- Sweden

- /

- Healthtech

- /

- OM:RAY B

RaySearch Laboratories AB (publ) (STO:RAY B) Stocks Shoot Up 28% But Its P/E Still Looks Reasonable

RaySearch Laboratories AB (publ) (STO:RAY B) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 91%.

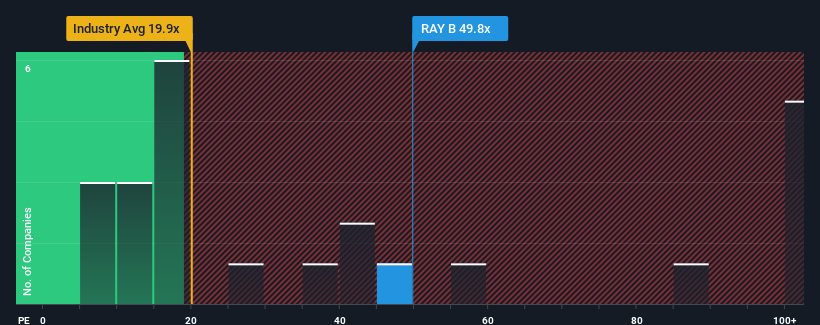

Since its price has surged higher, given close to half the companies in Sweden have price-to-earnings ratios (or "P/E's") below 22x, you may consider RaySearch Laboratories as a stock to avoid entirely with its 49.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, RaySearch Laboratories has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for RaySearch Laboratories

Is There Enough Growth For RaySearch Laboratories?

The only time you'd be truly comfortable seeing a P/E as steep as RaySearch Laboratories' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 357% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 36% over the next year. Meanwhile, the rest of the market is forecast to only expand by 28%, which is noticeably less attractive.

With this information, we can see why RaySearch Laboratories is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in RaySearch Laboratories have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of RaySearch Laboratories' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for RaySearch Laboratories with six simple checks on some of these key factors.

If you're unsure about the strength of RaySearch Laboratories' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer treatment worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.