- Sweden

- /

- Capital Markets

- /

- OM:RATO B

Ratos (OM:RATO B) Earnings Growth Surges 110.7%, Challenging Expected Downturn Narratives

Reviewed by Simply Wall St

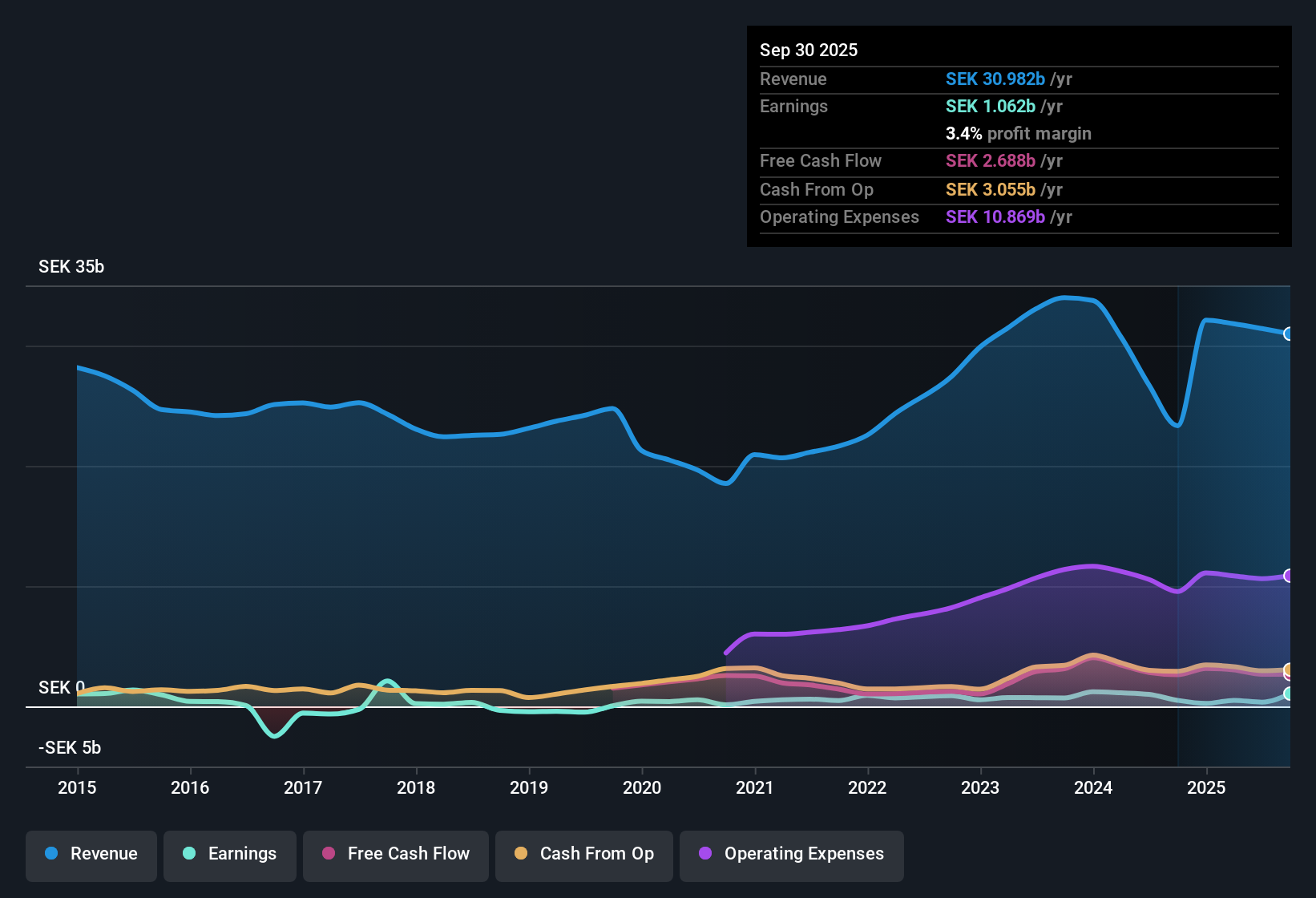

Ratos (OM:RATO B) delivered standout earnings growth this year, with net profit up 110.7% and a net profit margin rising to 3.4% from last year’s 2.2%. Despite this momentum, forecasts point to annual revenue falling 15.5% and earnings dipping 0.9% per year over the next three years. This places an emphasis on the company’s resilience as market conditions evolve. Investors face a classic trade-off: Ratos’s improved profitability and value-priced shares come against a backdrop of expected declines and questions around sustainability.

See our full analysis for Ratos.The next section sets Ratos’s latest numbers against the widely held narratives on Simply Wall St, highlighting where the consensus view matches reality and where the data may surprise.

See what the community is saying about Ratos

Margin Gains Defy Revenue Slide

- Net profit margin has climbed to 3.4%, up from 2.2% the prior year, even as revenue is forecast to fall 15.5% annually over the next three years.

- According to analysts' consensus view, operational efficiency and portfolio streamlining are driving these margin improvements, but risks, including exposure to weak core markets and restructuring challenges, could threaten longer-term stability.

- Consensus narrative highlights that Ratos’s push in high-growth, sustainable sectors, along with cost controls, has delivered recurring revenue and growing margins.

- However, ongoing restructuring and currency volatility remain key threats to margin upside and earnings quality, especially if integration or divestments underperform.

Consensus narrative notes that Ratos’s recurring margin gains and focus on sustainable infrastructure may balance out sector headwinds. See if the market agrees in the latest consensus take on the Ratos story. 📊 Read the full Ratos Consensus Narrative.

Profit Growth Outpaces History

- Earnings leapt 110.7% in the latest year, considerably exceeding Ratos’s five-year average annual growth of 7.3%.

- Analysts' consensus view argues that this surge is underpinned by stable demand in core services as well as operational excellence and efficiency programs.

- Consensus view underscores that high-growth platform acquisitions and recurring cash flows are supporting higher earnings quality and return on capital.

- Yet, further upside may depend on the company’s ability to maintain cost discipline and successfully execute on growth through both organic and bolt-on initiatives.

Valuation Still Cheaper Than Peers

- Ratos’s Price-To-Earnings ratio stands at 11.8x, a discount to the European Capital Markets industry at 16.5x and peer group at 19.1x, and only a slight premium over its DCF fair value of SEK37.91 versus the current share price of SEK38.20.

- According to the analysts' consensus view, this valuation gap reflects a balance between Ratos’s margin and profit momentum and the risks of incoming revenue contraction and leverage increase.

- Consensus notes the stock may offer compelling long-term value if profit margins trend toward the projected 6.0% in three years and DCF fair value anchors future price support.

- On the other hand, downside risk exists if leverage increases, acquisitions under-deliver, or the anticipated revenue declines accelerate.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ratos on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your viewpoint and shape your story in just minutes. Do it your way.

A great starting point for your Ratos research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Despite impressive profit growth and margin expansion, Ratos faces forecasts of declining revenue, persistent restructuring challenges, and increasing leverage. These factors could strain financial stability.

If you want to focus on sturdier companies with better financial health, start your search with solid balance sheet and fundamentals stocks screener (1981 results) positioned to weather tougher market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RATO B

Ratos

A private equity firm specializing in buyouts, turnarounds, add on acquisitions, and middle market transactions.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives