- Sweden

- /

- Capital Markets

- /

- OM:EQT

3 Growth Companies With High Insider Ownership On The Swedish Exchange Expecting Up To 35% Earnings Growth

Reviewed by Simply Wall St

The Swedish stock market has been buoyant, with growth stocks outperforming value shares significantly, driven by strong performances in the technology sector. Against this backdrop, identifying growth companies with high insider ownership can be particularly promising as it often indicates confidence from those closest to the business. In this article, we will explore three such companies listed on the Swedish exchange that are expecting up to 35% earnings growth.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| Biovica International (OM:BIOVIC B) | 18.8% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

Let's dive into some prime choices out of the screener.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of approximately SEK410.39 billion.

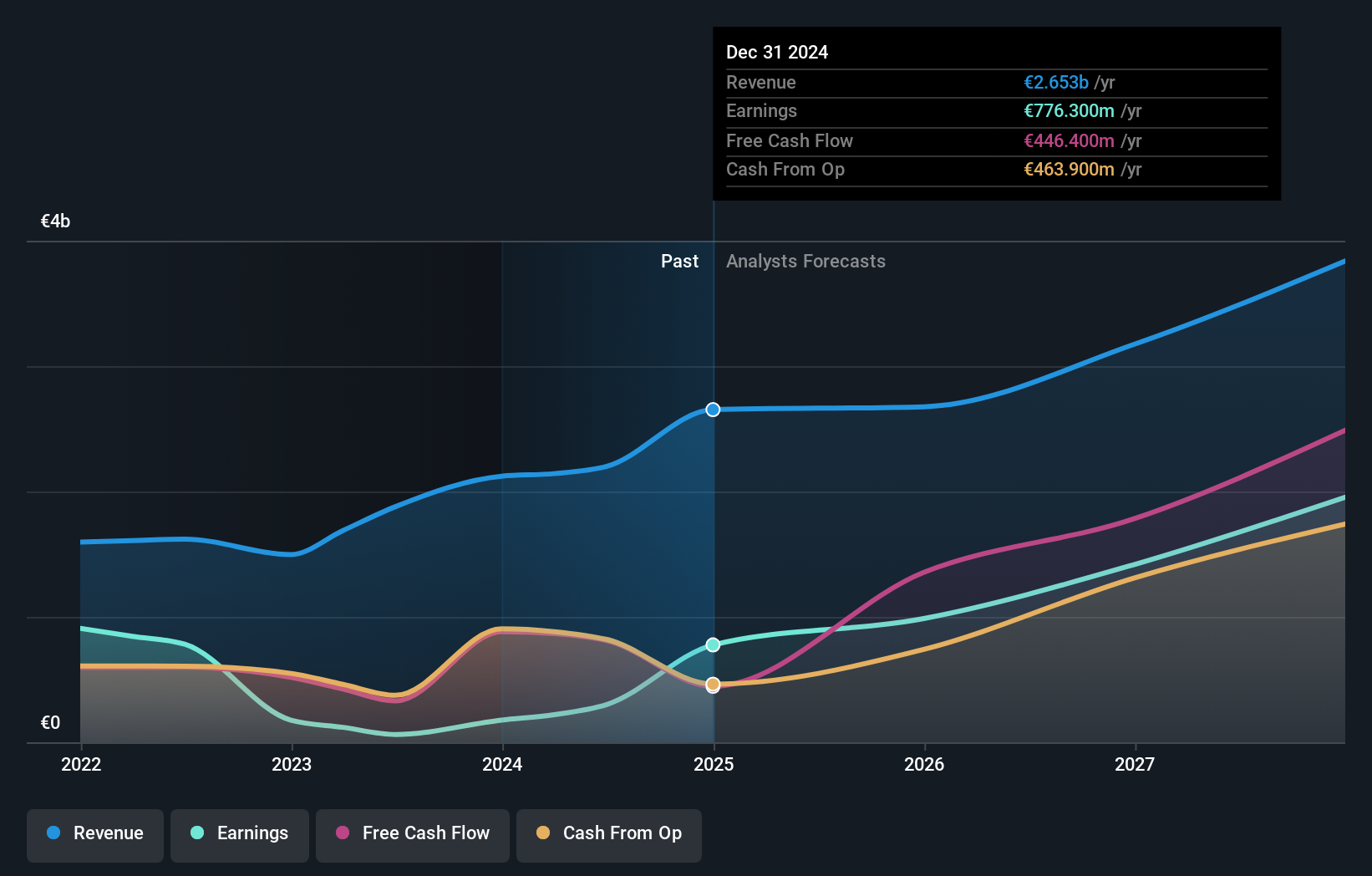

Operations: The firm's revenue segments include €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

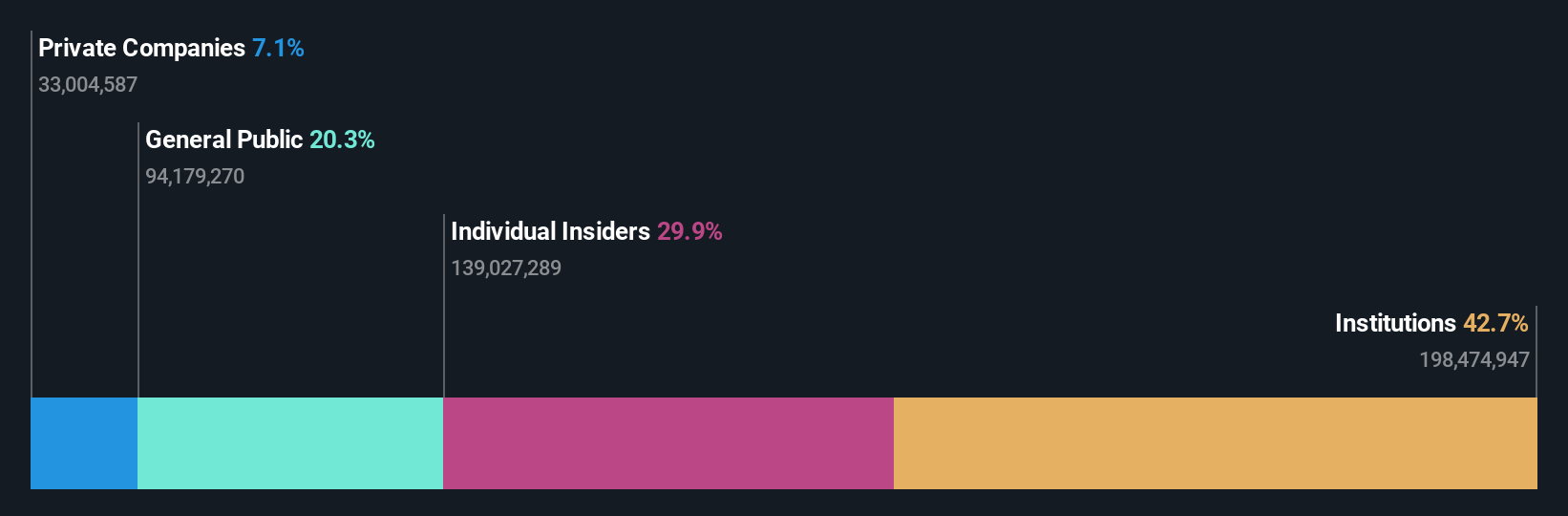

Insider Ownership: 30.9%

Earnings Growth Forecast: 35.9% p.a.

EQT, a Swedish private equity firm, is forecast to grow earnings by 35.9% annually, significantly outpacing the market's 15.3%. Despite trading slightly below its fair value and having no substantial insider buying recently, EQT has seen more insider purchases than sales in the past three months. Recent activities include potential acquisitions and divestitures across various sectors, such as healthcare and logistics, highlighting its aggressive growth strategy amidst high-quality earnings impacted by large one-off items.

- Unlock comprehensive insights into our analysis of EQT stock in this growth report.

- According our valuation report, there's an indication that EQT's share price might be on the expensive side.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK97.20 billion.

Operations: The company's revenue from rental real estate amounts to SEK4.63 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 28.7% p.a.

AB Sagax, a Swedish real estate company, has demonstrated substantial growth with earnings surging by 196.5% over the past year and forecasted to grow 28.72% annually, outpacing the Swedish market's 15.3%. Despite recent shareholder dilution and debt concerns relative to operating cash flow, insider ownership remains high with no significant insider trading in the last three months. Recent earnings reports show impressive results; net income for Q2 reached SEK 978 million compared to SEK 53 million a year ago.

- Get an in-depth perspective on AB Sagax's performance by reading our analyst estimates report here.

- Our valuation report here indicates AB Sagax may be overvalued.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe, with a market cap of SEK51.94 billion.

Operations: Sectra's revenue segments include Imaging IT Solutions at SEK2.67 billion, Secure Communications at SEK388.55 million, and Business Innovation at SEK90.77 million.

Insider Ownership: 30.3%

Earnings Growth Forecast: 21.2% p.a.

Sectra AB, a Swedish medical technology company, has shown solid growth with earnings increasing by 17% over the past year and forecasted to grow 21.21% annually. Recent Q1 results highlighted revenue of SEK 739.48 million, up from SEK 603.03 million a year prior, and net income rising to SEK 80.4 million from SEK 61.56 million. High insider ownership aligns with this growth trajectory, underscoring confidence in the company's future prospects despite slower revenue growth forecasts compared to peers.

- Take a closer look at Sectra's potential here in our earnings growth report.

- The analysis detailed in our Sectra valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Get an in-depth perspective on all 91 Fast Growing Swedish Companies With High Insider Ownership by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity firm specializing in private capital and real asset segments.

Excellent balance sheet with reasonable growth potential.