- Spain

- /

- Real Estate

- /

- BME:MVC

European Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As European markets navigate the complexities of interest rate policies and trade uncertainties, major indices like Italy’s FTSE MIB and Germany’s DAX have shown modest gains, reflecting a cautiously optimistic investor sentiment. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Millenium Hospitality Real Estate SOCIMI (BME:YMHRE) | €2.08 | €4.06 | 48.8% |

| Midsummer (OM:MIDS) | SEK2.76 | SEK5.45 | 49.3% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.15 | NOK59.61 | 49.4% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.46 | €12.64 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.377 | €0.73 | 48.6% |

| Endomines Finland Oyj (HLSE:PAMPALO) | €25.70 | €50.50 | 49.1% |

| E-Globe (BIT:EGB) | €0.665 | €1.31 | 49.4% |

| Echo Investment (WSE:ECH) | PLN5.48 | PLN10.71 | 48.8% |

| Atea (OB:ATEA) | NOK145.40 | NOK282.88 | 48.6% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.915 | €3.77 | 49.2% |

Let's uncover some gems from our specialized screener.

Metrovacesa (BME:MVC)

Overview: Metrovacesa S.A. is a real estate development company operating in Spain with a market cap of €1.57 billion.

Operations: Metrovacesa generates its revenue primarily from residential real estate development, contributing €516.37 million, and also earns €38.88 million from tertiary projects in Spain.

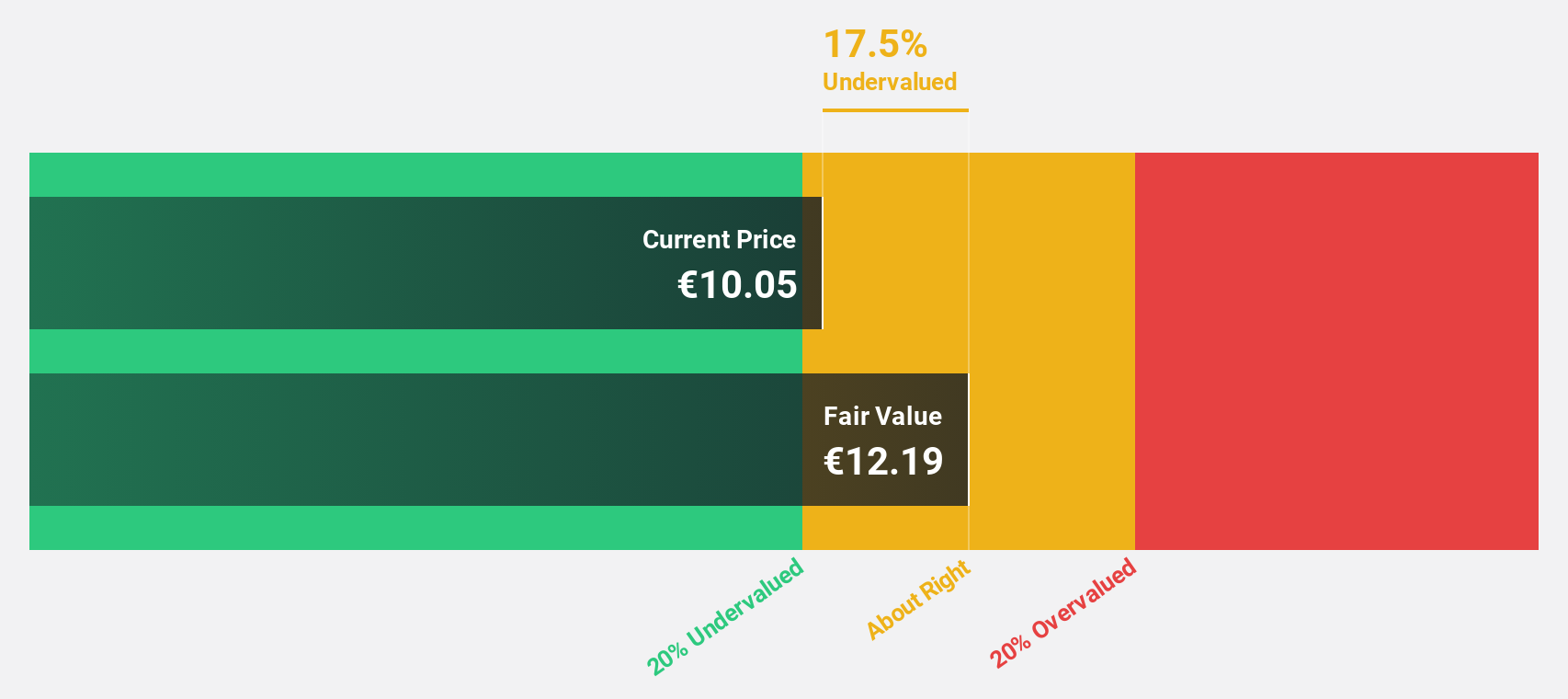

Estimated Discount To Fair Value: 13%

Metrovacesa is trading at €10.35, below its estimated fair value of €11.89, indicating potential undervaluation based on cash flows. Despite a recent net loss of €15.49 million for the first half of 2025, revenue growth is forecast at 8% annually, surpassing the Spanish market's average growth rate of 4.6%. While expected to become profitable in three years with earnings forecasted to grow substantially, return on equity remains low at a projected 4.9%.

- Our expertly prepared growth report on Metrovacesa implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Metrovacesa's balance sheet by reading our health report here.

Pandora (CPSE:PNDORA)

Overview: Pandora A/S designs, manufactures, and markets jewelry products with a market cap of DKK63.85 billion.

Operations: The company's revenue is primarily derived from its Core segment, which accounts for DKK24.03 billion, and the Fuel with More segment, contributing DKK8.47 billion.

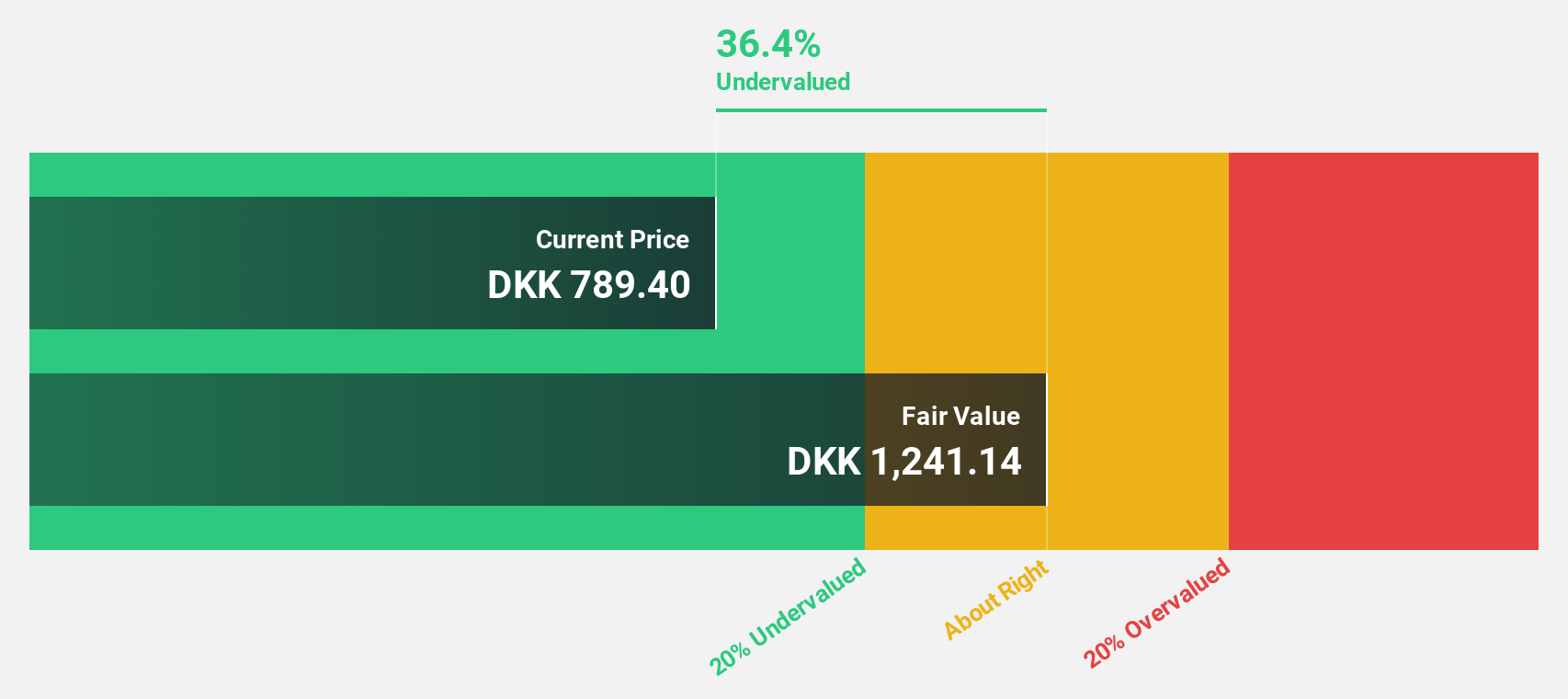

Estimated Discount To Fair Value: 42.5%

Pandora is trading at DKK 842.4, significantly below its estimated fair value of DKK 1,466.2, suggesting undervaluation based on cash flows. Despite a volatile share price and high debt levels, the company forecasts revenue growth of 6.2% annually, outpacing the Danish market's average. Earnings are projected to grow by 6.6% per year with an exceptionally high return on equity forecasted at 93.4%. Recent leadership changes may influence strategic direction positively.

- The analysis detailed in our Pandora growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Pandora.

Asker Healthcare Group (OM:ASKER)

Overview: Asker Healthcare Group AB supplies medical supplies, devices, and equipment along with related solutions to support patient care, with a market cap of SEK32.76 billion.

Operations: The company's revenue segments include West at SEK7.79 billion, Central at SEK2.82 billion, and North (including East) at SEK5.44 billion.

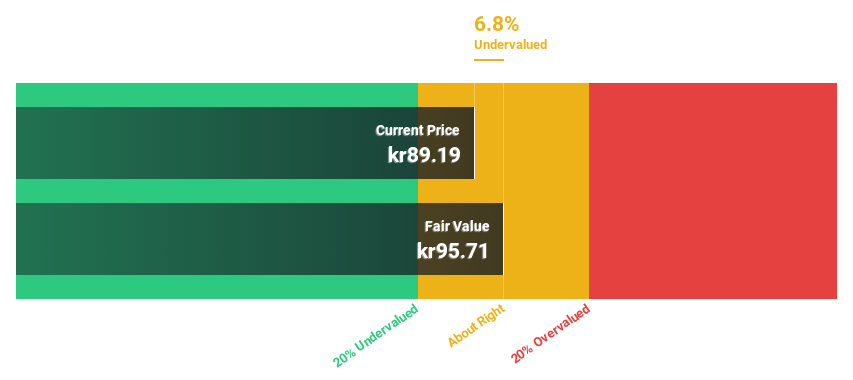

Estimated Discount To Fair Value: 23.9%

Asker Healthcare Group, trading at SEK 85.52, is undervalued relative to its estimated fair value of SEK 112.39. The company anticipates substantial earnings growth of 24.5% annually, surpassing the Swedish market average, although revenue growth at 11.5% per year is slower than desired for high-growth stocks. Despite a high debt level and modest return on equity forecasts, recent inclusion in the S&P Global BMI Index could enhance visibility and investor interest.

- In light of our recent growth report, it seems possible that Asker Healthcare Group's financial performance will exceed current levels.

- Take a closer look at Asker Healthcare Group's balance sheet health here in our report.

Where To Now?

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 207 more companies for you to explore.Click here to unveil our expertly curated list of 210 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:MVC

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success