- Sweden

- /

- Capital Markets

- /

- OM:MANG

Risks Still Elevated At These Prices As Mangold Fondkommission AB (STO:MANG) Shares Dive 28%

Mangold Fondkommission AB (STO:MANG) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

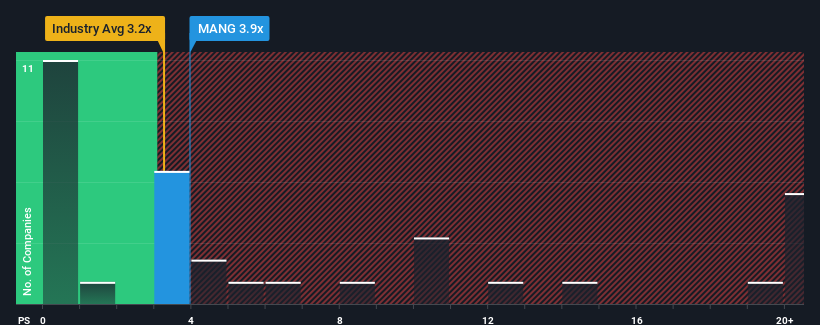

Even after such a large drop in price, Mangold Fondkommission may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 3.9x, when you consider almost half of the companies in the Capital Markets industry in Sweden have P/S ratios under 3.2x and even P/S lower than 0.7x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Mangold Fondkommission

What Does Mangold Fondkommission's P/S Mean For Shareholders?

Mangold Fondkommission has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Mangold Fondkommission will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Mangold Fondkommission's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Still, lamentably revenue has fallen 47% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 3.9% shows it's an unpleasant look.

With this in mind, we find it worrying that Mangold Fondkommission's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Mangold Fondkommission's P/S

Mangold Fondkommission's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Mangold Fondkommission revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Mangold Fondkommission (1 is significant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Mangold Fondkommission, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MANG

Mangold Fondkommission

Provides financial services to companies, institutions, and private individuals in Sweden.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives