- Sweden

- /

- Medical Equipment

- /

- NGM:PHI

Is Phase Holographic Imaging PHI (NGM:PHI) Using Debt In A Risky Way?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Phase Holographic Imaging PHI AB (publ) (NGM:PHI) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Our analysis indicates that PHI is potentially overvalued!

What Is Phase Holographic Imaging PHI's Debt?

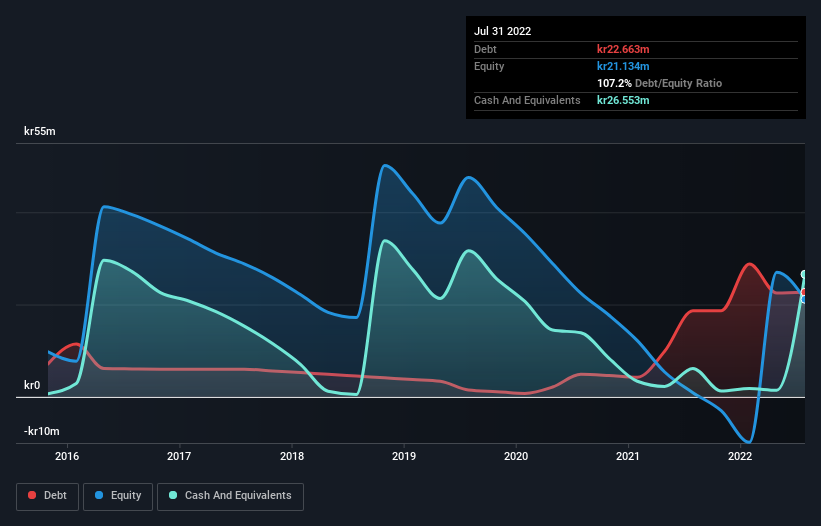

As you can see below, at the end of July 2022, Phase Holographic Imaging PHI had kr22.7m of debt, up from kr18.7m a year ago. Click the image for more detail. But it also has kr26.6m in cash to offset that, meaning it has kr3.89m net cash.

A Look At Phase Holographic Imaging PHI's Liabilities

The latest balance sheet data shows that Phase Holographic Imaging PHI had liabilities of kr6.97m due within a year, and liabilities of kr22.7m falling due after that. Offsetting these obligations, it had cash of kr26.6m as well as receivables valued at kr2.60m due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to Phase Holographic Imaging PHI's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the kr65.4m company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, Phase Holographic Imaging PHI also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is Phase Holographic Imaging PHI's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Phase Holographic Imaging PHI reported revenue of kr7.8m, which is a gain of 33%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Phase Holographic Imaging PHI?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Phase Holographic Imaging PHI lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through kr32m of cash and made a loss of kr27m. Given it only has net cash of kr3.89m, the company may need to raise more capital if it doesn't reach break-even soon. With very solid revenue growth in the last year, Phase Holographic Imaging PHI may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 6 warning signs we've spotted with Phase Holographic Imaging PHI (including 5 which are potentially serious) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:PHI

Phase Holographic Imaging PHI

A medical technology company, develops and markets non-invasive time-lapse imaging instruments in Sweden and internationally.

Worrying balance sheet with weak fundamentals.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026