- Sweden

- /

- Medical Equipment

- /

- NGM:CRBX

Kristofer Cook Is The CEO & Director of Carbiotix AB (publ) (NGM:CRBX) And They Just Picked Up 1.8% More Shares

Whilst it may not be a huge deal, we thought it was good to see that the Carbiotix AB (publ) (NGM:CRBX) CEO & Director, Kristofer Cook, recently bought kr181k worth of stock, for kr4.92 per share. However, it only increased their shares held by 1.8%, and it wasn't a huge purchase by absolute value, either.

See our latest analysis for Carbiotix

The Last 12 Months Of Insider Transactions At Carbiotix

Notably, that recent purchase by Kristofer Cook is the biggest insider purchase of Carbiotix shares that we've seen in the last year. That implies that an insider found the current price of kr6.00 per share to be enticing. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. The good news for Carbiotix share holders is that an insider was buying at near the current price. Kristofer Cook was the only individual insider to buy shares in the last twelve months.

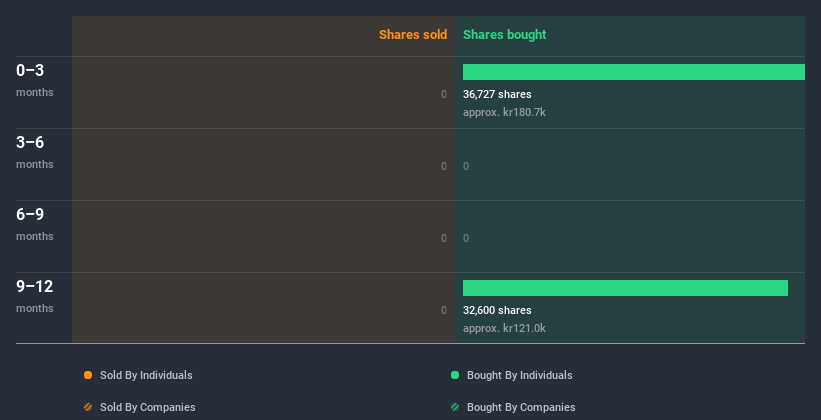

Kristofer Cook bought 69.33k shares over the last 12 months at an average price of kr4.35. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does Carbiotix Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Carbiotix insiders own 46% of the company, currently worth about kr31m based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Carbiotix Insider Transactions Indicate?

It is good to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. But we don't feel the same about the fact the company is making losses. When combined with notable insider ownership, these factors suggest Carbiotix insiders are well aligned, and quite possibly think the share price is too low. That's what I like to see! While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For instance, we've identified 5 warning signs for Carbiotix (3 are a bit unpleasant) you should be aware of.

But note: Carbiotix may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Carbiotix or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NGM:CRBX

Carbiotix

A biotechnology company develops health testing and microbiome modulators to address a range of chronic and metabolic diseases.

Medium-low risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.