- Sweden

- /

- Medical Equipment

- /

- OM:PAX

Insider Sellers Might Regret Selling Paxman Shares at a Lower Price Than Current Market Value

Despite the fact that Paxman AB (publ)'s (STO:PAX) value has dropped 11% in the last week insiders who sold kr7.6m worth of stock in the past 12 months have had less success. Insiders might have been better off holding onto their shares, given that the average selling price of kr65.00 is still below the current share price.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

The Last 12 Months Of Insider Transactions At Paxman

Over the last year, we can see that the biggest insider sale was by the Independent Director, Bjorn Littorin, for kr7.6m worth of shares, at about kr65.00 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The silver lining is that this sell-down took place above the latest price (kr55.20). So it is hard to draw any strong conclusion from it. Bjorn Littorin was the only individual insider to sell over the last year.

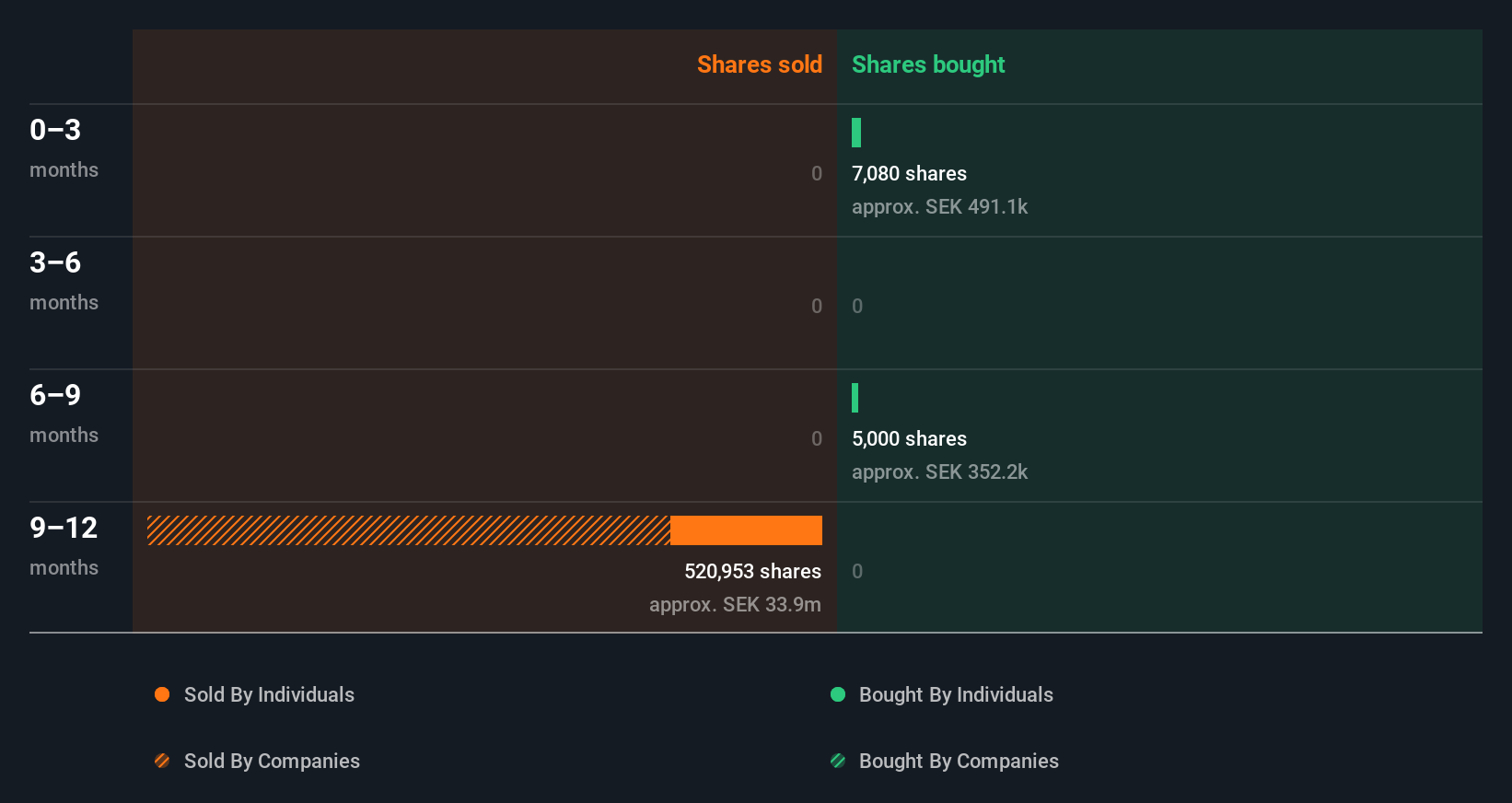

Happily, we note that in the last year insiders paid kr828k for 12.08k shares. On the other hand they divested 117.21k shares, for kr7.6m. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Check out our latest analysis for Paxman

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Paxman Insiders Bought Stock Recently

We saw some Paxman insider buying shares in the last three months. Insiders purchased kr476k worth of shares in that period. It's good to see the insider buying, as well as the lack of recent sellers. But in this case the amount purchased means the recent transaction may not be very meaningful on its own.

Does Paxman Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Paxman insiders own 52% of the company, currently worth about kr674m based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Paxman Insider Transactions Indicate?

It is good to see recent purchasing. But we can't say the same for the transactions over the last 12 months. Overall, we'd prefer see a more sustained buying from directors, but with a significant insider holding and more recent purchases, Paxman insiders are reasonably well aligned, and optimistic for the future. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Paxman. Case in point: We've spotted 2 warning signs for Paxman you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PAX

Paxman

Develops and sells Paxman scalp cooling system to minimize hair loss in connection with chemotherapy treatment worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.