- Sweden

- /

- Healthtech

- /

- OM:RAY B

Unearthing European Stock Gems With Strong Potential In July 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains steady amid ongoing U.S. and European trade discussions, investors are keenly observing economic indicators like industrial production growth and widening trade surpluses in the eurozone. In this environment, identifying stocks with strong fundamentals and resilience to macroeconomic shifts can be crucial for uncovering potential opportunities in Europe's diverse market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Karnell Group (OM:KARNEL B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Karnell Group AB (publ) is a private equity firm that focuses on investments in add-on acquisitions, expansion, and small to medium-sized companies, with a market cap of SEK3.23 billion.

Operations: Karnell Group's revenue streams primarily derive from its investments in small to medium-sized enterprises and expansion initiatives. The company's financial structure includes a market cap of approximately SEK3.23 billion, reflecting its investment scale and reach within the private equity sector.

Karnell Group, a dynamic player in the Industrials sector, has shown impressive growth with earnings surging by 94.1% over the past year, outpacing the industry average of 3.2%. Their net debt to equity ratio stands at a satisfactory 28.2%, complemented by high-quality earnings and robust EBIT covering interest payments 14.2 times over. Recent financial results highlight strong performance; Q2 sales reached SEK 431 million compared to SEK 357.2 million last year, while net income rose to SEK 36.8 million from SEK 15.8 million previously, reflecting strategic operational excellence and disciplined growth initiatives in their pipeline.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer treatment globally, with a market cap of SEK12.36 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, which reported SEK1.27 billion in sales.

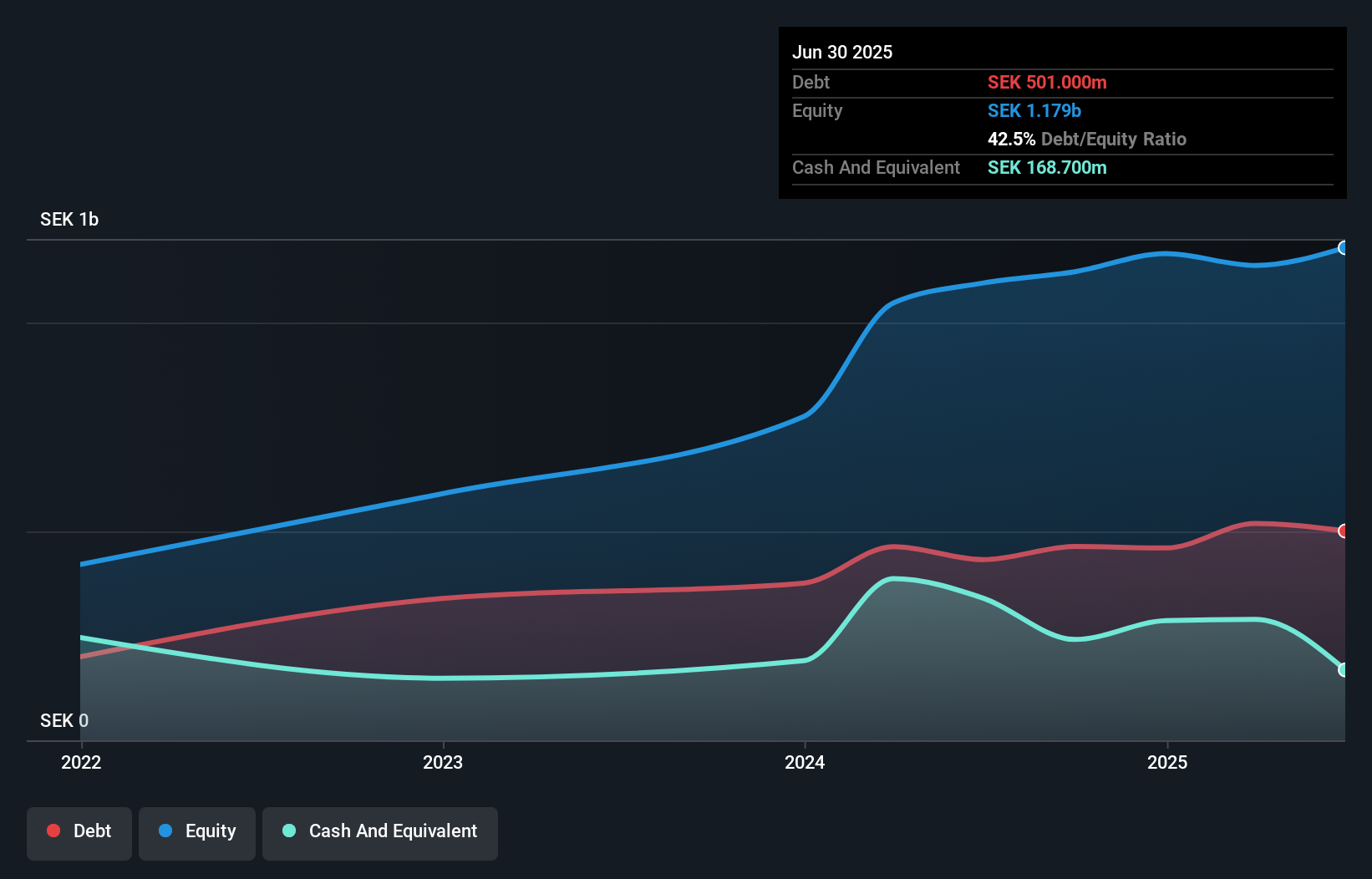

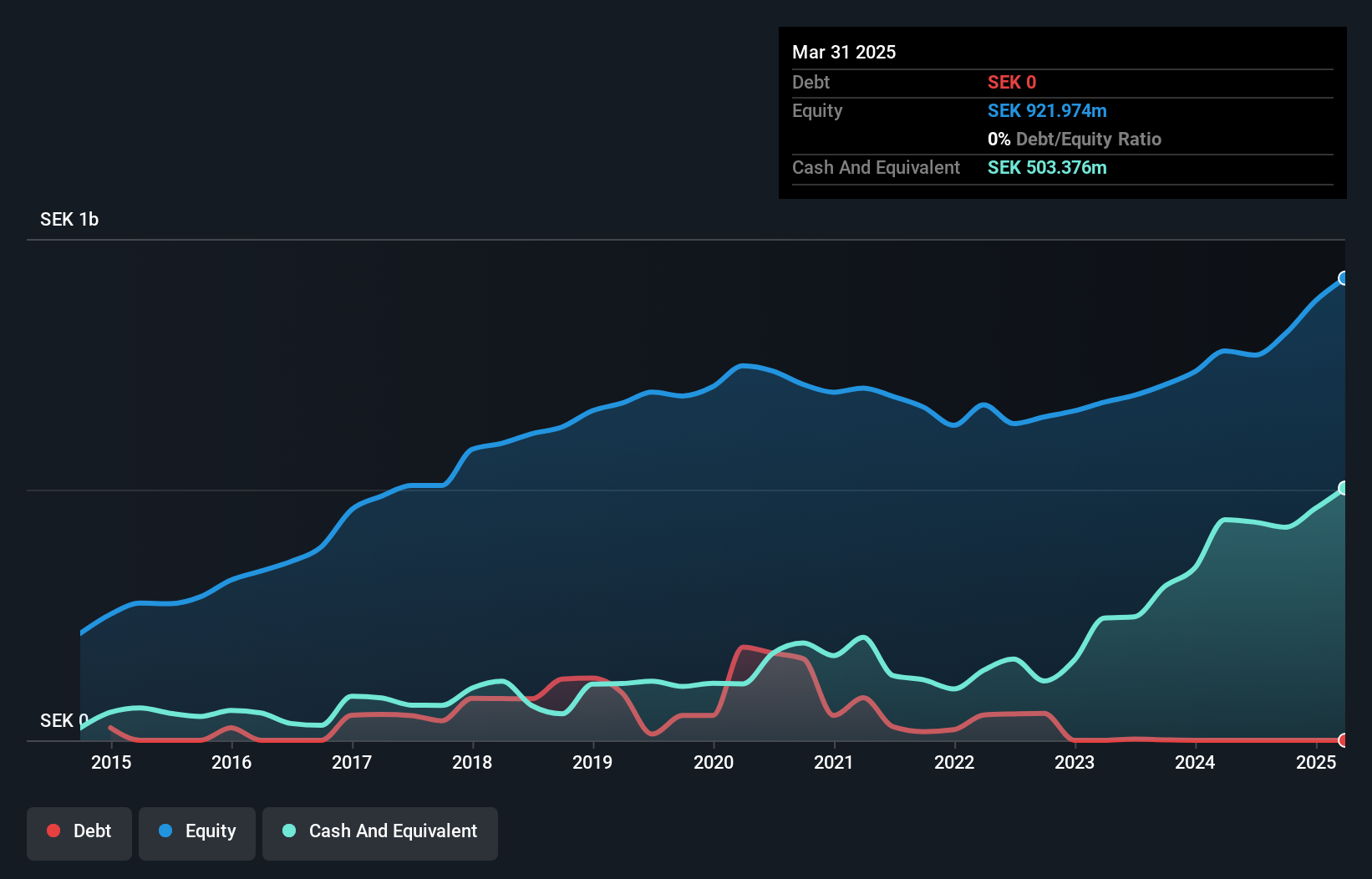

RaySearch Laboratories, a nimble player in the medical tech space, is leveraging AI and automation to enhance cancer treatment planning. The company recently reported a 122% surge in earnings over the past year, outpacing its industry peers' -6.9% performance. With no debt on its books now compared to a 24.9% debt-to-equity ratio five years ago, RaySearch has improved financial stability. Despite challenges like exchange rate volatility and regulatory hurdles in key markets such as China, analysts project an annual revenue growth of 13.9%, with profit margins expected to rise from 17.7% to 21.9%.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF1.47 billion, operates through its subsidiaries to deliver electrical engineering services to the construction sector mainly in Switzerland.

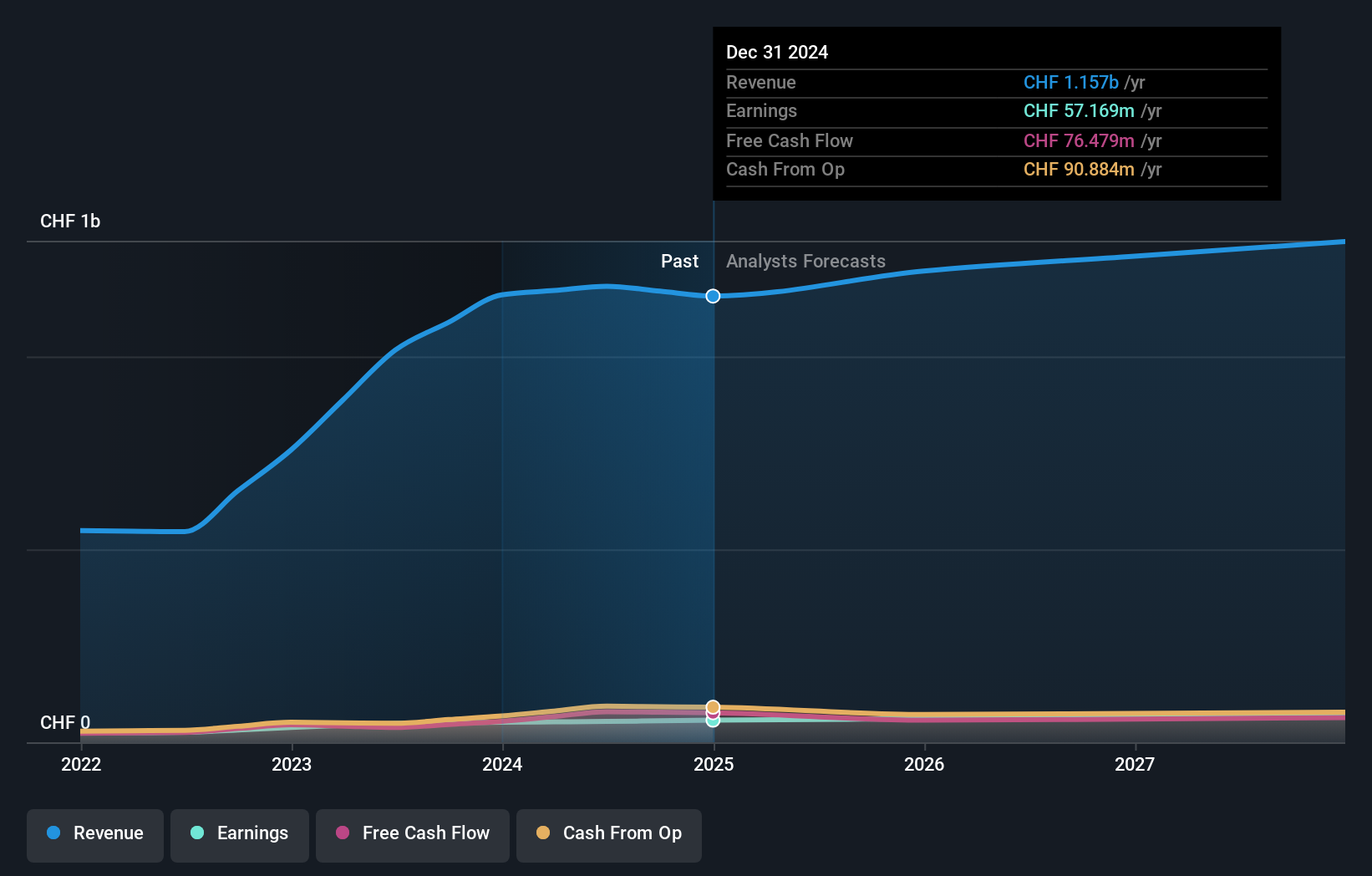

Operations: The company's primary revenue stream is electrical engineering services, generating CHF1.16 billion. With a market cap of CHF1.47 billion, it focuses on the Swiss construction sector through its subsidiaries.

With Burkhalter Holding's earnings growth of 10.2% outpacing the Construction industry's 4.9%, this Swiss company is showcasing its competitive edge. Its debt to equity ratio has risen from 14.8% to 37.5% over five years, suggesting increased leverage, yet interest payments are comfortably covered by EBIT at a multiple of 58 times, indicating strong financial health. Moreover, trading slightly below fair value enhances its appeal for potential investors seeking undervalued opportunities in Europe’s market landscape. The recent approval of a CHF 4.85 dividend per share further underscores confidence in future profitability and shareholder returns.

- Click to explore a detailed breakdown of our findings in Burkhalter Holding's health report.

Assess Burkhalter Holding's past performance with our detailed historical performance reports.

Next Steps

- Reveal the 320 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer treatment worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives