- Sweden

- /

- Capital Markets

- /

- OM:LINC

Linc And 2 Other Undiscovered Gems In Sweden With Promising Potential

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts have bolstered optimism for further monetary easing, the pan-European STOXX Europe 600 Index has seen a modest rise, reflecting a positive sentiment in the region's markets. This environment could be conducive for small-cap companies in Sweden, where identifying stocks with strong fundamentals and growth potential is crucial amid evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 16.75% | 15.13% | 21.34% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Bulten | 62.66% | 16.28% | 20.43% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Linc (OM:LINC)

Simply Wall St Value Rating: ★★★★★★

Overview: Linc AB is a private equity and venture capital firm focused on early and mature stage investments in pharmaceutical, life-science, and med-tech companies, with a market cap of approximately SEK4.66 billion.

Operations: Linc AB's revenue primarily comes from its listed holdings, amounting to SEK1.56 billion, while its unlisted holdings show a slight negative value of SEK0.79 million.

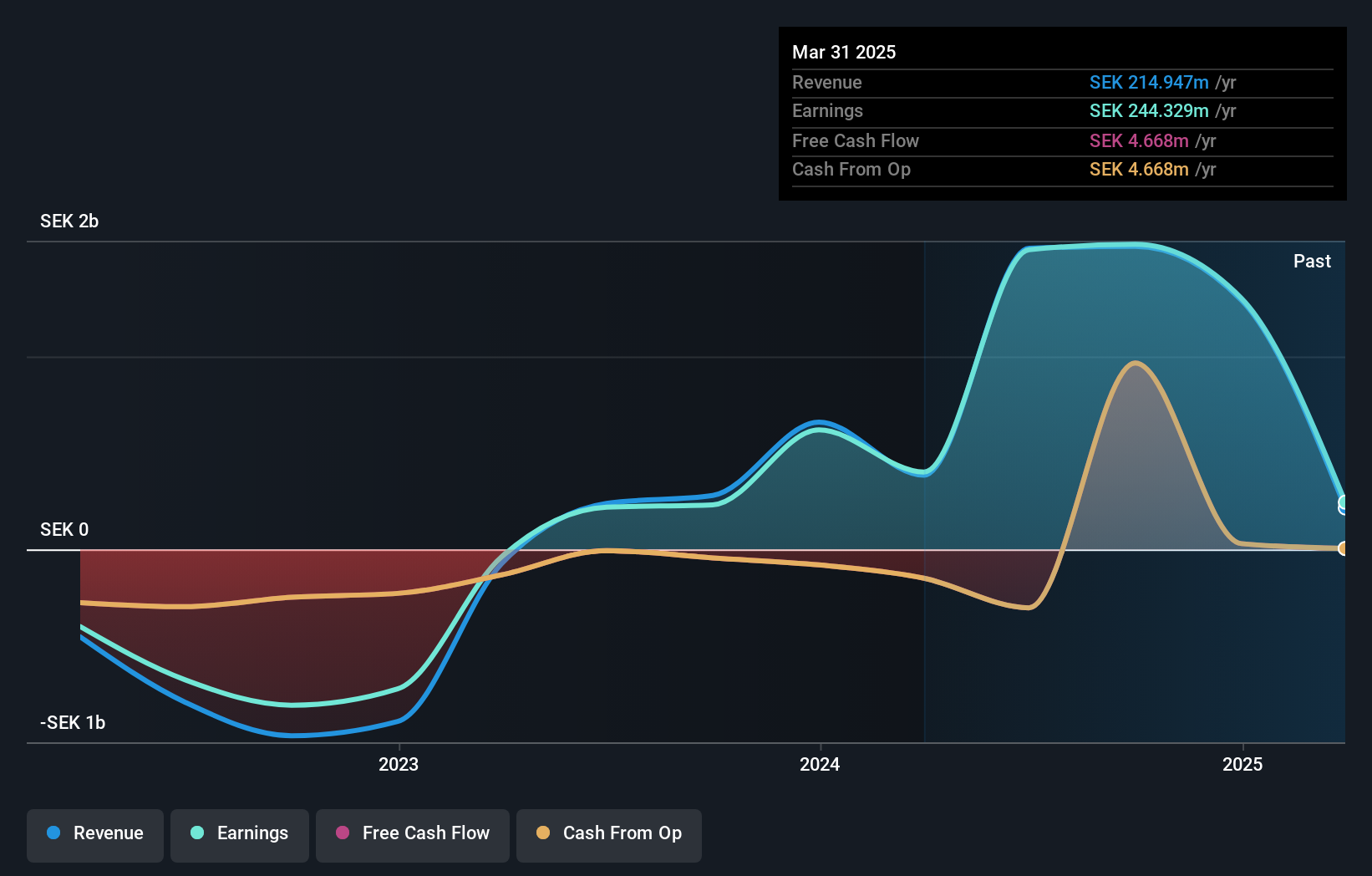

Linc, a Swedish company, showcases impressive earnings growth of 610% over the past year, significantly outpacing the Capital Markets industry's 40.9%. With a price-to-earnings ratio of just 3x compared to the Swedish market's 23.4x, it seems undervalued. Despite not being free cash flow positive recently, Linc remains debt-free and doesn't face concerns about interest coverage or cash runway due to its profitability. The company's high level of non-cash earnings suggests strong operational performance but also highlights potential areas for improvement in cash generation efficiency.

- Dive into the specifics of Linc here with our thorough health report.

Understand Linc's track record by examining our Past report.

Scandi Standard (OM:SCST)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Scandi Standard AB (publ) is a company that produces and sells chilled, frozen, and ready-to-eat chicken products across various countries including Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, and internationally with a market cap of approximately SEK5.37 billion.

Operations: Scandi Standard generates revenue primarily from its Ready-To-Cook and Ready-To-Eat segments, with the former contributing SEK9.70 billion and the latter SEK2.61 billion.

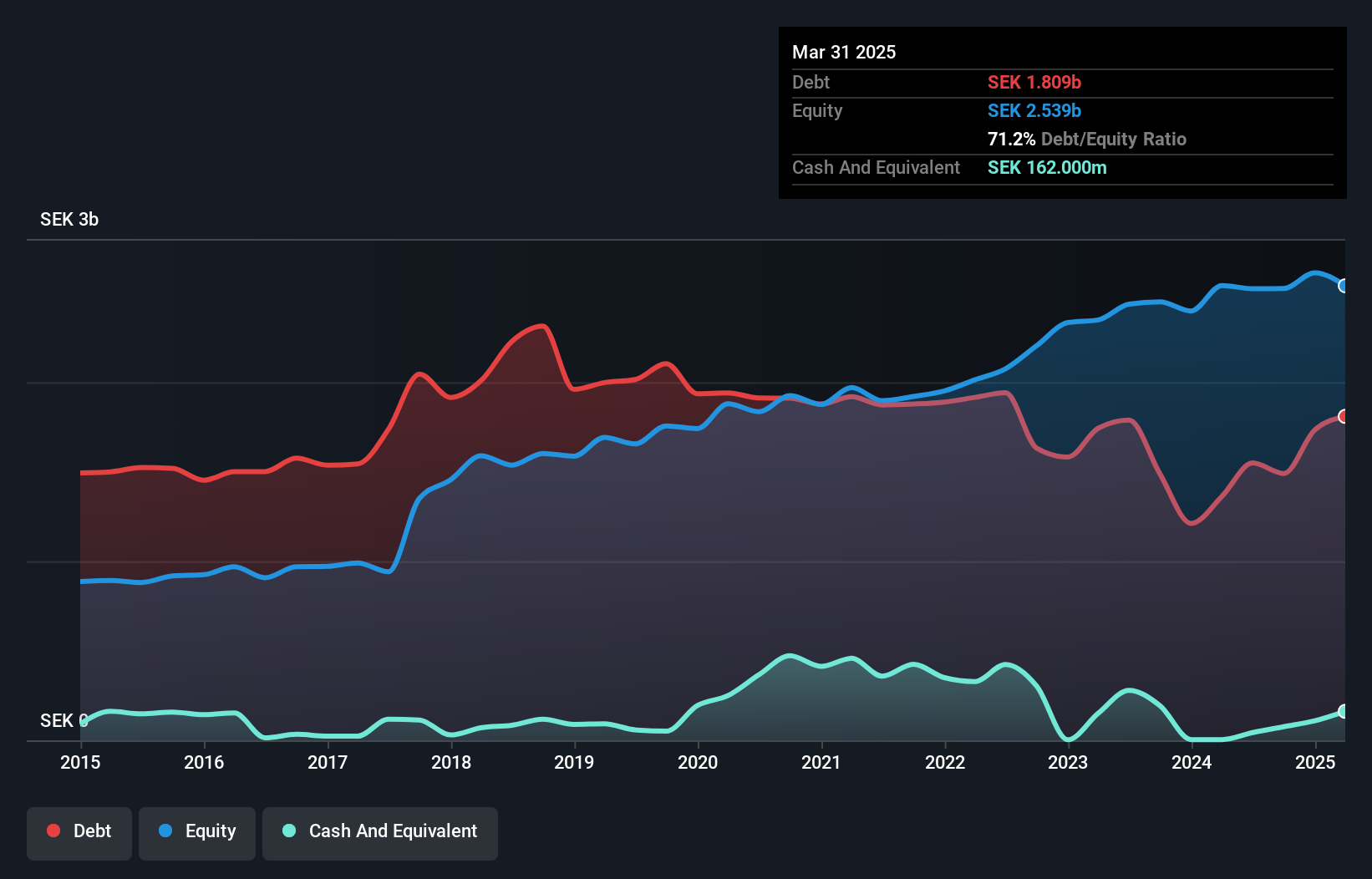

Scandi Standard, a notable player in the Swedish food sector, is trading at 58.2% below its estimated fair value, presenting an intriguing opportunity. Over the past five years, their debt to equity ratio has impressively decreased from 121.8% to 61.4%, indicating improved financial health despite a high net debt to equity ratio of 59.7%. While earnings grew by 14.6% last year, they lagged behind the broader food industry’s growth of 24.3%. The company shows strong cash flow positivity and maintains high-quality earnings with interest payments well covered by EBIT at a multiple of 3.5x.

- Click here and access our complete health analysis report to understand the dynamics of Scandi Standard.

Review our historical performance report to gain insights into Scandi Standard's's past performance.

Svolder (OM:SVOL B)

Simply Wall St Value Rating: ★★★★★★

Overview: Svolder AB (publ) is a publicly owned investment manager with a market capitalization of SEK6.22 billion.

Operations: Svolder AB (publ) generates revenue from its investment management activities, with reported revenue of SEK122.10 million.

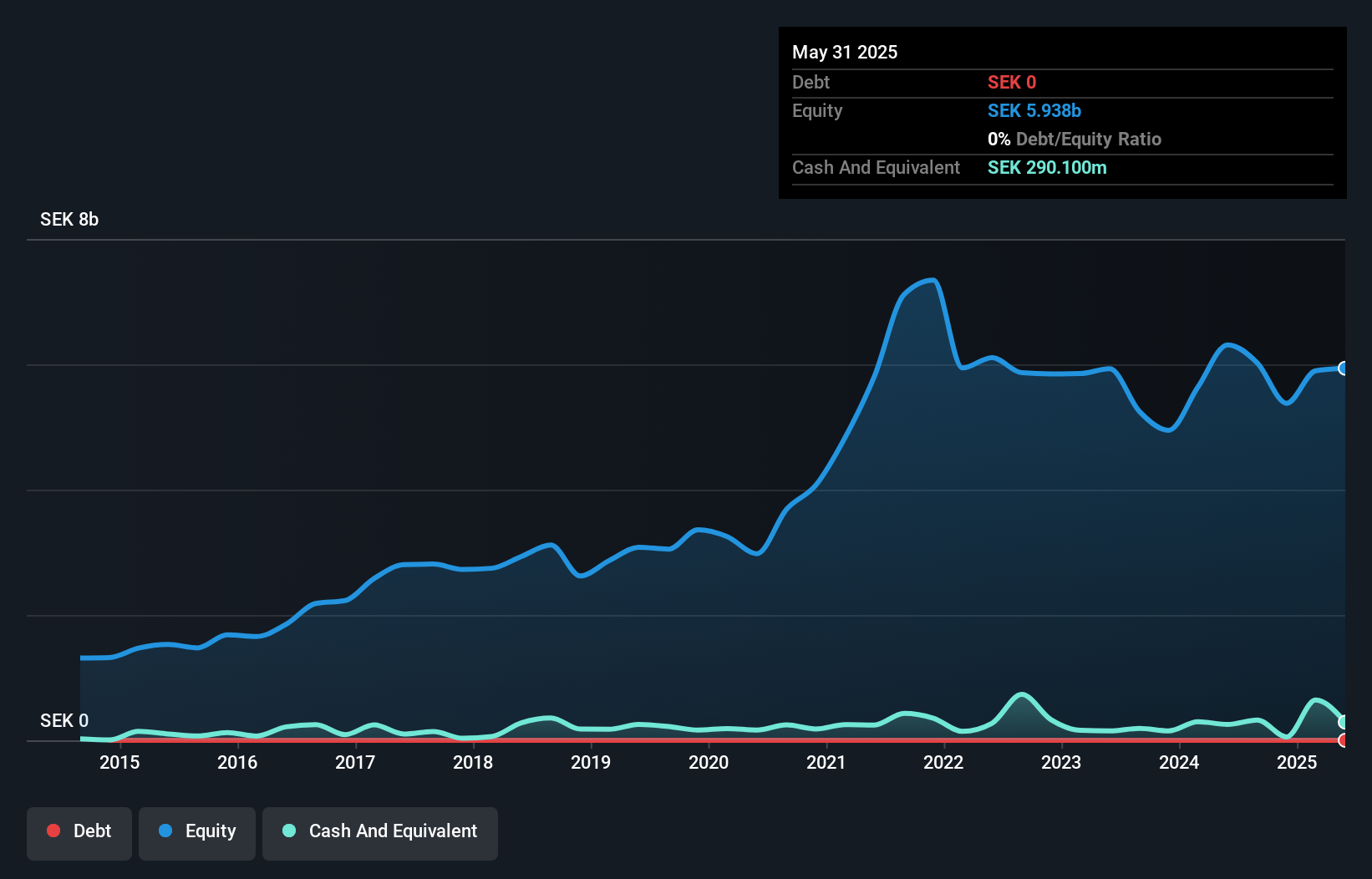

Svolder, a Swedish financial entity, has shown a remarkable turnaround by becoming profitable this year with net income of SEK 876.2 million, contrasting sharply with last year's loss of SEK 525.5 million. The company enjoys a debt-free status for the past five years and boasts high-quality earnings, which likely contributes to its solid financial health. Its price-to-earnings ratio stands at 6.9x, significantly lower than the market average of 23.4x, suggesting it might be undervalued in its sector. Despite reporting a net loss of SEK 289.8 million in Q4 this year compared to SEK 681.2 million last year, Svolder's basic earnings per share improved from a loss of SEK 5.1 to an earning of SEK 8.6 over the full year period ending August 2024.

- Unlock comprehensive insights into our analysis of Svolder stock in this health report.

Evaluate Svolder's historical performance by accessing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 56 Swedish Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LINC

Linc

A private equity and venture capital firm, specializing in early and mature stage investments in pharmaceutical, life-science and med-tech companies.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives