It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like AAK AB (publ.) (STO:AAK). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for AAK AB (publ.)

How Fast Is AAK AB (publ.) Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that AAK AB (publ.) has managed to grow EPS by 35% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

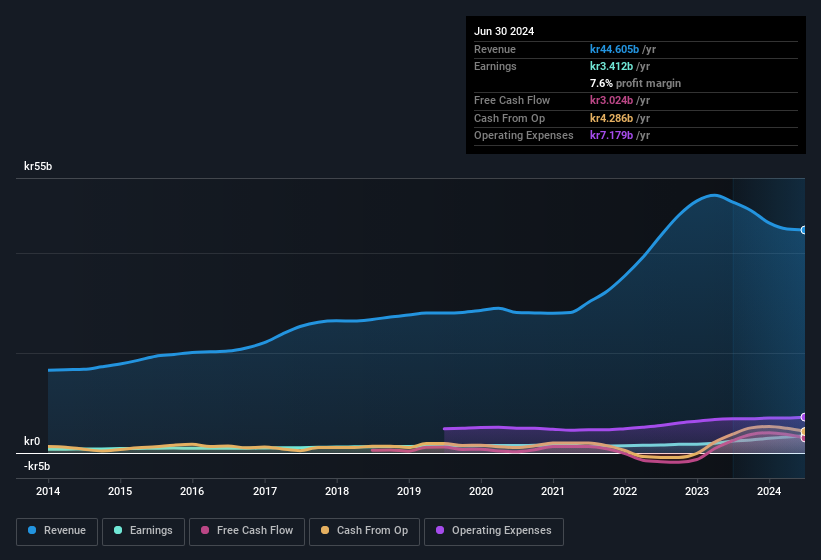

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Unfortunately, AAK AB (publ.)'s revenue dropped 11% last year, but the silver lining is that EBIT margins improved from 6.9% to 10%. While not disastrous, these figures could be better.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of AAK AB (publ.)'s forecast profits?

Are AAK AB (publ.) Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

AAK AB (publ.) top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the kr734k that Independent Chairman Patrik Andersson spent buying shares (at an average price of about kr216). It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Is AAK AB (publ.) Worth Keeping An Eye On?

For growth investors, AAK AB (publ.)'s raw rate of earnings growth is a beacon in the night. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. So on this analysis, AAK AB (publ.) is probably worth spending some time on. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of AAK AB (publ.).

The good news is that AAK AB (publ.) is not the only stock with insider buying. Here's a list of small cap, undervalued companies in SE with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AAK

AAK AB (publ.)

Develops and sells plant-based oils and fats in Sweden and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives