- Sweden

- /

- Medical Equipment

- /

- OM:IMP A SDB

Implantica (STO:IMP A SDB investor one-year losses grow to 65% as the stock sheds kr566m this past week

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of Implantica AG (STO:IMP A SDB) have suffered share price declines over the last year. In that relatively short period, the share price has plunged 65%. Implantica may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 56% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Implantica

We don't think Implantica's revenue of €951,000 is enough to establish significant demand. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Implantica can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Implantica has already given some investors a taste of the bitter losses that high risk investing can cause.

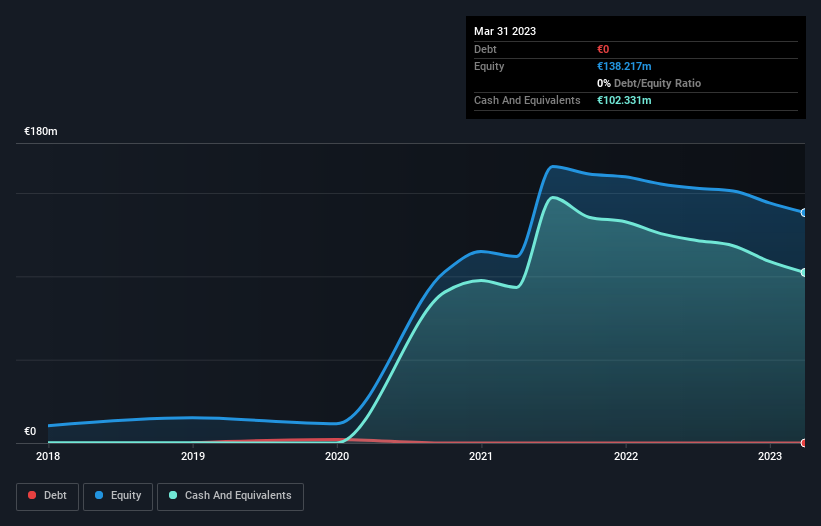

When it last reported its balance sheet in March 2023, Implantica could boast a strong position, with cash in excess of all liabilities of €98m. This gives management the flexibility to drive business growth, without worrying too much about cash reserves. But with the share price diving 65% in the last year , it could be that the price was previously too hyped up. The image below shows how Implantica's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

While Implantica shareholders are down 65% for the year, the market itself is up 1.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 56% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Implantica has 3 warning signs (and 1 which can't be ignored) we think you should know about.

But note: Implantica may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

If you're looking to trade Implantica, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:IMP A SDB

Implantica

Engages in the research and distribution of medical implants in Switzerland.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives