- Sweden

- /

- Medical Equipment

- /

- OM:BOUL

Is Boule Diagnostics' (STO:BOUL) 210% Share Price Increase Well Justified?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. Long term Boule Diagnostics AB (publ) (STO:BOUL) shareholders would be well aware of this, since the stock is up 210% in five years. It's also good to see the share price up 12% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 10.0% in 90 days).

See our latest analysis for Boule Diagnostics

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Boule Diagnostics actually saw its EPS drop 18% per year.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

The modest 0.9% dividend yield is unlikely to be propping up the share price. In contrast revenue growth of 5.3% per year is probably viewed as evidence that Boule Diagnostics is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

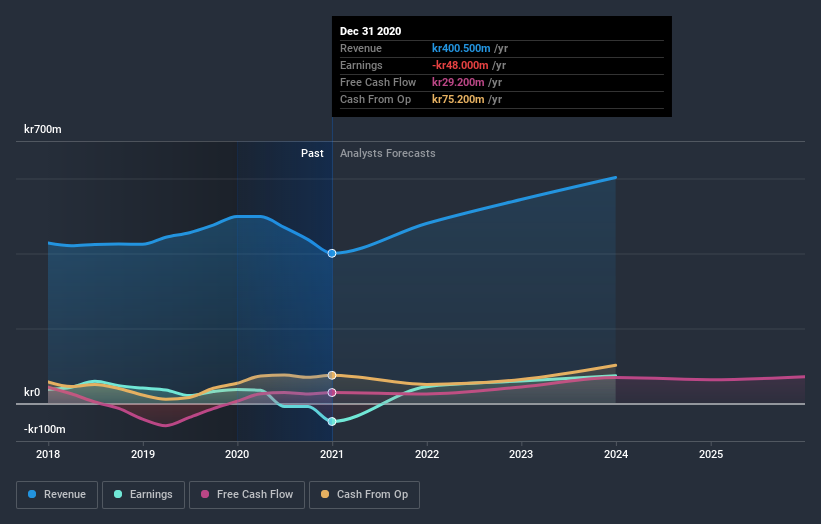

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Boule Diagnostics' financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Boule Diagnostics' TSR for the last 5 years was 219%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 17% in the last year, Boule Diagnostics shareholders lost 20% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 26% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on Boule Diagnostics it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade Boule Diagnostics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boule Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BOUL

Boule Diagnostics

Develops, manufactures, and markets instruments and consumable products for blood diagnostics in the United States of America, Asia, Eastern Europe, Latin America, Western Europe, Africa, and the Middle East.

Undervalued with high growth potential.

Market Insights

Community Narratives