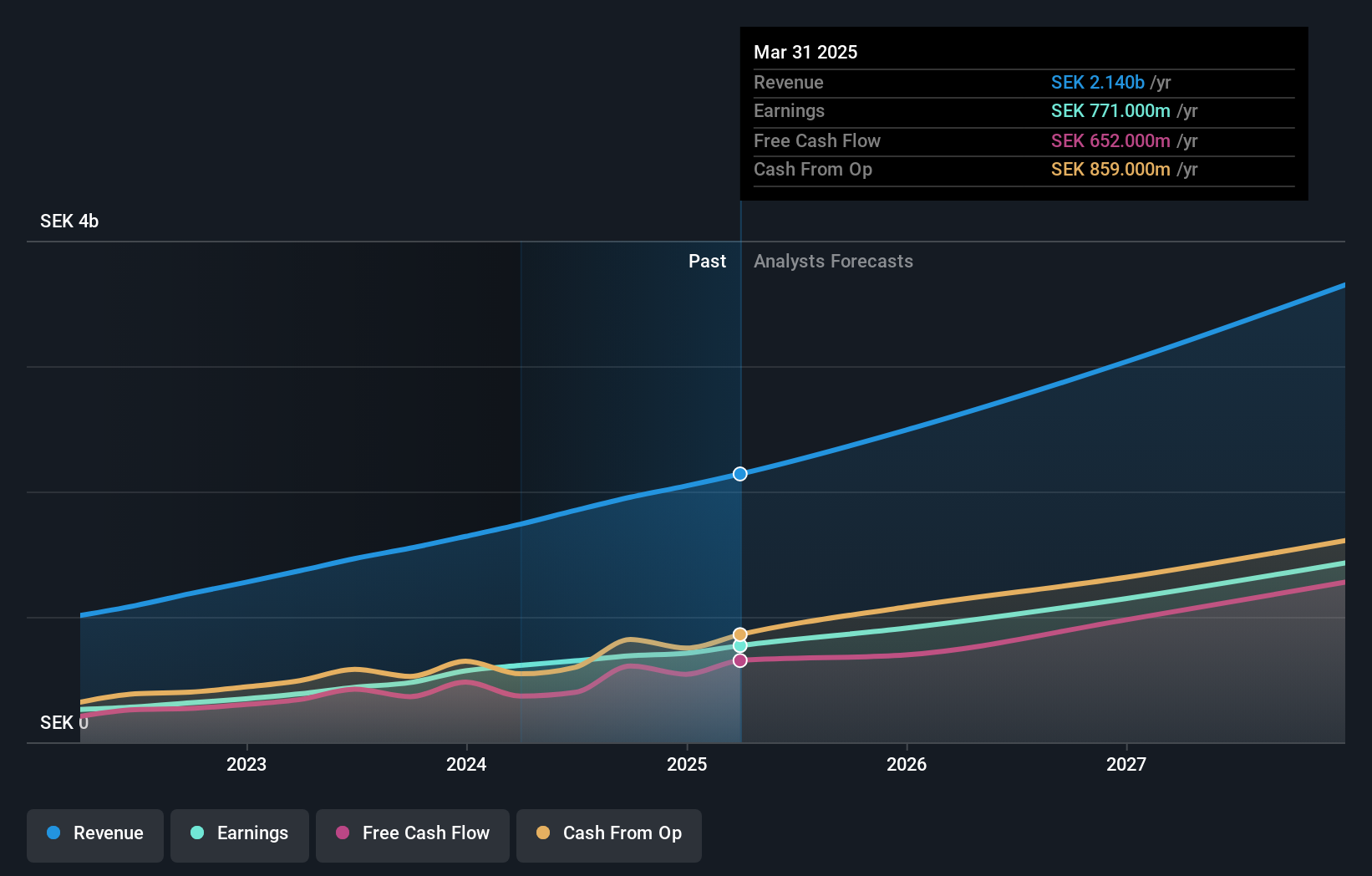

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK56.95 billion.

Operations: The company's revenue is primarily derived from Imaging IT Solutions, contributing SEK2.67 billion, followed by Secure Communications at SEK388.55 million and Business Innovation at SEK90.77 million.

Insider Ownership: 30.3%

Earnings Growth Forecast: 21.2% p.a.

Sectra's growth trajectory is supported by insider ownership, with earnings forecasted to grow significantly at 21.2% annually, outpacing the Swedish market. Recent client agreements, such as the five-year deal with MaineGeneral Health for Sectra One Cloud, highlight its expanding footprint and innovative offerings in medical imaging IT. Despite no substantial recent insider buying, earnings have consistently grown over the past five years. First-quarter results show increased sales and net income compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of Sectra.

- Our valuation report unveils the possibility Sectra's shares may be trading at a premium.

Seize The Opportunity

- Click here to access our complete index of 80 Fast Growing Swedish Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives