Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Bactiguard Holding AB (publ) (STO:BACTI B) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Bactiguard Holding

What Is Bactiguard Holding's Debt?

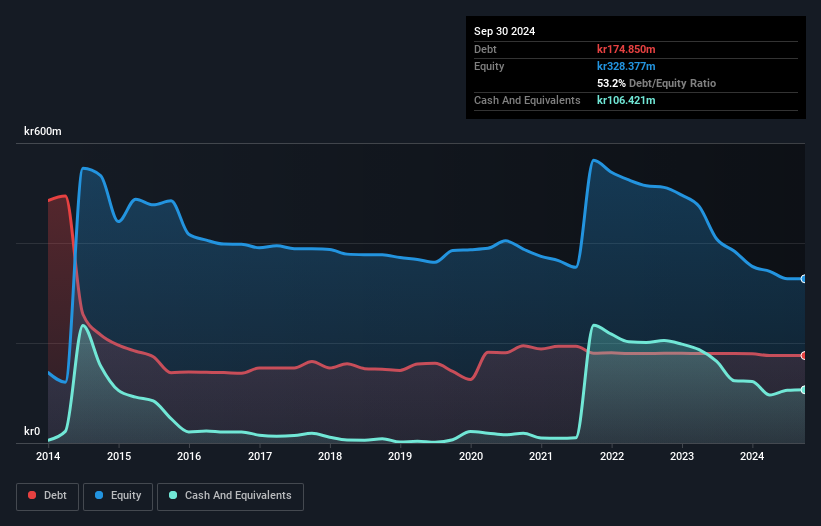

As you can see below, Bactiguard Holding had kr174.9m of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of kr106.4m, its net debt is less, at about kr68.4m.

How Strong Is Bactiguard Holding's Balance Sheet?

The latest balance sheet data shows that Bactiguard Holding had liabilities of kr298.0m due within a year, and liabilities of kr49.7m falling due after that. On the other hand, it had cash of kr106.4m and kr52.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr188.8m.

Since publicly traded Bactiguard Holding shares are worth a total of kr1.31b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Bactiguard Holding can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Bactiguard Holding reported revenue of kr237m, which is a gain of 12%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Bactiguard Holding had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost kr37m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled kr2.9m in negative free cash flow over the last twelve months. So to be blunt we think it is risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Bactiguard Holding insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Bactiguard Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BACTI B

Bactiguard Holding

A medical device company, provides infection prevention solutions in orthopedics, urology, intravascular/critical care, dental, and wound care therapeutic areas in the United States, Sweden, Malaysia, India, Bangladesh, Indonesia, the Kingdom of Saudi Arabia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives