Exploring Paradox Interactive And Two More High Growth Tech Stocks In Europe

Reviewed by Simply Wall St

Amidst a backdrop of political instability and economic uncertainty, the European market has seen its indices, such as the STOXX Europe 600, decline due to concerns over U.S. Federal Reserve independence and geopolitical tensions. In this environment, identifying high-growth tech stocks like Paradox Interactive becomes crucial for investors seeking opportunities in sectors resilient to broader market fluctuations.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| argenx | 21.15% | 25.86% | ★★★★★★ |

| Comet Holding | 11.39% | 35.45% | ★★★★★☆ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Bonesupport Holding | 25.30% | 59.70% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| CD Projekt | 35.10% | 42.68% | ★★★★★★ |

| Aelis Farma | 79.30% | 106.93% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Yubico | 15.46% | 33.06% | ★★★★★☆ |

We'll examine a selection from our screener results.

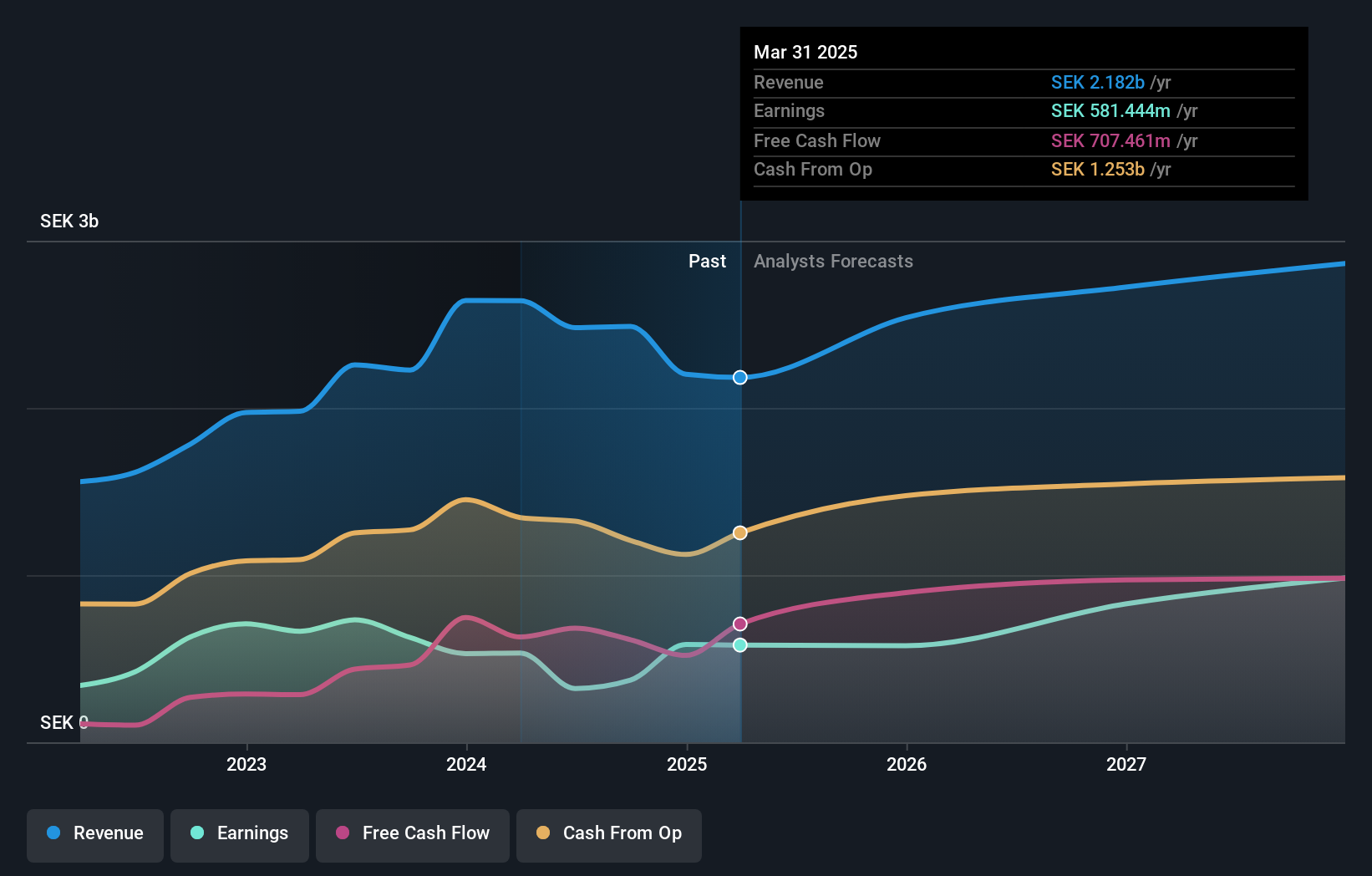

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across various regions, including the United States, Europe, and Sweden, with a market cap of approximately SEK18.25 billion.

Operations: Paradox Interactive generates revenue primarily from its computer graphics segment, totaling SEK2.07 billion. The company focuses on developing and publishing strategy and management games for PC and consoles across various international markets.

Paradox Interactive (PDX) has demonstrated robust growth with a 106.5% increase in earnings over the past year, outpacing the entertainment industry's average of 49.9%. This surge is supported by a strong R&D focus, with significant investments that have fueled innovation and product development, evident from recent launches like 'Empire of Sin: Hunt for Aurora'. The company's strategic releases and updates, such as the upcoming grand strategy game featuring dynastic rivalries set to launch on September 9, 2025, underline its commitment to enhancing user engagement and expanding its market reach. With an expected annual profit growth rate of 19.9%, PDX is poised to maintain its momentum well above Sweden's market average of 16.7%, indicating promising prospects for continued expansion in high-growth tech sectors.

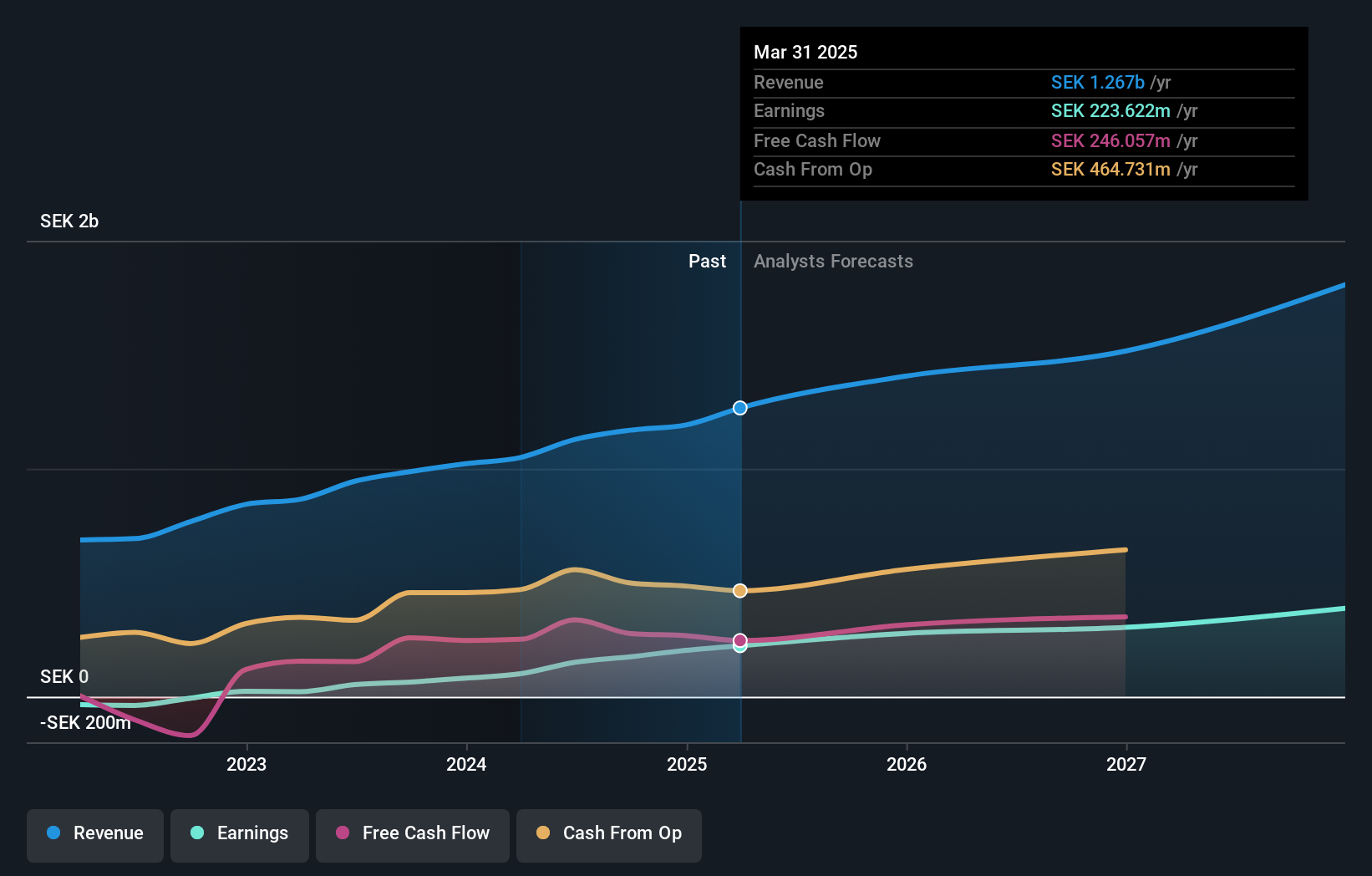

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer treatment globally, with a market cap of SEK8.74 billion.

Operations: The company generates revenue primarily through its healthcare software segment, which reported SEK1.25 billion.

RaySearch Laboratories is making significant strides in the oncology sector with its innovative RayIntelligence® v2025 system, enhancing clinical data usability and treatment outcomes. This advancement aligns with recent earnings reports indicating a revenue increase to SEK 636.56 million over six months, despite a slight dip in net income. The firm's commitment to R&D is evident as it continues to integrate cutting-edge technologies like synchrotron-based proton pencil beam scanning therapy at Keimyung University Dongsan Medical Center, setting new standards for precision in cancer treatment. With an annual profit growth forecast of 24.8% and revenue growth at 13.7%, RaySearch's trajectory suggests robust potential amid evolving healthcare demands.

- Click to explore a detailed breakdown of our findings in RaySearch Laboratories' health report.

Gain insights into RaySearch Laboratories' past trends and performance with our Past report.

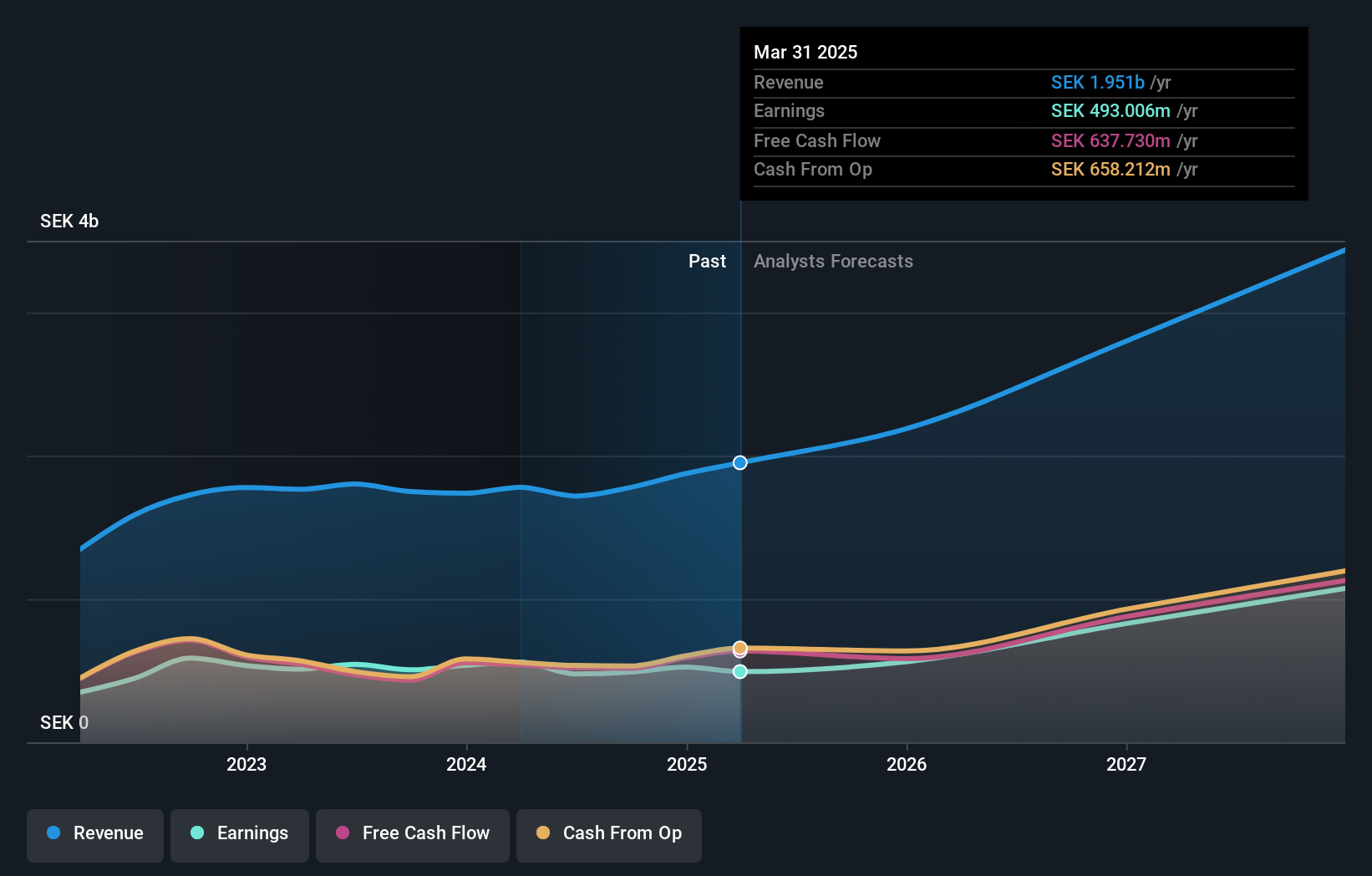

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Truecaller AB (publ) is a company that develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and other international markets with a market cap of approximately SEK15.16 billion.

Operations: The company's primary revenue stream is from its communications software segment, generating approximately SEK2 billion.

Truecaller is refining its position in the high-growth tech sector with strategic personnel and product enhancements. With the recent appointment of Saraswati Agarwal, who brings over 15 years of industry experience, as Regional Sales Head for Ad Solutions in the MEA region, Truecaller aims to boost its advertising efficacy. This move complements their latest product launch, Secure Calls, aimed at enhancing call authenticity for businesses and reducing fraud risks. Financially, Truecaller reported a year-on-year sales increase from SEK 457.87 million to SEK 506.16 million in Q2 2025 but saw a slight dip in net income from SEK 123.01 million to SEK 117.99 million during the same period. These developments underscore Truecaller's commitment to both market expansion and technological innovation in communication security.

- Click here to discover the nuances of Truecaller with our detailed analytical health report.

Evaluate Truecaller's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 51 European High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives