- Sweden

- /

- Diversified Financial

- /

- OM:LUND B

L E Lundbergföretagen (STO:LUND B) Is Paying Out A Larger Dividend Than Last Year

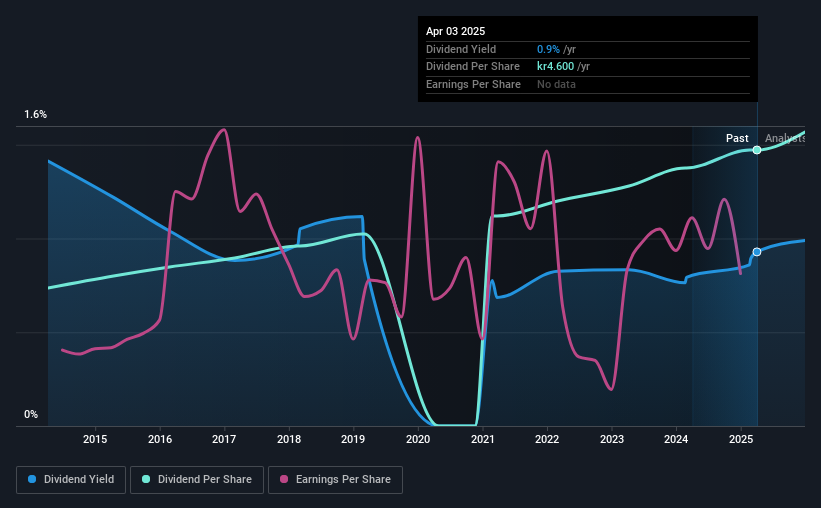

The board of L E Lundbergföretagen AB (publ) (STO:LUND B) has announced that it will be paying its dividend of SEK4.60 on the 16th of April, an increased payment from last year's comparable dividend. Even though the dividend went up, the yield is still quite low at only 0.9%.

L E Lundbergföretagen's Projected Earnings Seem Likely To Cover Future Distributions

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, L E Lundbergföretagen was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, EPS could fall by 12.0% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 22%, which is definitely feasible to continue.

View our latest analysis for L E Lundbergföretagen

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of SEK2.30 in 2015 to the most recent total annual payment of SEK4.60. This implies that the company grew its distributions at a yearly rate of about 7.2% over that duration. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. L E Lundbergföretagen's earnings per share has shrunk at 12% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think L E Lundbergföretagen's payments are rock solid. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for L E Lundbergföretagen that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LUND B

L E Lundbergföretagen

Engages in the manufacture and sale of paperboard, paper, and sawn timber products worldwide.

Mediocre balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.