As European markets grapple with concerns over Middle East tensions and economic uncertainties, the pan-European STOXX Europe 600 Index recently ended 1.54% lower, reflecting a cautious investor sentiment. In this climate, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business in its long-term potential and resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| VusionGroup (ENXTPA:VU) | 13.4% | 71.2% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 58.6% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's uncover some gems from our specialized screener.

Getinge (OM:GETI B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Getinge AB (publ) offers products and solutions for operating rooms, intensive-care units, and sterilization departments both in Sweden and internationally, with a market cap of approximately SEK50.66 billion.

Operations: Getinge's revenue is primarily derived from three segments: Acute Care Therapies at SEK18.75 billion, Surgical Workflows (excluding Life Science) at SEK12.27 billion, and Life Science at SEK4.54 billion.

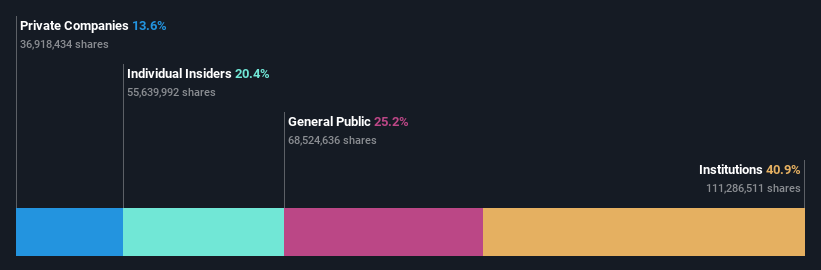

Insider Ownership: 20.4%

Earnings Growth Forecast: 25.3% p.a.

Getinge shows potential as a growth company with high insider ownership, highlighted by its forecasted earnings growth of 25.33% annually, outpacing the Swedish market's 14.4%. Despite trading at 52% below estimated fair value and analysts predicting a 28% price rise, insider buying has been minimal recently. The company faces challenges with declining profit margins and an unstable dividend track record but maintains organic sales guidance for modest revenue growth in 2025 amidst strategic business shifts.

- Take a closer look at Getinge's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Getinge is trading behind its estimated value.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK35.78 billion.

Operations: The company's revenue is primarily generated from Healthcare Services, amounting to €1.52 billion, and Diagnostic Services, contributing €677.10 million.

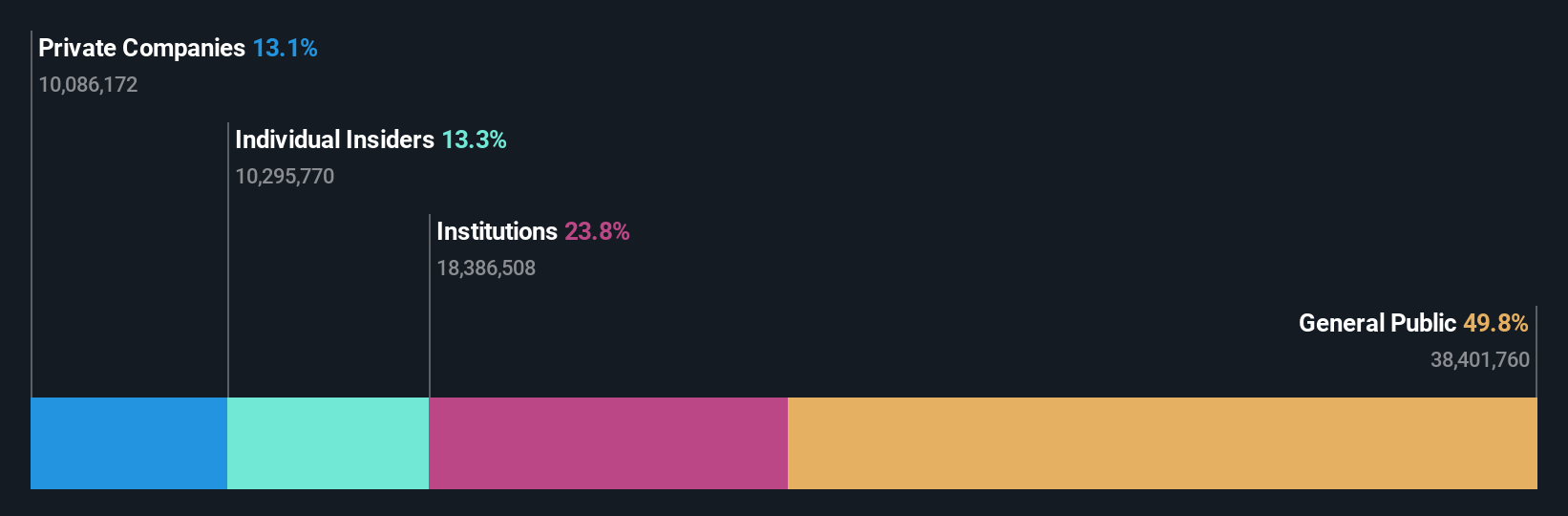

Insider Ownership: 11.2%

Earnings Growth Forecast: 29.6% p.a.

Medicover demonstrates strong growth potential with forecasted earnings growth of 29.6% annually, surpassing the Swedish market's 14.7%. Despite limited recent insider buying, the company has seen more shares bought than sold by insiders recently. Recent positive interim results from its DART clinical study underscore innovation in its healthcare services. However, interest payments are not well covered by earnings, posing a financial challenge even as Medicover trades at a significant discount to estimated fair value.

- Click to explore a detailed breakdown of our findings in Medicover's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Medicover shares in the market.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK6.97 billion.

Operations: The company's revenue is primarily derived from its streaming services, which account for SEK3.43 billion, and its publishing segment, contributing SEK1.16 billion.

Insider Ownership: 12.7%

Earnings Growth Forecast: 27.3% p.a.

Storytel's earnings are forecast to grow significantly, at 27.3% annually, outpacing the Swedish market's growth rate. Despite significant insider selling recently, the company trades well below its estimated fair value and has become profitable this year. Revenue is expected to grow faster than the market at 10.4% per year. Recent strategic moves include acquiring Bokfabriken and appointing Åsa Wilson as Chief People Officer to enhance operational and cultural transformation efforts aligned with business goals.

- Click here and access our complete growth analysis report to understand the dynamics of Storytel.

- Our expertly prepared valuation report Storytel implies its share price may be lower than expected.

Where To Now?

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 206 companies by clicking here.

- Contemplating Other Strategies? Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives