- Sweden

- /

- Entertainment

- /

- OM:PDX

High Growth Tech Stocks in Europe to Watch This October 2025

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index climbing 1.68% and key indices in Germany, Italy, France, and the UK showing positive momentum, investors are increasingly focused on high-growth sectors such as technology. In this environment of strengthening business activity and improving consumer confidence across the eurozone, identifying tech stocks with robust growth potential can be crucial for those looking to capitalize on emerging opportunities within Europe's dynamic market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| argenx | 21.83% | 26.68% | ★★★★★★ |

| Paradox Interactive | 11.85% | 20.30% | ★★★★★☆ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| Bonesupport Holding | 27.78% | 51.42% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| ContextVision | 2.19% | 56.51% | ★★★★★☆ |

| CD Projekt | 36.72% | 49.58% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| Gapwaves | 41.49% | 89.60% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Smartoptics Group (OB:SMOP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smartoptics Group ASA is a company that offers optical networking solutions and devices across various regions including the Americas, Europe, the Middle East, Africa, and the Asia-Pacific, with a market capitalization of NOK3.04 billion.

Operations: Smartoptics Group ASA specializes in providing optical networking solutions and devices globally. The company's revenue model is centered around these core offerings, catering to diverse geographical markets.

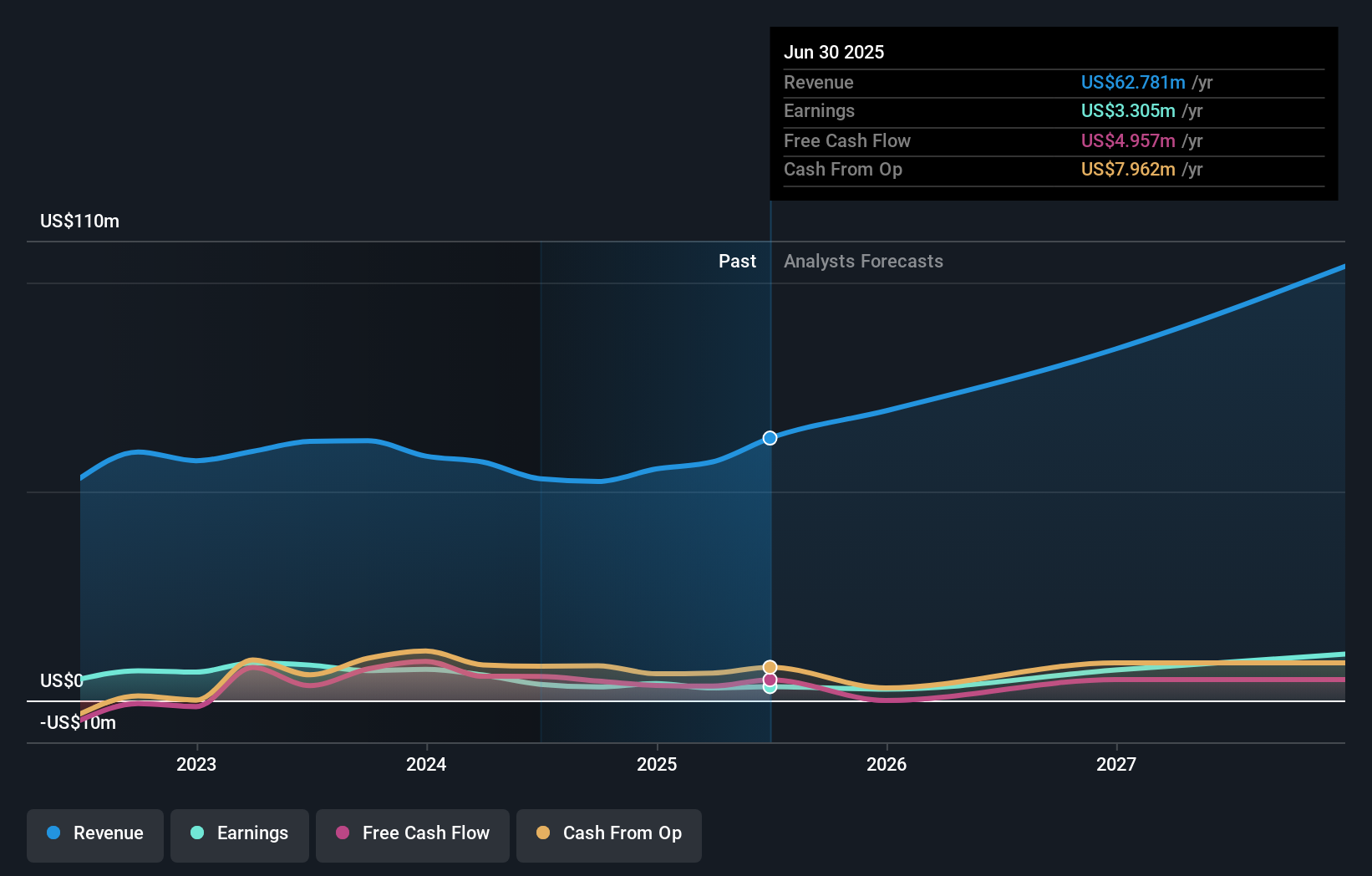

Smartoptics Group ASA recently demonstrated its commitment to technological advancement by enabling Geneseo Communications to overhaul its core network, enhancing scalability and reducing operational complexities. This move not only solidifies Smartoptics' role in supporting regional communication needs but also aligns with the latest trends toward more efficient and cost-effective network solutions. Financially, Smartoptics is poised for significant growth with a projected annual earnings increase of 55.9% and revenue growth at 20.5%. Despite a volatile share price and past performance challenges, these developments could position Smartoptics favorably in the high-tech European market as they continue to expand their influence in telecommunications infrastructure.

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across the United States, Europe, Sweden, and other international markets, with a market cap of approximately SEK17.52 billion.

Operations: Paradox Interactive generates revenue primarily from developing and publishing strategy and management games for PC and consoles, with a significant portion of its SEK2.03 billion revenue coming from computer graphics. The company's financial performance is reflected in its market cap of approximately SEK17.52 billion.

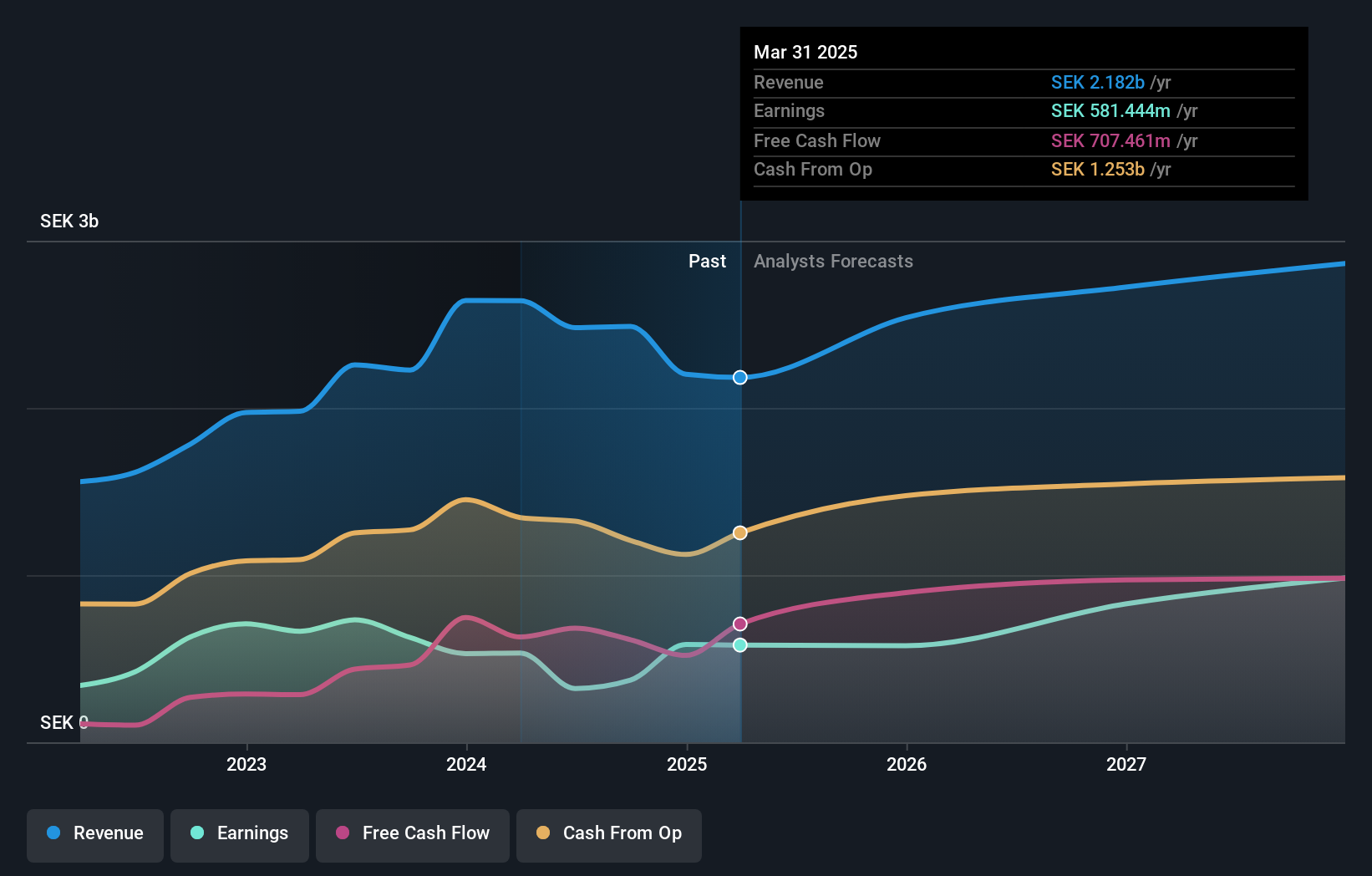

Paradox Interactive, a Swedish game developer, recently reported a mixed financial performance with a decline in quarterly sales to SEK 394.96 million from SEK 433.99 million year-over-year, yet showcased resilience with an increase in nine-month net income to SEK 326.85 million from SEK 273.81 million. The company's commitment to innovation is evident in its upcoming release of "Bridges & Ports" for Cities: Skylines II, aiming to enhance gameplay by integrating complex maritime and city-planning dynamics. This strategic expansion aligns with Paradox's focus on deepening user engagement and expanding its product portfolio, positioning it well amidst the competitive gaming industry despite slower revenue growth projections of 11.8% annually compared to the market average.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer treatment on a global scale, with a market capitalization of SEK7.77 billion.

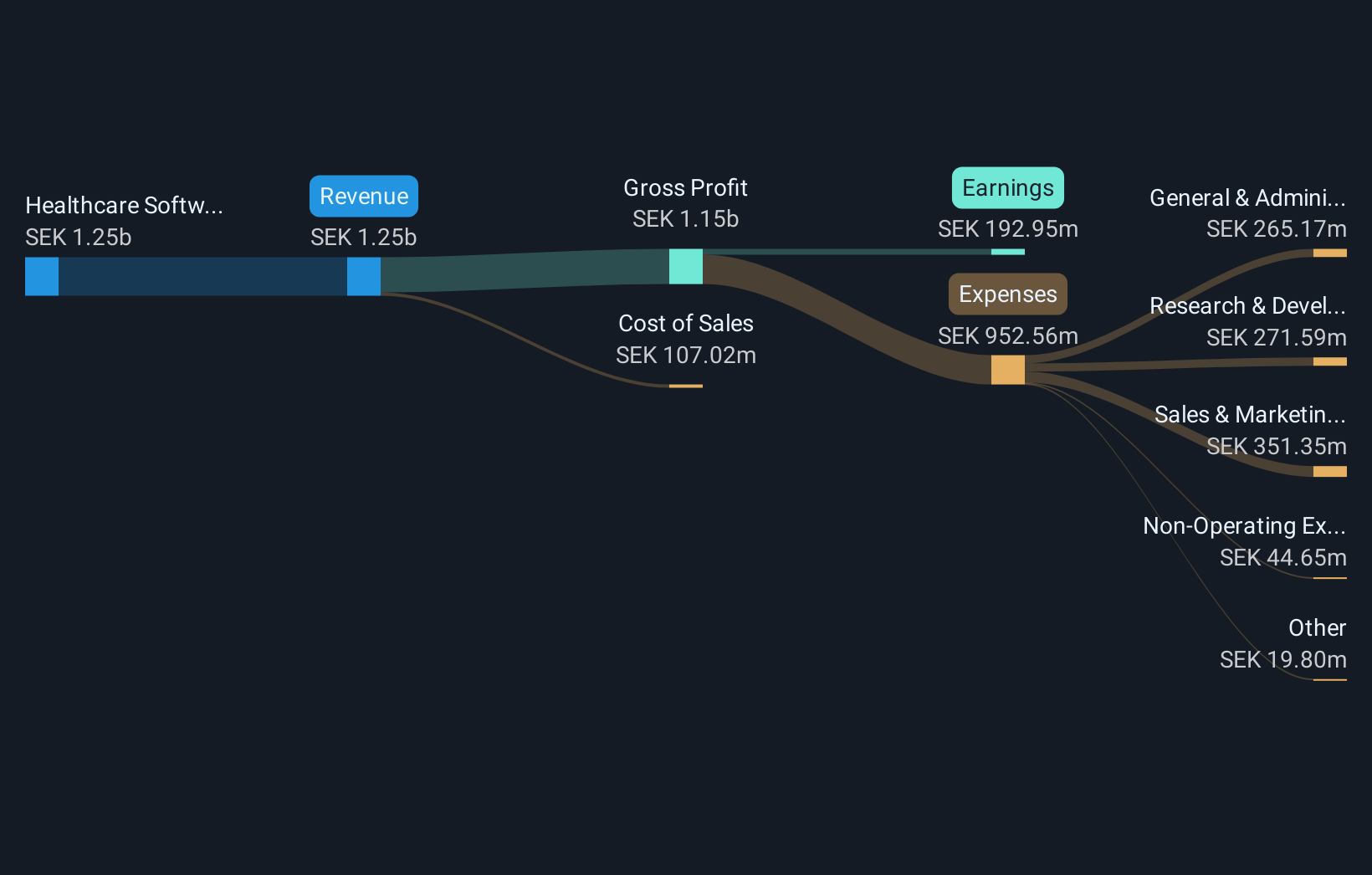

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, amounting to SEK1.25 billion. The company focuses on providing innovative software solutions for cancer treatment globally.

RaySearch Laboratories, a leader in oncology treatment software, is poised for significant growth with its innovative product line including RayStation and RayCare. The company's focus on integrating advanced analytics and patient management systems is demonstrated by the recent release of RayIntelligence v2025, which transforms scattered clinical data into actionable insights. This strategic innovation not only enhances treatment outcomes but also positions RaySearch at the forefront of the healthcare tech industry. With a robust 13.8% annual revenue growth and an impressive 25.4% increase in earnings per year, coupled with substantial R&D investments accounting for a notable portion of their budget, RaySearch is effectively setting new standards in cancer care technology while expanding its market reach globally.

- Click to explore a detailed breakdown of our findings in RaySearch Laboratories' health report.

Evaluate RaySearch Laboratories' historical performance by accessing our past performance report.

Seize The Opportunity

- Navigate through the entire inventory of 50 European High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PDX

Paradox Interactive

Develops and publishes strategy and management games on PC and consoles in the United States, Rest of Europe, Sweden, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives