- Sweden

- /

- Medical Equipment

- /

- OM:IMP A SDB

Could FDA Feedback on RefluxStop Shape Implantica's US Ambitions and Long-Term Strategy (OM:IMP A SDB)?

Reviewed by Sasha Jovanovic

- Implantica AG recently announced the successful completion of its 100-Day meeting with the U.S. FDA regarding the Premarket Approval application for its RefluxStop® device.

- This milestone is a critical step in the U.S. regulatory pathway, providing important clarity on the future progress of RefluxStop® toward potential approval.

- With regulatory progress now clearer for RefluxStop®, we'll explore how this development shapes Implantica's wider investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Implantica's Investment Narrative?

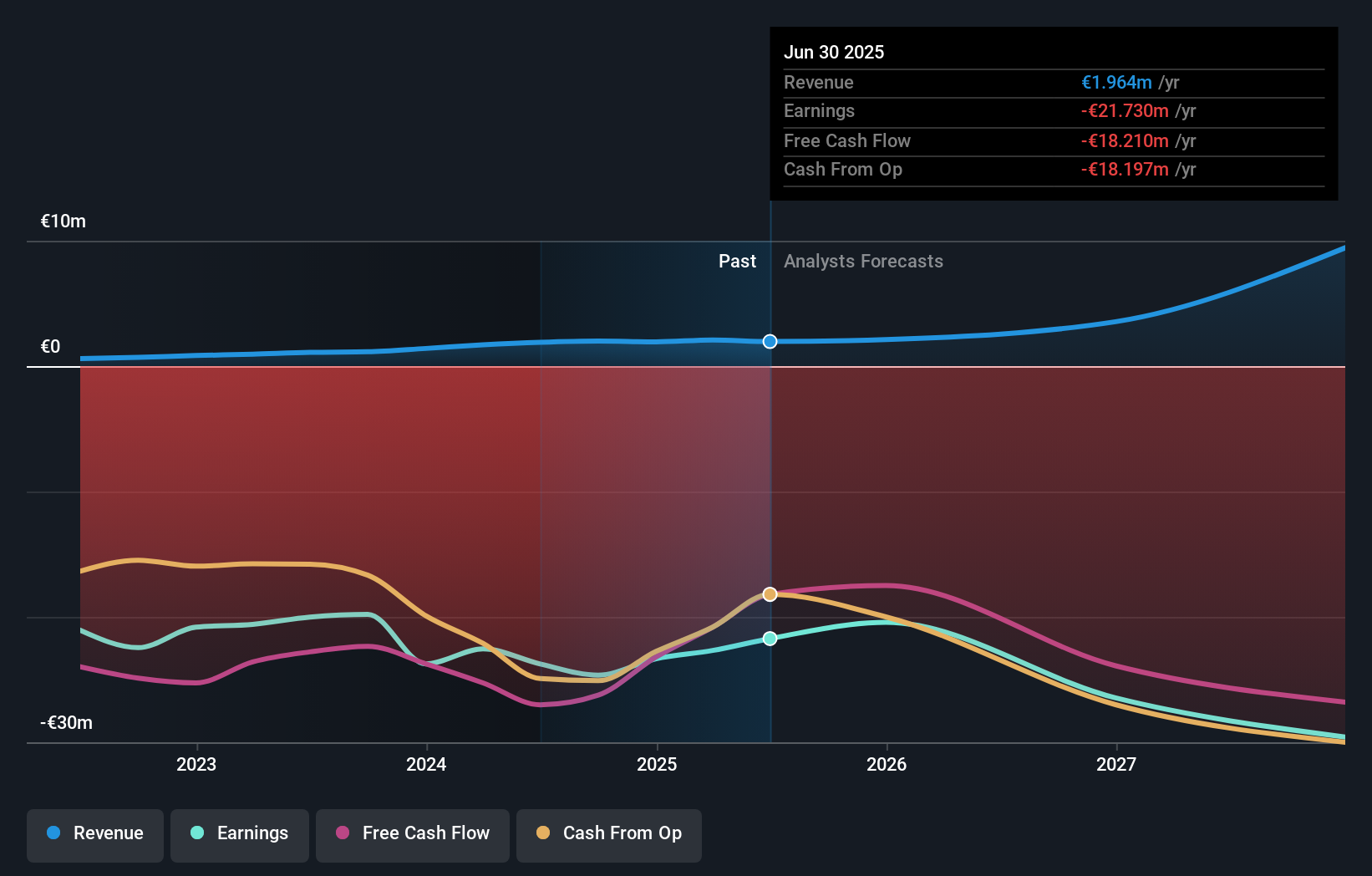

For anyone weighing Implantica as an investment, the central thesis rests on confidence in the commercial and regulatory momentum behind RefluxStop®, especially as the company pushes for U.S. market entry. The recent successful 100-Day FDA meeting marks a meaningful regulatory stride, providing clearer visibility on timelines and next steps, a shift that could bring near-term catalysts forward if the process continues smoothly. While the business remains unprofitable and its volatile share price reflects market uncertainty, a more defined regulatory outlook for RefluxStop® may help reduce some event-driven risk for now. Still, limited revenue, ongoing losses, and a premium valuation relative to peers keep execution risk front and center, making future approval decisions and initial U.S. commercial uptake the most important near-term factors. This latest FDA update does help clarify the path ahead, but the company's high expectations for growth make timely progress essential.

But profitability still hasn’t come into view, something every investor should keep an eye on. The valuation report we've compiled suggests that Implantica's current price could be inflated.Exploring Other Perspectives

Explore another fair value estimate on Implantica - why the stock might be worth as much as 31% more than the current price!

Build Your Own Implantica Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Implantica research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Implantica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Implantica's overall financial health at a glance.

No Opportunity In Implantica?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IMP A SDB

Implantica

Engages in the research and distribution of medical implants in Switzerland.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives