- United Kingdom

- /

- Office REITs

- /

- LSE:CLI

Global Undervalued Small Caps With Insider Action For May 2025

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable upswing, largely driven by the positive sentiment following the temporary suspension of tariffs between the U.S. and China. This development has bolstered indices such as the S&P MidCap 400 and Russell 2000, highlighting renewed investor interest in small-cap stocks amid easing trade tensions and cooling inflation pressures. In this environment, identifying promising small-cap opportunities involves looking for companies with solid fundamentals that can thrive despite broader economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.3x | 0.6x | 33.77% | ★★★★★☆ |

| Tristel | 29.9x | 4.2x | 19.75% | ★★★★☆☆ |

| Cloetta | 15.6x | 1.1x | 46.05% | ★★★★☆☆ |

| SmartCraft | 42.2x | 7.5x | 33.70% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 41.23% | ★★★★☆☆ |

| Absolent Air Care Group | 22.6x | 1.8x | 48.73% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.1x | 0.4x | -32.01% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.1x | 0.7x | 2.08% | ★★★☆☆☆ |

| Eastnine | 18.3x | 8.8x | 39.84% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.5x | 44.30% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

CLS Holdings (LSE:CLI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CLS Holdings focuses on the ownership, management, and development of investment properties across the United Kingdom, Germany, and France, with a market capitalization of approximately £1.02 billion.

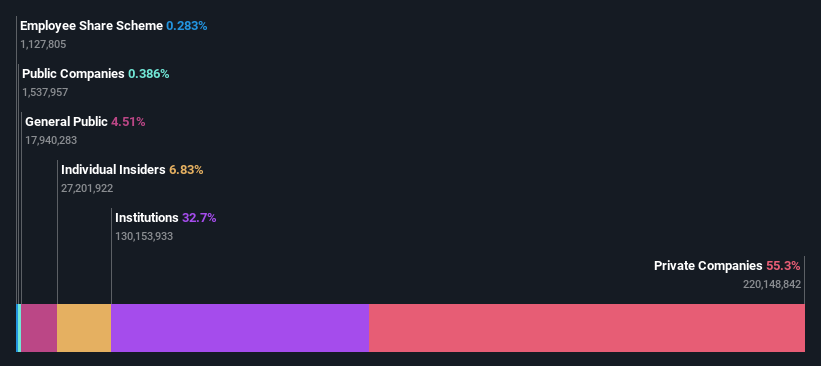

Operations: The company generates revenue primarily from investment properties in the United Kingdom, Germany, and France. Over recent periods, the net income margin has shown a declining trend, reaching -0.62% by 2025-05-20. Operating expenses have remained relatively stable around £35 million to £36 million in recent quarters.

PE: -2.6x

CLS Holdings, a smaller company with potential for growth, recently faced challenges with its auditor expressing doubts about its ability to continue as a going concern. Despite this, the company reported sales of £151.9 million for 2024 and reduced its net loss significantly from the previous year. Insider confidence is evident through share purchases, signaling trust in future prospects. However, interest payments remain poorly covered by earnings. Earnings are forecasted to grow substantially at nearly 97% annually, suggesting potential upside if financial stability improves.

- Take a closer look at CLS Holdings' potential here in our valuation report.

Examine CLS Holdings' past performance report to understand how it has performed in the past.

Scandi Standard (OM:SCST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Scandi Standard is a leading producer of chicken-based food products, specializing in ready-to-cook and ready-to-eat segments, with a market capitalization of SEK 3.92 billion.

Operations: Scandi Standard's revenue is primarily derived from its Ready-To-Cook segment, contributing significantly to its total income. The company's gross profit margin has shown a varied trend, reaching 39.60% by the end of March 2025. Operating expenses are a substantial part of the cost structure, with general and administrative expenses consistently being significant contributors.

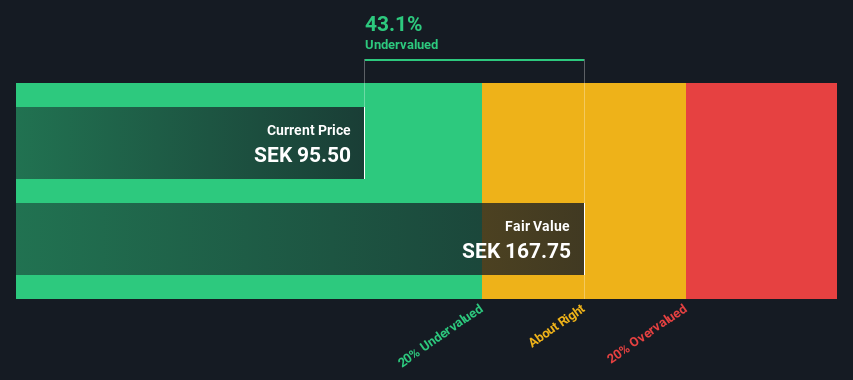

PE: 22.8x

Scandi Standard, a poultry producer, shows potential as an undervalued stock despite its high debt levels and reliance on external borrowing. Earnings are projected to grow 19.74% annually, suggesting future profitability. Recent financials reveal Q1 sales of SEK 3.4 billion with net income slightly down at SEK 66 million from last year’s SEK 70 million. Insider confidence is reflected in recent share purchases by key stakeholders, indicating belief in the company's growth trajectory amidst dividend increases approved for May and September 2025 payments.

- Delve into the full analysis valuation report here for a deeper understanding of Scandi Standard.

Evaluate Scandi Standard's historical performance by accessing our past performance report.

Killam Apartment REIT (TSX:KMP.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Killam Apartment REIT operates as a real estate investment trust focused on owning, managing, and developing residential apartment buildings, commercial properties, and manufactured home communities with a market capitalization of CA$2.14 billion.

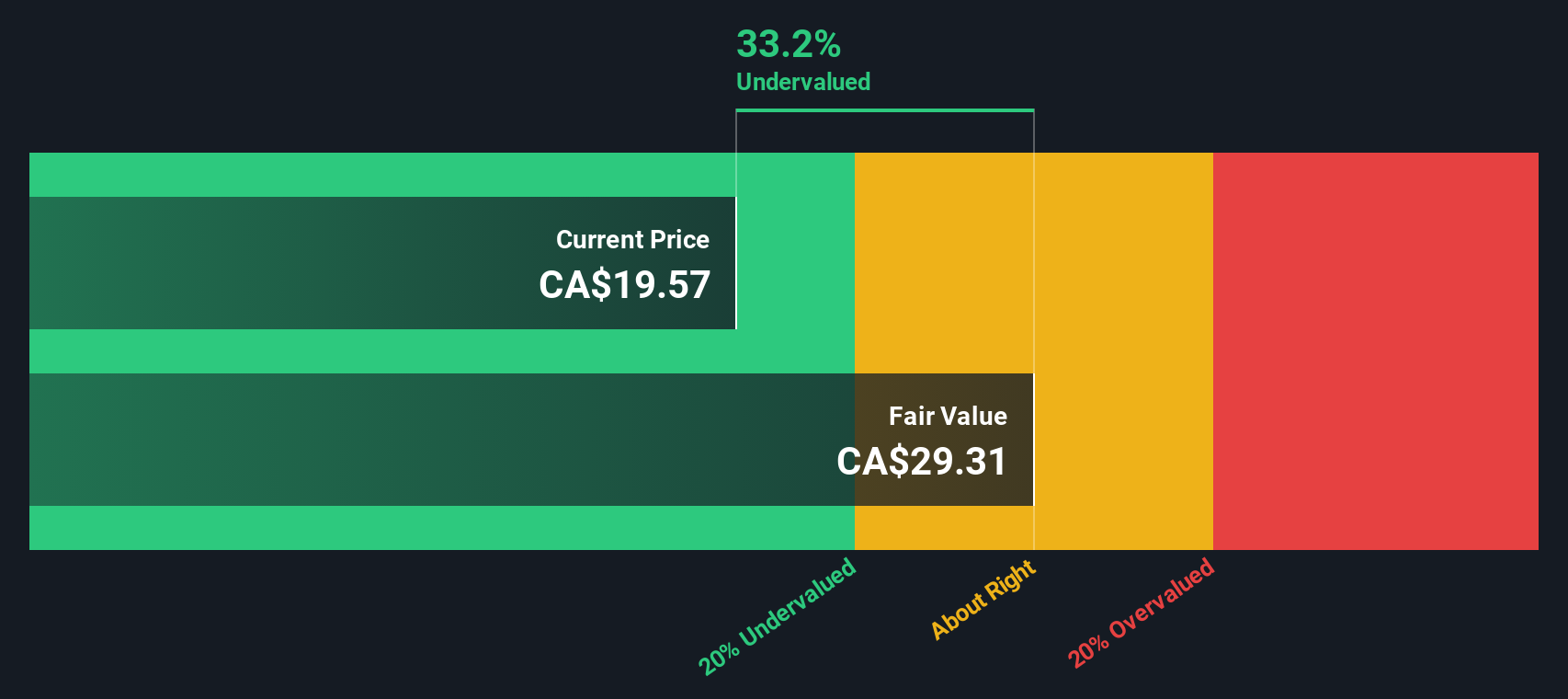

Operations: Killam Apartment REIT generates revenue primarily from its apartment segment, contributing CA$326.19 million, with additional income from commercial properties and manufactured home communities. The company's cost of goods sold (COGS) has been a significant expense, impacting gross profit margins which reached 66.26% as of March 2025. Operating expenses and non-operating expenses also play a role in shaping net income margins, which have shown notable fluctuations over the periods analyzed.

PE: 3.4x

Killam Apartment REIT, a smaller player in the real estate sector, recently reported Q1 2025 earnings with sales of C$93.02 million, up from C$87.51 million the previous year, while net income decreased to C$101.91 million from C$127.24 million. Despite reliance on external borrowing for funding and interest payments not being well-covered by earnings, insider confidence is evident with recent share purchases in early 2025. Revenue is projected to grow annually by 4.12%, indicating potential future value amidst these challenges.

Summing It All Up

- Click here to access our complete index of 168 Undervalued Global Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLI

CLS Holdings

Engages in the investment, development, and management of commercial properties in the United Kingdom, Germany, and France.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives