- Sweden

- /

- Healthtech

- /

- NGM:SYNT

SyntheticMR AB (publ)'s (NGM:SYNT) stock has plunged to kr47.70, but insiders may have sold too soon at an even lower price of kr45.90

SyntheticMR AB (publ)'s (NGM:SYNT) value has fallen 14% in the last week, but insiders who sold kr4.0m worth of stock over the last year have had less success. Insiders might have been better off holding onto their shares, given that the average selling price of kr45.90 is still below the current share price.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for SyntheticMR

SyntheticMR Insider Transactions Over The Last Year

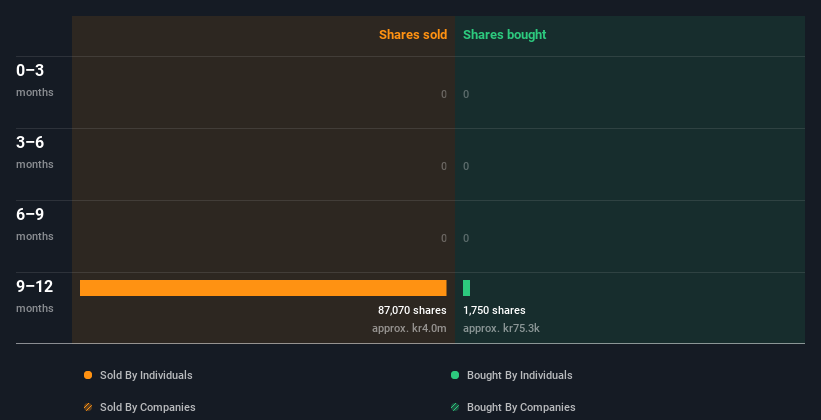

In the last twelve months, the biggest single sale by an insider was when the Director, Staffan Persson, sold kr4.0m worth of shares at a price of kr45.90 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of kr47.70. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. It is worth noting that this sale was only 7.3% of Staffan Persson's holding. The only individual insider seller over the last year was Staffan Persson.

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Does SyntheticMR Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. SyntheticMR insiders own about kr530m worth of shares. That equates to 27% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The SyntheticMR Insider Transactions Indicate?

The fact that there have been no SyntheticMR insider transactions recently certainly doesn't bother us. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of SyntheticMR insider transactions don't fill us with confidence. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing SyntheticMR. At Simply Wall St, we've found that SyntheticMR has 2 warning signs (1 is concerning!) that deserve your attention before going any further with your analysis.

But note: SyntheticMR may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:SYNT

SyntheticMR

Engages in the development and marketing of imaging and software solutions for magnetic resonance imaging (MRI) in Sweden and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.