As the pan-European STOXX Europe 600 Index continues its upward trajectory, marking a fourth consecutive week of gains amid easing trade tensions between China and the U.S., investors are closely watching how these developments influence high-growth tech stocks in Europe. In this dynamic environment, identifying promising tech stocks involves assessing their ability to innovate and adapt to shifting market conditions while leveraging opportunities presented by evolving trade relationships.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 22.16% | 27.03% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| Elliptic Laboratories | 23.60% | 51.89% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

We'll examine a selection from our screener results.

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

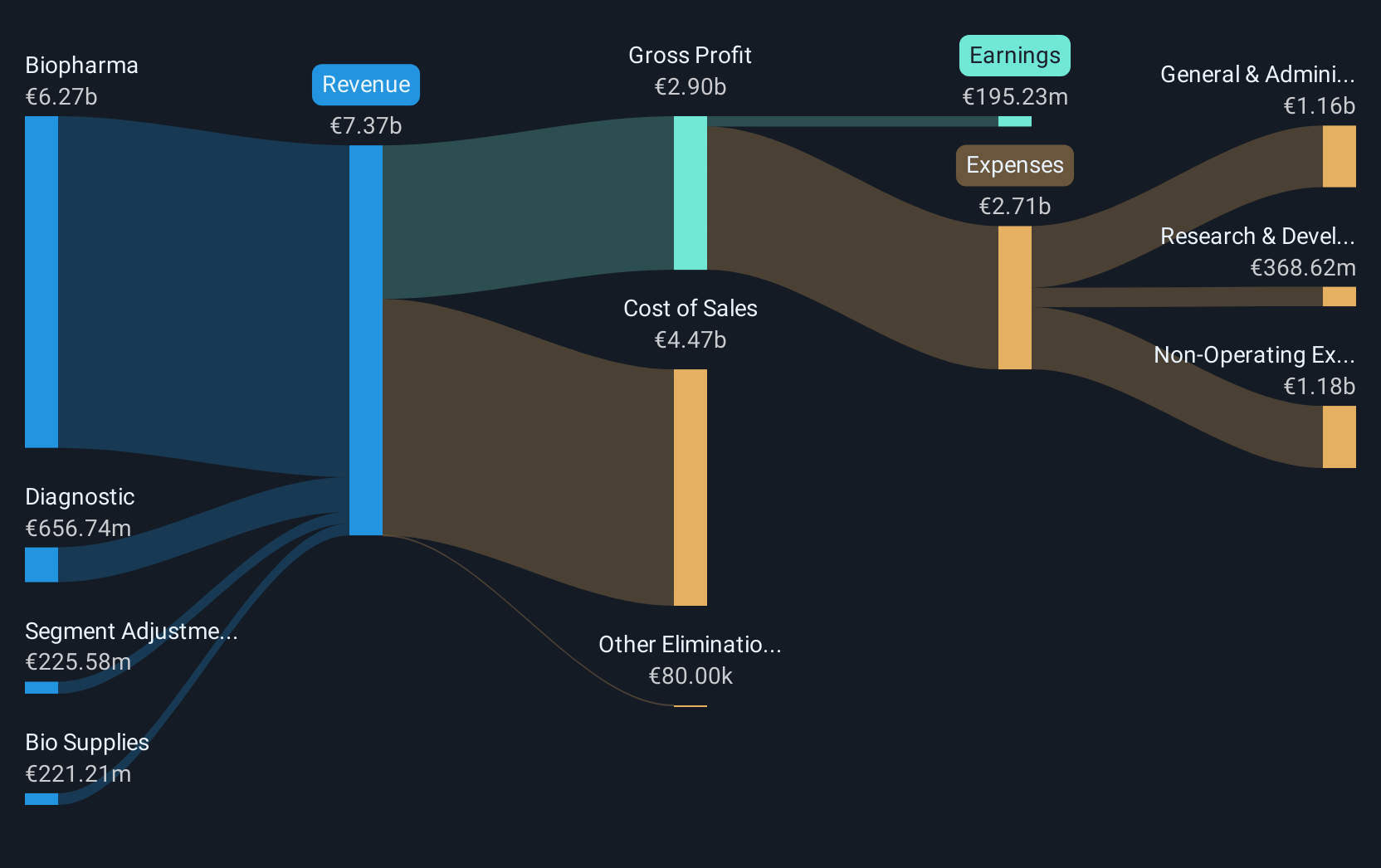

Overview: Grifols, S.A. is a plasma therapeutic company with operations in Spain, the United States, Canada, and other international markets, and it has a market capitalization of approximately €5.55 billion.

Operations: Grifols generates revenue primarily from its Biopharma segment, which accounts for €6.14 billion, followed by the Diagnostic and Bio Supplies segments with €644.90 million and €215.66 million respectively.

Grifols has demonstrated robust financial performance with a 270.8% surge in earnings over the past year, significantly outpacing the biotech industry's average of 31.3%. This growth is underpinned by a strategic focus on specialty diagnostics, highlighted by their recent partnership with IBL International to develop biomarker panels, enhancing Grifols' offerings in high-value diagnostic solutions. Additionally, Grifols' commitment to R&D is evident from its substantial investment in innovation, which positions the company well for sustained growth amid dynamic market demands. The firm's proactive approach in forming strategic alliances and expanding its technological base underscores its potential to maintain momentum and adapt to evolving industry landscapes.

- Delve into the full analysis health report here for a deeper understanding of Grifols.

Review our historical performance report to gain insights into Grifols''s past performance.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★☆☆

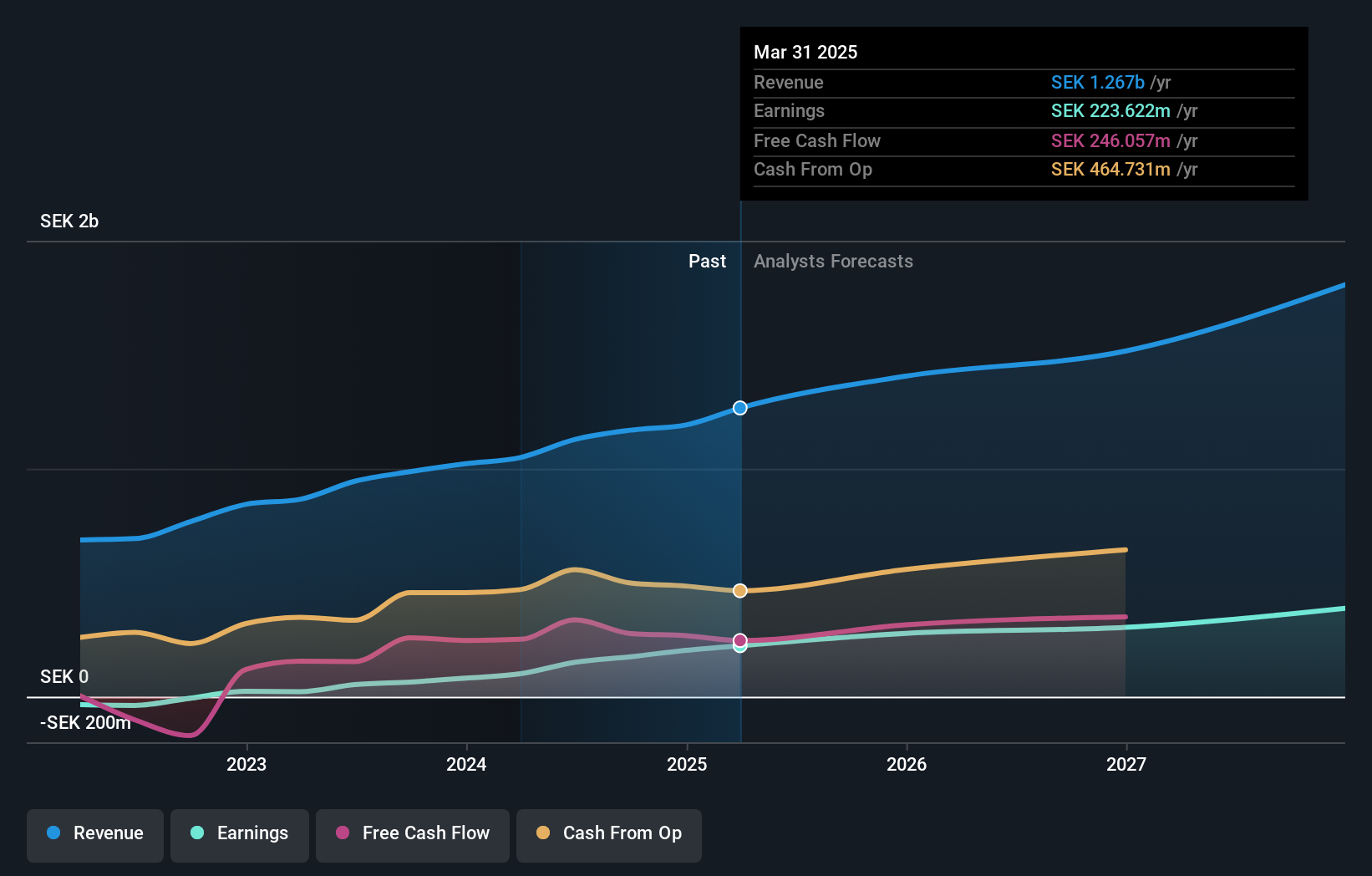

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer treatment globally, with a market capitalization of SEK11.18 billion.

Operations: RaySearch Laboratories generates revenue by providing advanced software solutions for cancer treatment across the globe. The company's financial performance is reflected in its market capitalization of SEK11.18 billion, with notable trends in its net profit margin percentage.

RaySearch Laboratories, a beacon in the European tech landscape, has recently showcased significant financial and strategic growth. In the first quarter of 2025, the firm saw its sales climb to SEK 331.7 million from SEK 257.2 million year-over-year, coupled with a net income increase to SEK 56.81 million from SEK 36.7 million, reflecting an earnings surge of over 122% compared to the previous year. These robust figures are underpinned by RaySearch's aggressive investment in R&D and strategic alliances such as their integration with Vision RT's MapRT in their RayStation system, enhancing radiation therapy planning precision and efficiency. This focus not only drives revenue growth at an impressive annual rate of 12.7% but also solidifies its market position by adapting swiftly to evolving oncological needs through technological innovation.

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

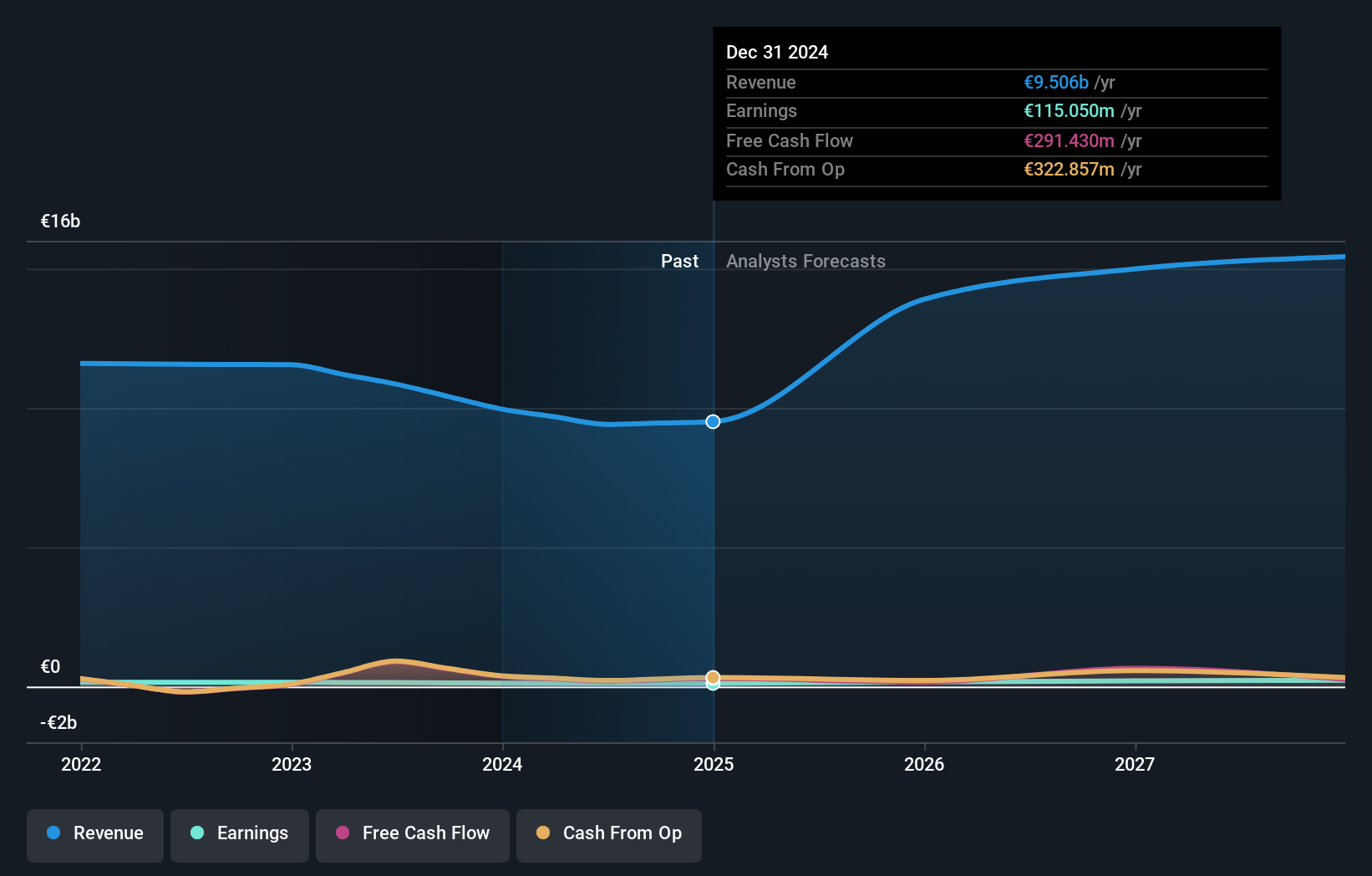

Overview: ALSO Holding AG, with a market cap of CHF3.32 billion, operates as a technology services provider for the ICT industry across Switzerland, Germany, the Netherlands, Poland, and other international markets.

Operations: With a focus on technology services, the company generates revenue primarily from Central Europe (€4.72 billion) and Northern/Eastern Europe (€5.24 billion).

ALSO Holding AG is strategically expanding its footprint in the high-growth cybersecurity sector, recently launching new products tailored for SMBs through its partnership with CYE. This initiative taps into a burgeoning European cybersecurity market projected to hit EUR 70 billion by 2030, addressing the acute need for manageable security solutions amidst a complex landscape with over 3,000 vendors. Financially, ALSO reported a slight dip in annual sales to EUR 9.51 billion from EUR 9.96 billion and net income decreased to EUR 115.05 million from EUR 123.66 million year-over-year. Despite these challenges, the company's forward-looking revenue growth at an annual rate of 8.9% and earnings growth forecast at an impressive 21.1% per year underscore its potential resilience and adaptability in navigating market shifts and capitalizing on strategic innovations within tech-driven sectors.

- Dive into the specifics of ALSO Holding here with our thorough health report.

Explore historical data to track ALSO Holding's performance over time in our Past section.

Turning Ideas Into Actions

- Explore the 223 names from our European High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Grifols, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GRF

Grifols

Operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives