- Sweden

- /

- Diversified Financial

- /

- OM:LUND B

Does L E Lundbergföretagen (STO:LUND B) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like L E Lundbergföretagen (STO:LUND B). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for L E Lundbergföretagen

L E Lundbergföretagen's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, L E Lundbergföretagen has grown EPS by 22% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

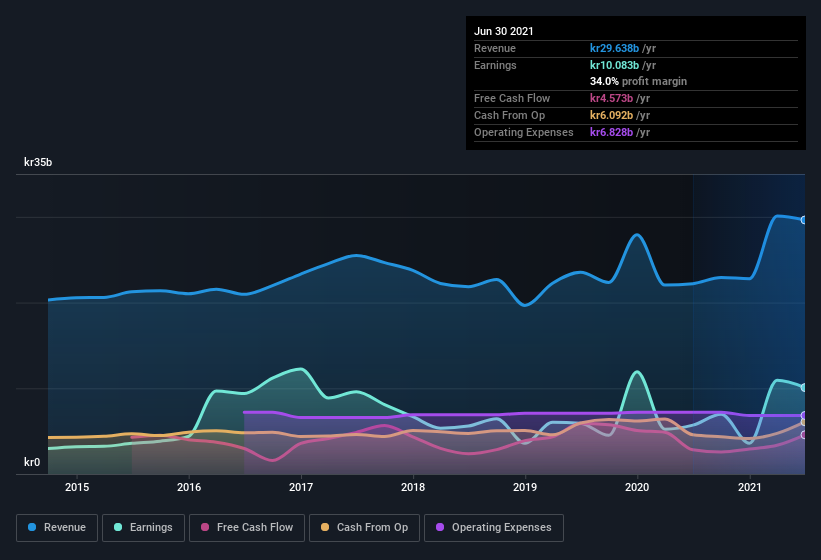

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that L E Lundbergföretagen's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that L E Lundbergföretagen is growing revenues, and EBIT margins improved by 19.0 percentage points to 38%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check L E Lundbergföretagen's balance sheet strength, before getting too excited.

Are L E Lundbergföretagen Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for L E Lundbergföretagen, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction President Fredrik Lundberg paid kr36m, for stock at kr464 per share. It doesn't get much better than that, in terms of large investments from insiders.

On top of the insider buying, we can also see that L E Lundbergföretagen insiders own a large chunk of the company. In fact, they own 71% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping kr90b. That means they have plenty of their own capital riding on the performance of the business!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Fredrik Lundberg, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like L E Lundbergföretagen, with market caps over kr69b, is about kr21m.

The CEO of L E Lundbergföretagen only received kr1.5m in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does L E Lundbergföretagen Deserve A Spot On Your Watchlist?

For growth investors like me, L E Lundbergföretagen's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 1 warning sign for L E Lundbergföretagen that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of L E Lundbergföretagen, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading L E Lundbergföretagen or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:LUND B

L E Lundbergföretagen

Engages in the manufacture and sale of paperboard, paper, and sawn timber products worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives