- Japan

- /

- Construction

- /

- TSE:1982

Exploring Undiscovered Gems with Potential This November 2024

Reviewed by Simply Wall St

As global markets navigate a period of heightened economic activity and mixed signals from labor and manufacturing sectors, small-cap stocks have shown resilience compared to their larger counterparts. This November, as investors seek opportunities beyond the usual suspects, identifying undiscovered gems requires a focus on companies with strong fundamentals and the potential to thrive amidst current market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 44.92% | 51.98% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer care across various global regions, with a market cap of SEK5.64 billion.

Operations: The company generates revenue primarily from its healthcare software segment, amounting to SEK1.13 billion.

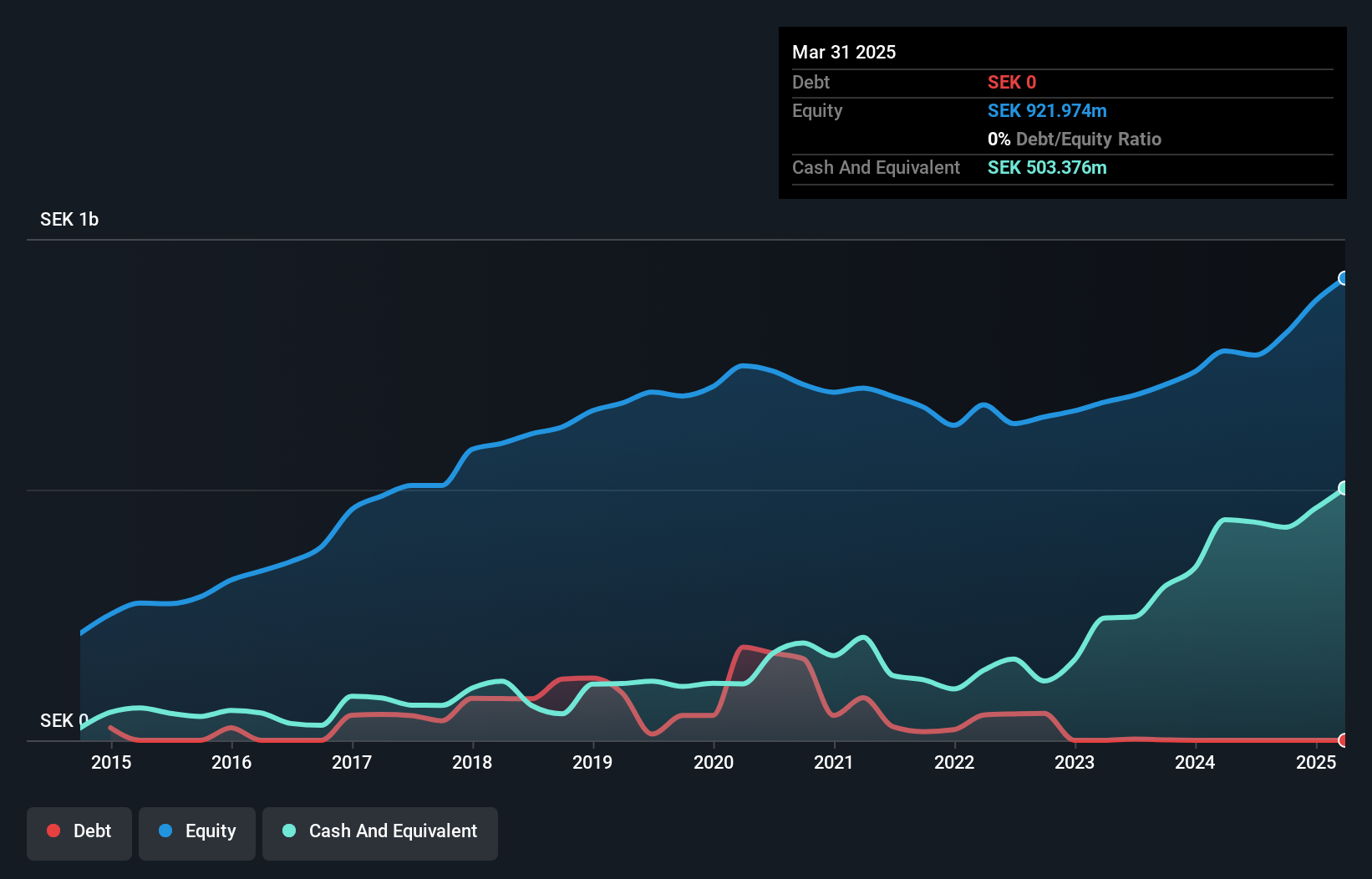

RaySearch Laboratories, a dynamic player in oncology software, has seen its earnings soar by 187% over the past year, outpacing the Healthcare Services industry growth of 7.1%. The company is debt-free, contrasting with a debt-to-equity ratio of 1.8 five years ago. Trading at 67% below estimated fair value suggests potential for investors seeking undervalued opportunities. Recent orders from Institut Curie and other European centers highlight strong demand for RayStation®, contributing to robust revenue recognition this year. However, significant insider selling in recent months might raise eyebrows about internal confidence despite high-quality earnings and positive free cash flow trends.

- Navigate through the intricacies of RaySearch Laboratories with our comprehensive health report here.

Understand RaySearch Laboratories' track record by examining our Past report.

ADATA Technology (TPEX:3260)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ADATA Technology Co., Ltd. is a global manufacturer and seller of memory products with a market capitalization of approximately NT$26.59 billion.

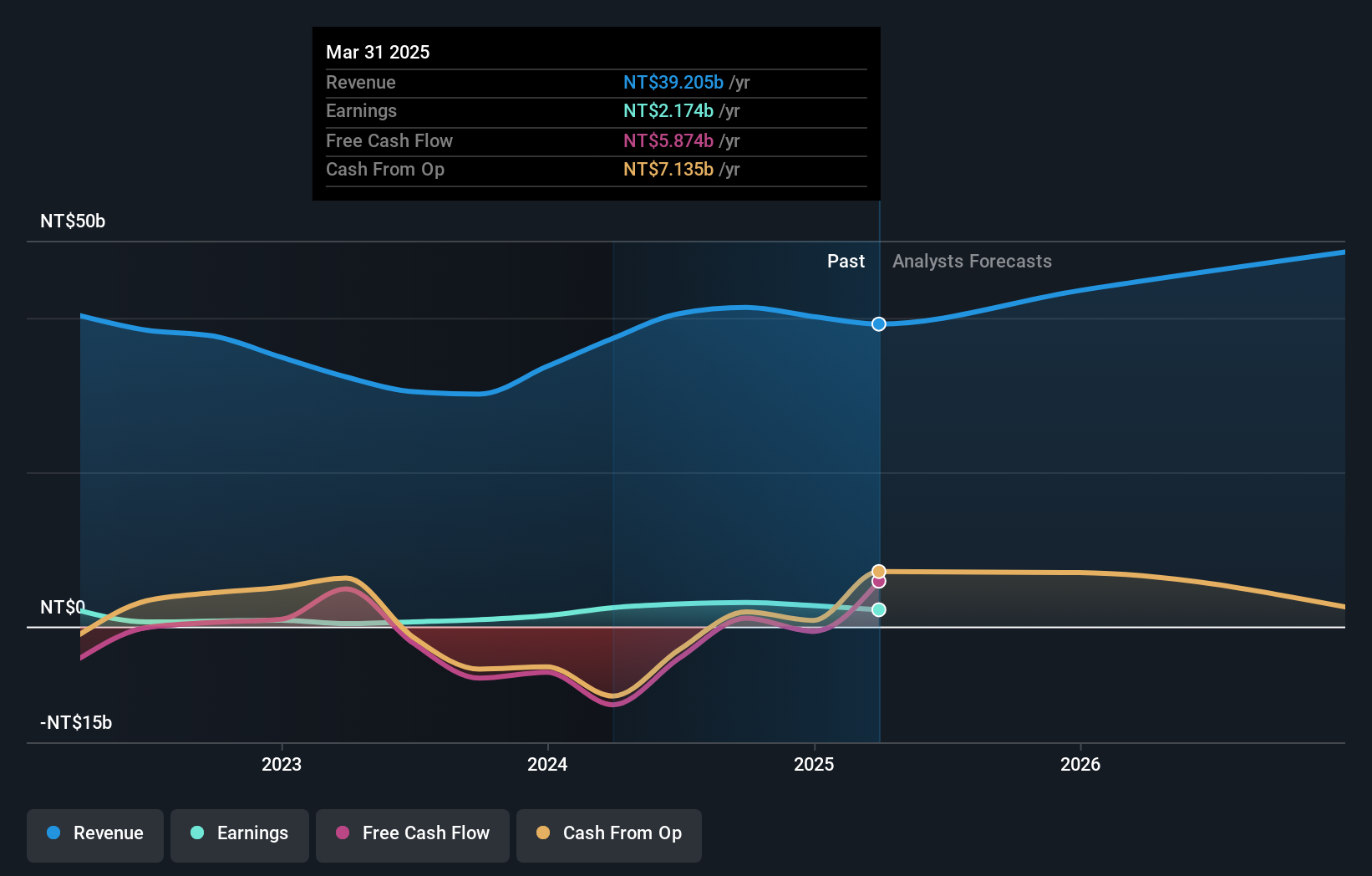

Operations: ADATA Technology generates revenue primarily from its Electronics Sector, contributing NT$40.52 billion, while the Biotechnology Segment adds NT$35.22 million.

ADATA Technology, a player in the semiconductor space, has showcased impressive earnings growth of 378% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a high 133%, suggesting potential leverage concerns despite a reduction from 165% five years ago. With a price-to-earnings ratio of 9x, it offers good value compared to the TW market average of 21x. Recent results highlight strong performance with second-quarter sales reaching TWD 10 billion and net income climbing to TWD 755 million from TWD 267 million last year. Earnings per share also improved significantly during this period.

- Unlock comprehensive insights into our analysis of ADATA Technology stock in this health report.

Explore historical data to track ADATA Technology's performance over time in our Past section.

Hibiya Engineering (TSE:1982)

Simply Wall St Value Rating: ★★★★★★

Overview: Hibiya Engineering, Ltd., along with its subsidiaries, offers a range of engineering products and services mainly in Japan, with a market cap of ¥83.85 billion.

Operations: Hibiya Engineering generates revenue through its engineering products and services primarily in Japan. The company's financial performance is reflected in its market cap of ¥83.85 billion.

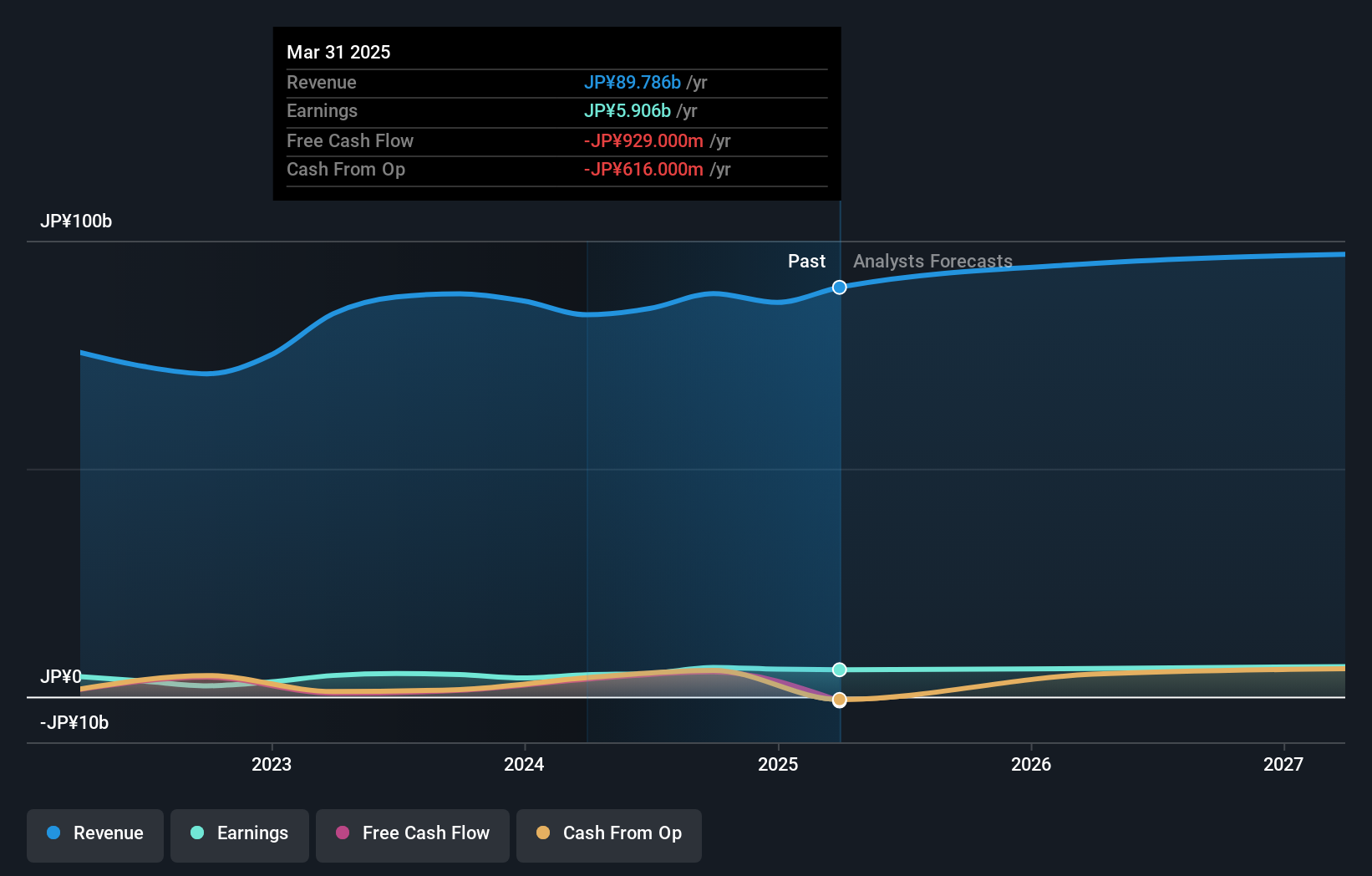

Hibiya Engineering, a nimble player in the market, showcases robust financial health with high-quality past earnings and a debt-free balance sheet. Over the last five years, its earnings have grown at an annual rate of 6.1%, though recent growth of 0.2% lags behind the broader construction sector's 26.5%. The company recently repurchased 253,600 shares for ¥781.6 million and forecasts net sales of ¥91 billion with an operating profit of ¥5.9 billion for fiscal year ending March 2025. Additionally, dividends are set to increase slightly to ¥44 per share from last year's ¥43 per share, reflecting steady shareholder returns.

Key Takeaways

- Investigate our full lineup of 4705 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hibiya Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1982

Hibiya Engineering

Provides various engineering products and services primarily in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives