- Sweden

- /

- Commercial Services

- /

- OM:ITAB

3 European Growth Companies With High Insider Ownership Expecting Up To 41% Revenue Growth

Reviewed by Simply Wall St

As European markets navigate a landscape of evolving interest rate policies and renewed trade concerns, major indices like the STOXX Europe 600 have shown resilience, ending largely unchanged amid cautious investor sentiment. In this environment, companies with strong insider ownership and promising growth prospects can offer unique opportunities for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.7% |

| KebNi (OM:KEBNI B) | 36.3% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

Let's dive into some prime choices out of the screener.

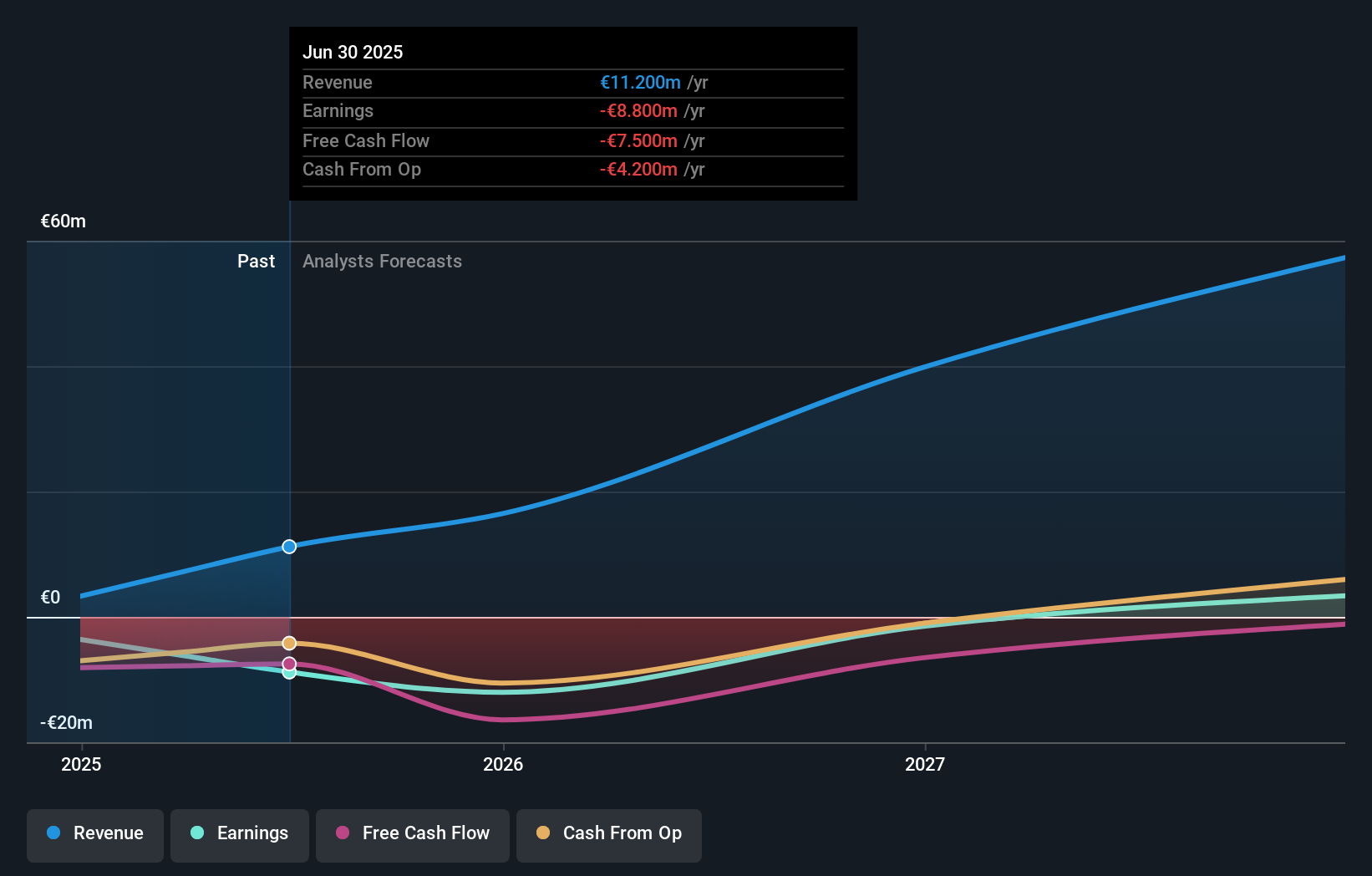

Canatu Oyj (HLSE:CANATU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canatu Oyj specializes in the development and sale of carbon nanotubes (CNTs) and related products for the semiconductor, automotive, and medical diagnostics industries across Finland, the United States, Japan, and Taiwan, with a market cap of €296.24 million.

Operations: The company's revenue is derived from its operations in the semiconductor, automotive, and medical diagnostics sectors across Finland, the United States, Japan, and Taiwan.

Insider Ownership: 12.5%

Revenue Growth Forecast: 41.6% p.a.

Canatu Oyj is poised for significant growth, with revenue expected to increase by 41.6% annually, outpacing the Finnish market. Despite recent volatility in share price, insider activity shows more buying than selling in the past three months. The company has strengthened its management team and invested in advanced metrology systems to enhance semiconductor capabilities. However, Canatu's revenue guidance for 2025 indicates potential declines if new orders are not secured, highlighting some risk factors.

- Get an in-depth perspective on Canatu Oyj's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Canatu Oyj implies its share price may be lower than expected.

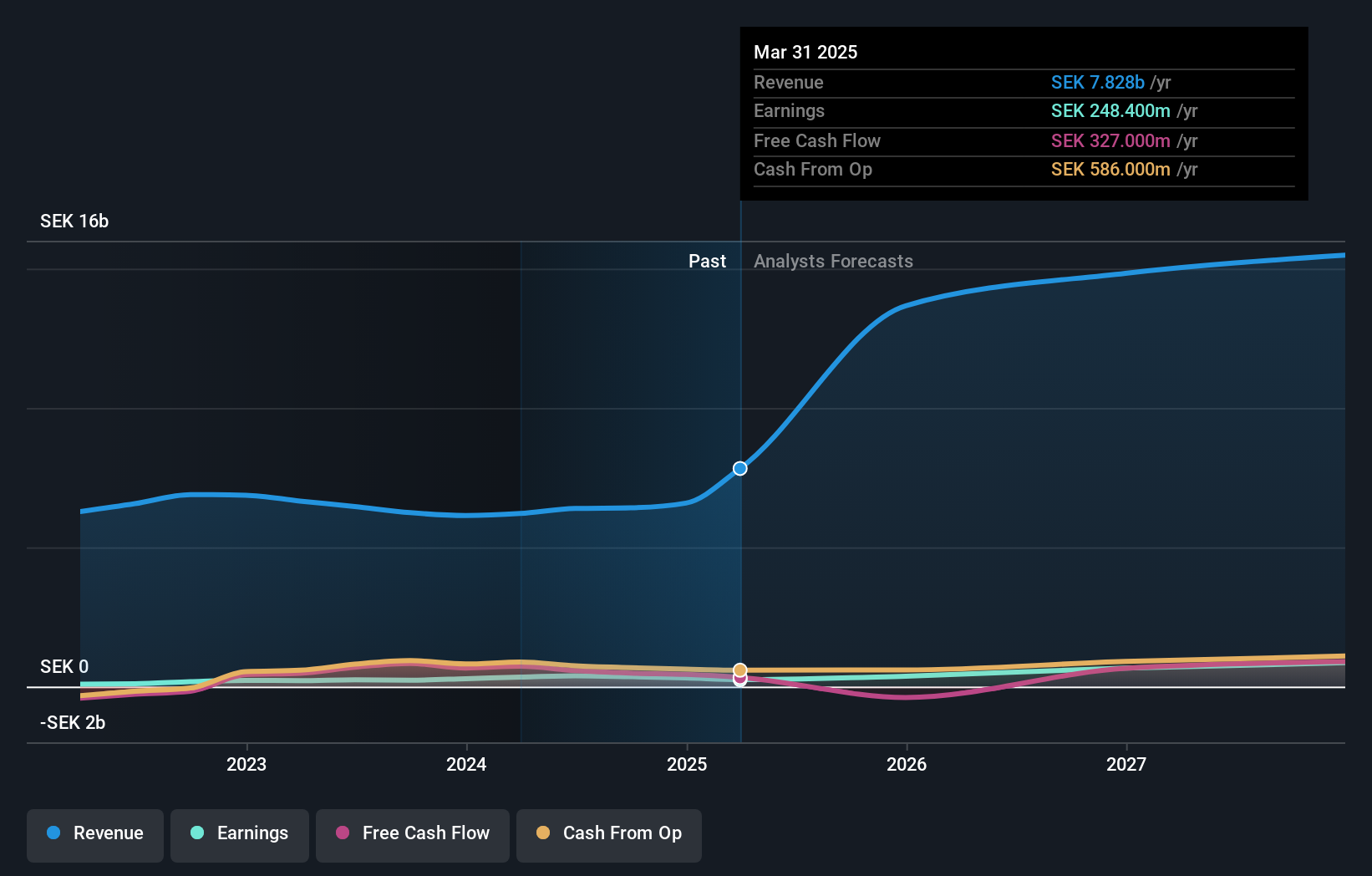

ITAB Shop Concept (OM:ITAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) develops, manufactures, sells, and installs store concepts for retail chain stores with a market cap of SEK4.29 billion.

Operations: The company's revenue segment is primarily derived from Furniture & Fixtures, amounting to SEK9.39 billion.

Insider Ownership: 11.9%

Revenue Growth Forecast: 16.1% p.a.

ITAB Shop Concept is experiencing robust growth, with earnings expected to rise significantly at 58.6% annually, surpassing the Swedish market's growth rate. Insiders have shown confidence by purchasing more shares than selling recently. Despite trading well below fair value estimates and analysts predicting an 86.3% price increase, challenges remain as revenue grows slower than desired and profit margins have declined from last year. CEO Andréas Elgaard's upcoming departure may impact strategic continuity.

- Navigate through the intricacies of ITAB Shop Concept with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, ITAB Shop Concept's share price might be too pessimistic.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK38.27 billion.

Operations: The company's revenue is primarily derived from Healthcare Services, generating €1.58 billion, and Diagnostic Services, contributing €703.20 million.

Insider Ownership: 11.2%

Revenue Growth Forecast: 11.2% p.a.

Medicover is experiencing strong earnings growth, with a recent 87.9% increase and forecasts suggesting an annual rise of 29.9%, outpacing the Swedish market. Despite trading at a significant discount to estimated fair value, the company's revenue growth is slower than desired at 11.2% annually. Insider activity shows more buying than selling recently, indicating confidence in future prospects. The company actively seeks synergistic acquisitions to bolster its growth trajectory further.

- Take a closer look at Medicover's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Medicover is trading beyond its estimated value.

Next Steps

- Discover the full array of 183 Fast Growing European Companies With High Insider Ownership right here.

- Curious About Other Options? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives