- Sweden

- /

- Healthcare Services

- /

- OM:HEGR

Should You Be Adding Hedera Group (STO:HEGR) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Hedera Group (STO:HEGR), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hedera Group with the means to add long-term value to shareholders.

View our latest analysis for Hedera Group

Hedera Group's Improving Profits

In the last three years Hedera Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Hedera Group's EPS shot up from kr0.96 to kr1.37; a result that's bound to keep shareholders happy. That's a fantastic gain of 43%.

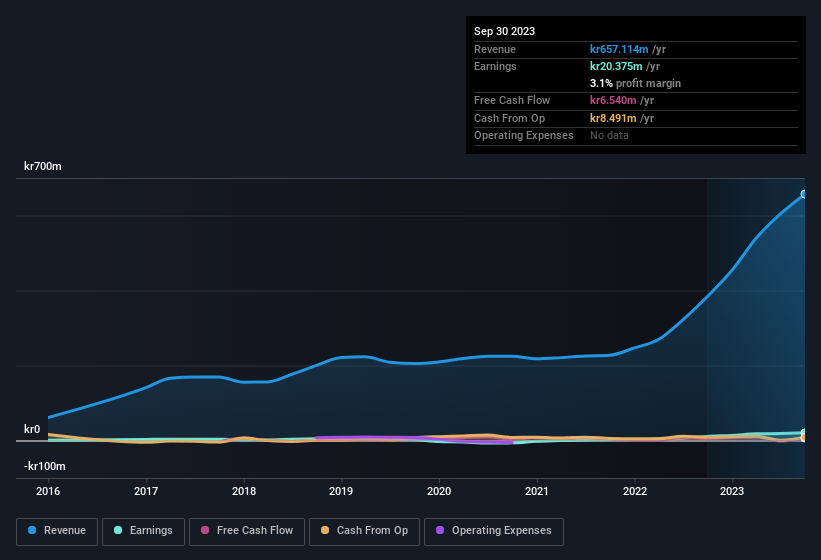

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Hedera Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 71% to kr657m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Hedera Group is no giant, with a market capitalisation of kr94m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Hedera Group Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Hedera Group will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Indeed, with a collective holding of 56%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Although, with Hedera Group being valued at kr94m, this is a small company we're talking about. So despite a large proportional holding, insiders only have kr53m worth of stock. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations under kr2.1b, like Hedera Group, the median CEO pay is around kr2.4m.

The Hedera Group CEO received kr2.2m in compensation for the year ending December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Hedera Group To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Hedera Group's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that Hedera Group has underlying strengths that make it worth a look at. Before you take the next step you should know about the 1 warning sign for Hedera Group that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Swedish companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Hedera Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hedera Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HEGR

Hedera Group

Provides personal assistance, staffing, and recruitment services for healthcare and social care sectors in Sweden.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives