- Sweden

- /

- Medical Equipment

- /

- OM:BACTI B

Swelling losses haven't held back gains for Bactiguard Holding (STO:BACTI B) shareholders since they're up 156% over 5 years

Bactiguard Holding AB (publ) (STO:BACTI B) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. We think most investors would be happy with the 156% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 29% drop, in the last year.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Bactiguard Holding

Bactiguard Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Bactiguard Holding can boast revenue growth at a rate of 8.3% per year. That's a pretty good long term growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 21% per year over five years. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

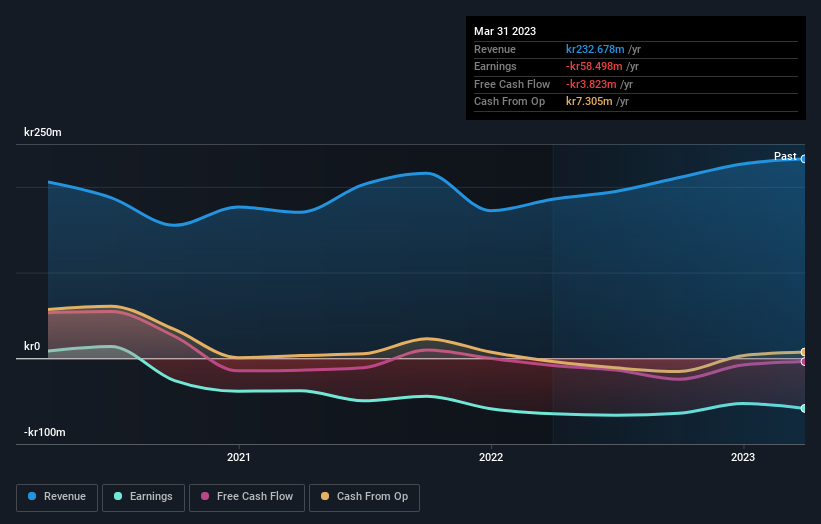

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that Bactiguard Holding shareholders are down 29% for the year. Unfortunately, that's worse than the broader market decline of 1.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 21%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Bactiguard Holding that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bactiguard Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BACTI B

Bactiguard Holding

A medTech company, provides infection prevention technology and solutions in orthopedics, cardiology, neurology, urology, and vascular access areas in the United States, Sweden, Malaysia, India, Bangladesh, Indonesia, the Kingdom of Saudi Arabia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives