- Sweden

- /

- Healthcare Services

- /

- OM:EQL

EQL Pharma AB (publ)'s (NGM:EQL) P/E Is Still On The Mark Following 30% Share Price Bounce

The EQL Pharma AB (publ) (NGM:EQL) share price has done very well over the last month, posting an excellent gain of 30%. The last 30 days bring the annual gain to a very sharp 69%.

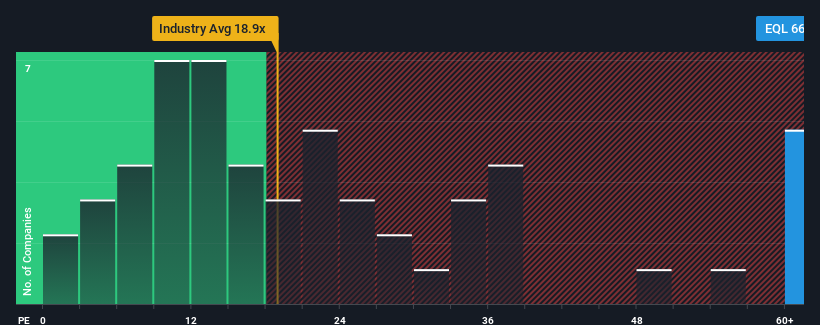

After such a large jump in price, given close to half the companies in Sweden have price-to-earnings ratios (or "P/E's") below 23x, you may consider EQL Pharma as a stock to avoid entirely with its 66.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, EQL Pharma's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for EQL Pharma

What Are Growth Metrics Telling Us About The High P/E?

EQL Pharma's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. Even so, admirably EPS has lifted 119% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 216% over the next year. Meanwhile, the rest of the market is forecast to only expand by 28%, which is noticeably less attractive.

In light of this, it's understandable that EQL Pharma's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

EQL Pharma's P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of EQL Pharma's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with EQL Pharma.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if EQL Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EQL

EQL Pharma

Engages in the development, marketing, and sale of generic medicines to pharmacies and hospitals in Sweden, Denmark, Norway, Finland, and the rest of Europe.

Exceptional growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives