- Sweden

- /

- Medical Equipment

- /

- OM:VIMIAN

Top 3 Swedish Growth Stocks With High Insider Ownership In September 2024

Reviewed by Simply Wall St

In September 2024, the Swedish market has been navigating through global economic uncertainties, with European indices experiencing notable declines amid fears of a slowdown in global growth. Despite these challenges, insider ownership remains a key indicator of confidence in growth companies. High insider ownership can signal strong alignment between management and shareholders' interests, making it an important factor when evaluating potential investments in today's volatile market.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.5% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.8% | 73.1% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.5% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Here we highlight a subset of our preferred stocks from the screener.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK36.56 billion.

Operations: The company's revenue segments include Businesses (SEK378 million), Marketplaces (SEK160 million), Core Products (SEK734 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million).

Insider Ownership: 21.1%

Revenue Growth Forecast: 20.2% p.a.

Fortnox, a Swedish growth company with high insider ownership, is forecasted to grow its revenue by 20.2% annually, significantly outpacing the market's 1% growth rate. The stock trades at 23.6% below estimated fair value and has seen substantial insider buying in the past three months. Recent earnings reports show strong performance with Q2 revenue of SEK 521 million and net income of SEK 164 million, both up from last year’s figures.

- Unlock comprehensive insights into our analysis of Fortnox stock in this growth report.

- The valuation report we've compiled suggests that Fortnox's current price could be quite moderate.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB (publ) operates healthcare and diagnostic services in Poland, Sweden, and internationally with a market cap of SEK28.98 billion.

Operations: Medicover's revenue segments include €610 million from Diagnostic Services and €1.32 billion from Healthcare Services.

Insider Ownership: 11.1%

Revenue Growth Forecast: 14.0% p.a.

Medicover's earnings are forecast to grow significantly at 38.6% annually, outperforming the Swedish market's 15.2%. However, its return on equity is expected to be low at 19.5% in three years. Despite trading at 45.3% below estimated fair value and showing substantial revenue growth (14% annually), interest payments are not well covered by earnings. Recent news includes appointing Anand Patel as CFO and providing guidance for organic revenue exceeding €2.2 billion by year-end 2025.

- Take a closer look at Medicover's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Medicover is trading beyond its estimated value.

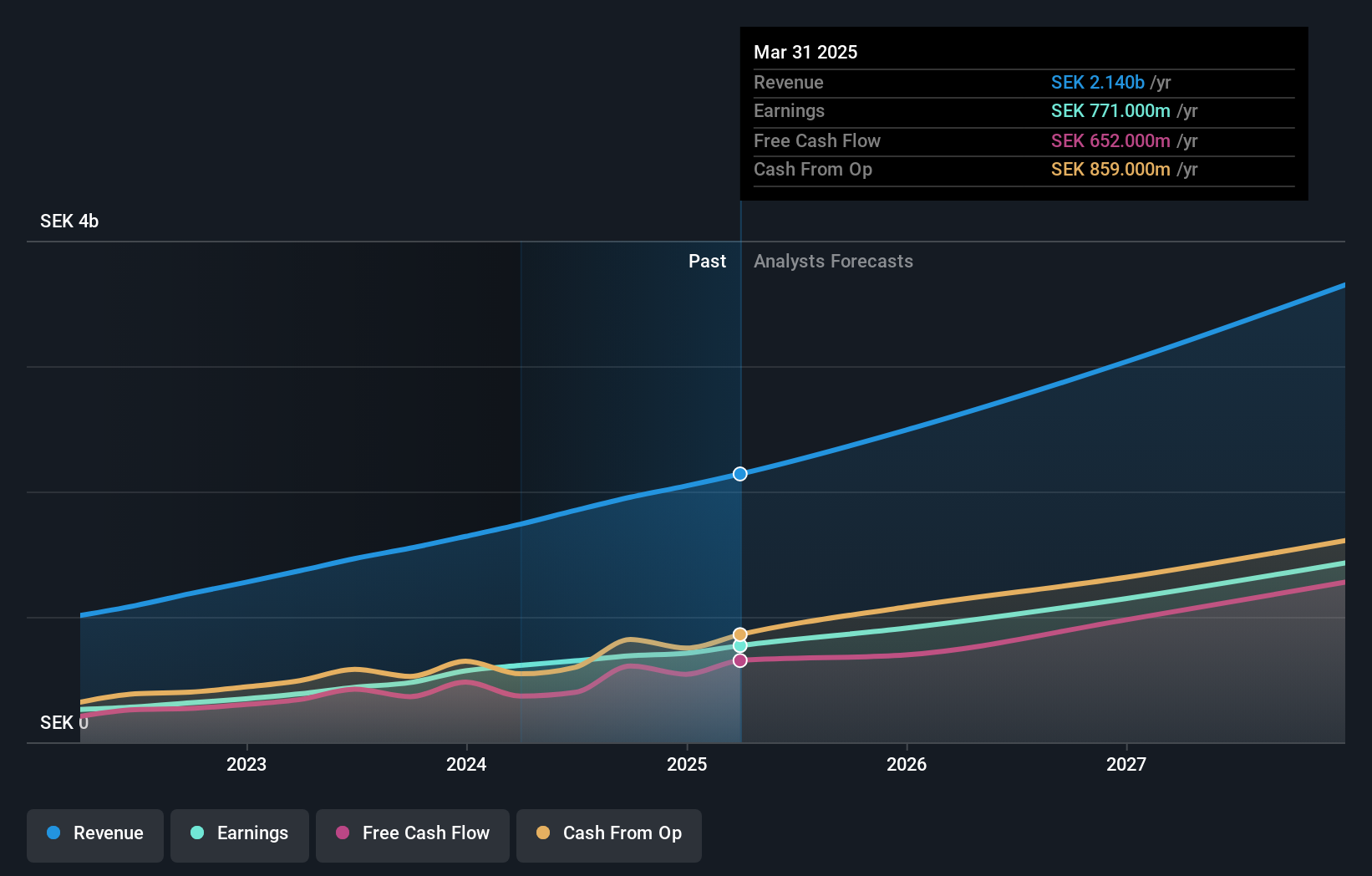

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market cap of approximately SEK23.51 billion.

Operations: The company's revenue segments include Medtech (€111.91 million), Diagnostics (€20.63 million), Specialty Pharma (€158.39 million), and Veterinary Services (€53.95 million).

Insider Ownership: 11.1%

Revenue Growth Forecast: 11.9% p.a.

Vimian Group's recent earnings report showed Q2 sales of €90.99 million, up from €81.31 million a year ago, with net income rising to €4.87 million from €2.99 million. Forecasts indicate significant annual earnings growth of 62.9%, outpacing the Swedish market's 15.2%. Despite trading at 27.7% below estimated fair value and no substantial insider selling recently, shareholders have faced dilution over the past year while insiders have substantially increased their holdings in the last three months.

- Click to explore a detailed breakdown of our findings in Vimian Group's earnings growth report.

- Our expertly prepared valuation report Vimian Group implies its share price may be lower than expected.

Where To Now?

- Delve into our full catalog of 92 Fast Growing Swedish Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Vimian Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIMIAN

Solid track record with reasonable growth potential.