On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. Over the last year the Mentice AB (publ) (STO:MNTC) share price is up 10%, but that's less than the broader market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Mentice

Mentice isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Mentice saw its revenue shrink by 1.6%. Given the revenue reduction the modest 10% share price rise over the year seems pretty decent. We'd want to see progress to profitability before getting too interested in this stock.

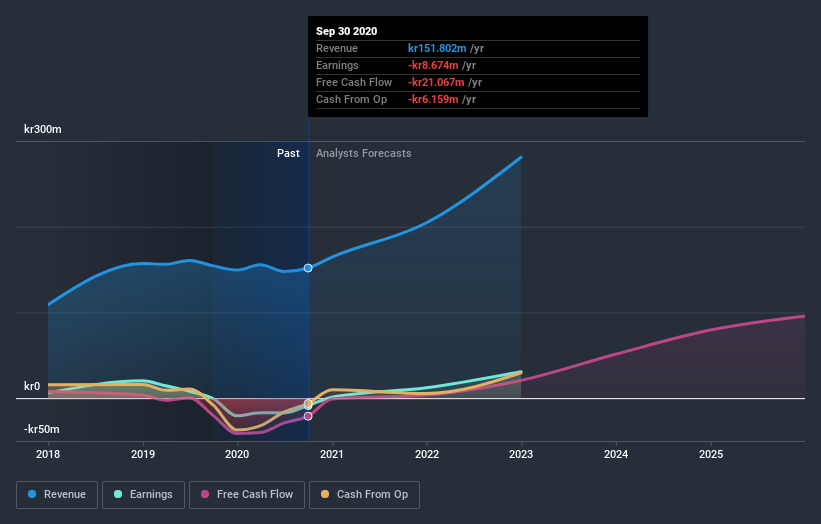

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Mentice's financial health with this free report on its balance sheet.

A Different Perspective

Mentice shareholders have gained 10% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 16%. That's a lot better than the more recent three month gain of 2.0%, implying that share price has plateaued recently, for now. It's not uncommon to see a company's share price between updates to shareholders. Before spending more time on Mentice it might be wise to click here to see if insiders have been buying or selling shares.

We will like Mentice better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you’re looking to trade Mentice, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:MNTC

Mentice

Provides endovascular simulation technology solutions in Europe, the Middle East, Africa, Asia, the Asia Pacific region, and the Americas.

Excellent balance sheet and good value.