- Sweden

- /

- Healthtech

- /

- OM:RAY B

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets continue to navigate the evolving economic landscape, major indices like the S&P 500 have reached record highs amid optimism surrounding trade policies and advancements in artificial intelligence. While large-cap stocks have generally outperformed their smaller counterparts, there remains a wealth of opportunity within the small-cap sector for investors seeking undiscovered gems with promising potential. Identifying such stocks often involves looking for companies with solid fundamentals that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Toyo Kanetsu K.K | 32.74% | 2.71% | 17.49% | ★★★★★☆ |

| Alembic | 0.72% | 21.20% | -6.80% | ★★★★★☆ |

| Piccadily Agro Industries | 34.60% | 14.20% | 46.61% | ★★★★★☆ |

| Sichuan Haite High-techLtd | 49.88% | 6.40% | -10.22% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

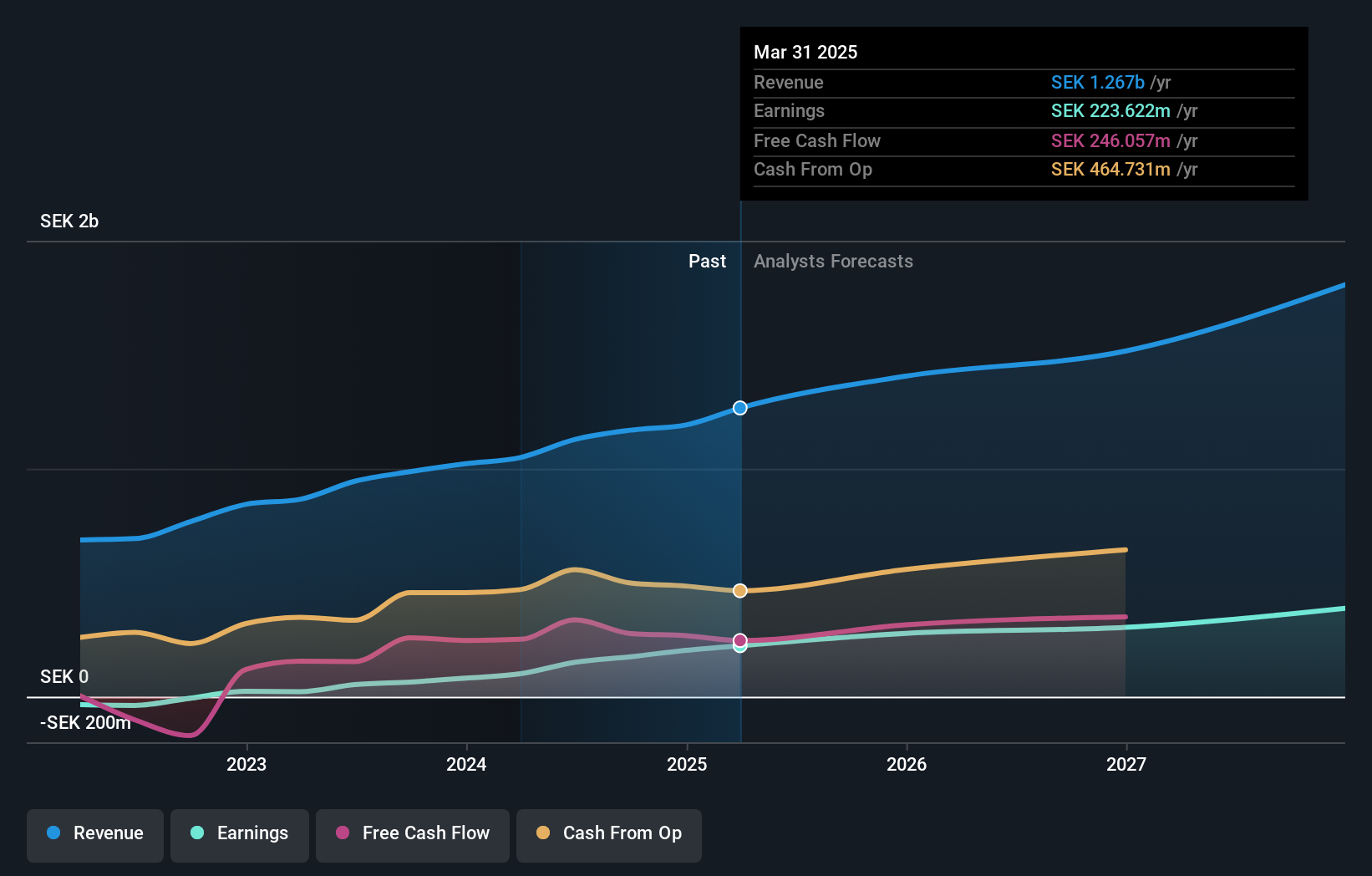

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer care across the Americas, Europe, Africa, the Asia-Pacific, and the Middle East with a market cap of SEK7.92 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, amounting to SEK1.17 billion.

RaySearch Laboratories, a dynamic player in the healthcare tech space, has shown impressive growth with earnings rising by 172.8% over the past year, outpacing the Healthcare Services industry average of 3.6%. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 7.2%, showcasing robust financial health. Recent client wins include orders for DrugLog from Medim and RayStation from Institut Curie, highlighting its expanding market presence and innovative offerings in cancer treatment solutions. With sales reaching SEK 869 million for nine months ending September 2024 and net income at SEK 144 million, RaySearch continues to demonstrate strong performance metrics and promising future prospects in its niche market segment.

Anhui Anfu Battery TechnologyLtd (SHSE:603031)

Simply Wall St Value Rating: ★★★★★☆

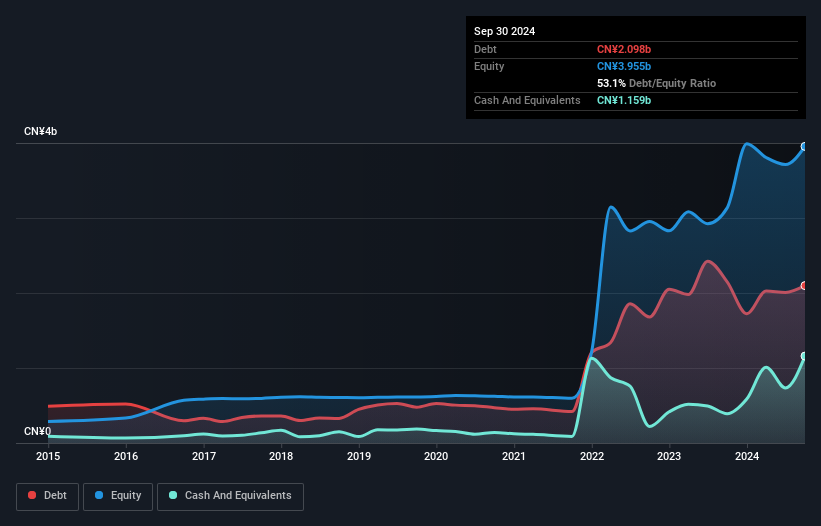

Overview: Anhui Anfu Battery Technology Co., Ltd is engaged in the research, development, production, and sale of zinc-manganese batteries in China with a market capitalization of CN¥5.76 billion.

Operations: Anhui Anfu Battery Technology generates revenue primarily from the production and sale of zinc-manganese batteries. The company's financial data reveals a focus on optimizing cost structures to enhance profitability, with particular attention to its net profit margin trends over recent periods.

Anhui Anfu Battery Technology, a nimble player in the battery industry, shows promising financial health with earnings growth of 54% over the past year, outpacing its peers. The company reported net income of CNY 149.95 million for the nine months ending September 2024, up from CNY 103.01 million in the previous year. Additionally, its debt to equity ratio has improved significantly from 77.8% to 53.1% over five years, indicating prudent financial management. With shares trading at a discount of approximately 41% below estimated fair value and robust EBIT interest coverage at 27 times, Anhui Anfu appears well-positioned for future opportunities.

Palfinger (WBAG:PAL)

Simply Wall St Value Rating: ★★★★☆☆

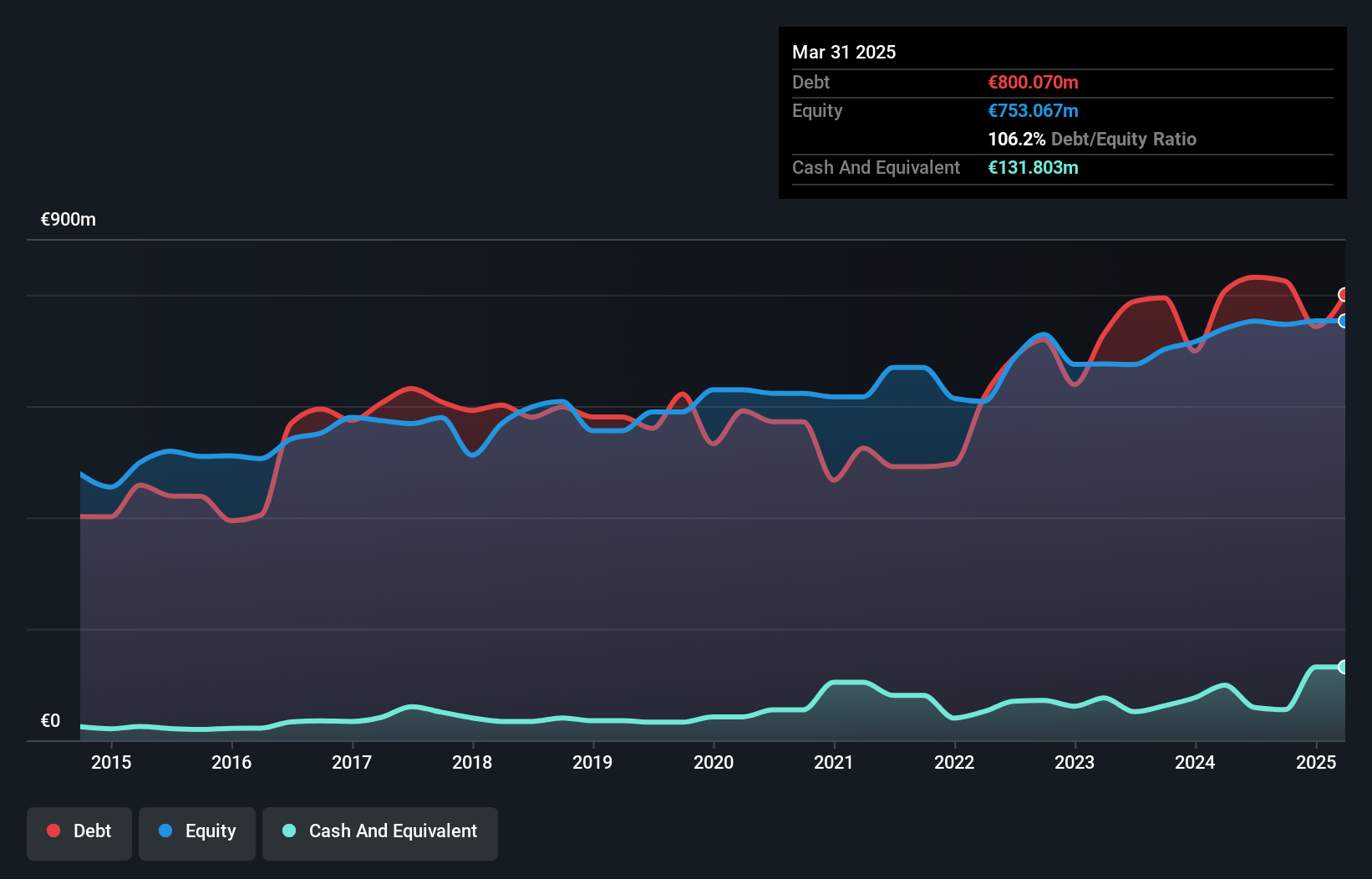

Overview: Palfinger AG is a global provider of crane and lifting solutions with a market capitalization of €731.84 million.

Operations: Palfinger AG generates revenue through the production and sale of crane and lifting solutions worldwide. The company focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on managing operational expenses effectively.

Palfinger, a notable player in the machinery sector, showcases a mixed financial landscape. Trading at 12.2% below its estimated fair value suggests potential upside for investors. However, its net debt to equity ratio stands high at 103.1%, indicating significant leverage that has increased over the last five years from 105.4% to 110.4%. Despite this, Palfinger's interest payments are well covered by EBIT with a coverage of 4.4 times, reflecting manageable debt servicing capabilities. Recent earnings show stability with EUR 90.81 million net income for nine months ending September 2024, nearly matching last year's EUR 90.95 million despite revenue dips from EUR 1,798 million to EUR 1,745 million in sales during the same period.

- Delve into the full analysis health report here for a deeper understanding of Palfinger.

Understand Palfinger's track record by examining our Past report.

Make It Happen

- Click through to start exploring the rest of the 4663 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer treatment worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives